Macro trend

Strong consumer demand drove retail sales in September to outperform expectations.

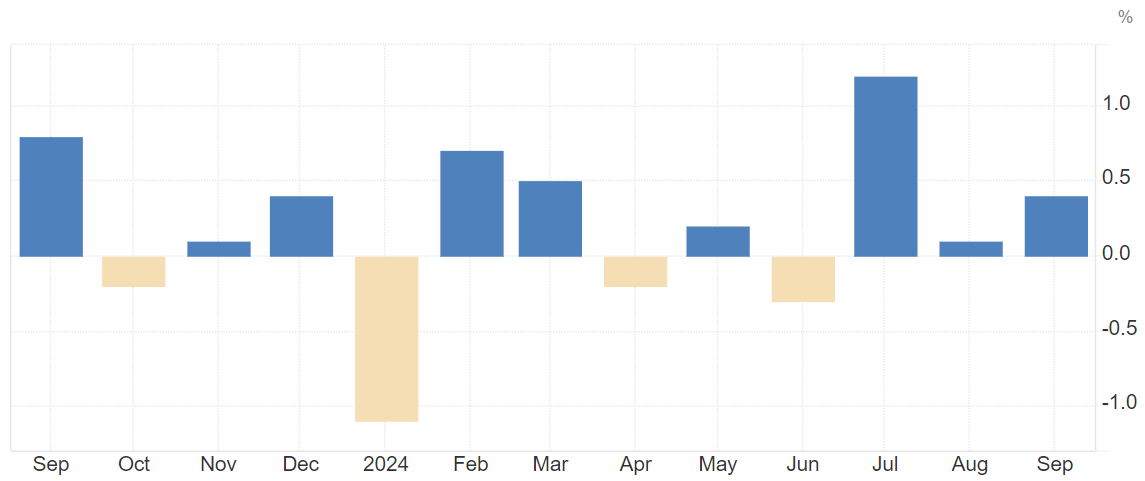

In September 2024, retail sales in the United States increased by 0.4% year-on-year, exceeding both the 0.1% growth in August and the market forecast of 0.3%. Miscellaneous store retailers led the growth with a 4% increase, followed by clothing (1.5%), health and personal care stores (1.1%), and food and beverage stores (1%). However, electronics and appliance stores experienced a significant decline of 3.3%, while gas stations and furniture stores declined by 1.6% and 1.4% respectively. Car dealers' sales remained unchanged.

It is worth noting that core retail sales (excluding food services, car dealers, building materials stores, and gas stations, used in GDP calculation) surged by 0.7%, marking the highest increase in three months. This indicator suggests that despite varied performances across retail sectors, there is a strong trend in potential consumer spending.

Source: Trading Economics

Source: Trading Economics

In October, the real estate market continues to be filled with optimism from builders.

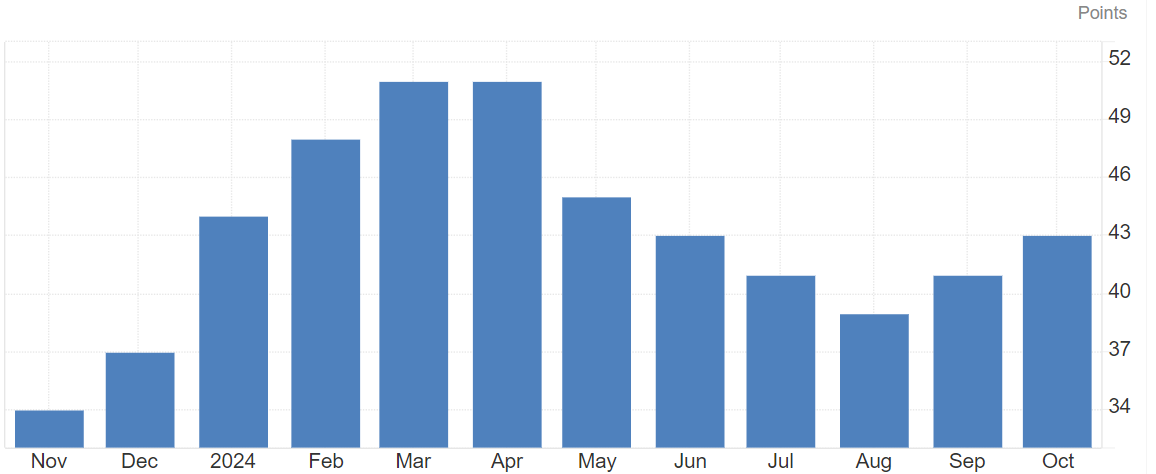

The National Association of Home Builders (NAHB) reported that builder confidence in the newly built single-family home market has risen for the second consecutive month. The NAHB/Wells Fargo Housing Market Index (HMI) rose by 2 points in October to reach 43 points.

The rise in builder confidence is attributed to easing inflation and positive expectations for mortgage rates. The HMI index, which measures builders' views on current and future home sales, if the reading is above 50, indicates that more builders consider the market conditions as 'good' rather than 'bad'.

Although the current index is 43, still below the threshold of 50, the continuous one-month increase indicates that the optimism in the real estate industry is increasing.

Source: Trading Economics

Fund Flows.

Spot gold broke through $2,700 per ounce, reaching a historical high. Since the beginning of this year, the uncertainty surrounding the U.S. election and expectations of loose monetary policies have been driving the U.S. dollar higher almost every month.

Following President Xi Jinping's emphasis on technological development and a series of central bank statements reigniting policy support optimism, the Chinese stock market continued its upward trend in the afternoon. The CSI 300 Index rose by 3.6%, rebounding from three consecutive days of decline, with semiconductor stocks leading the gains. The Hong Kong-listed Chinese technology stock index surged more than 7% at its peak during the session.

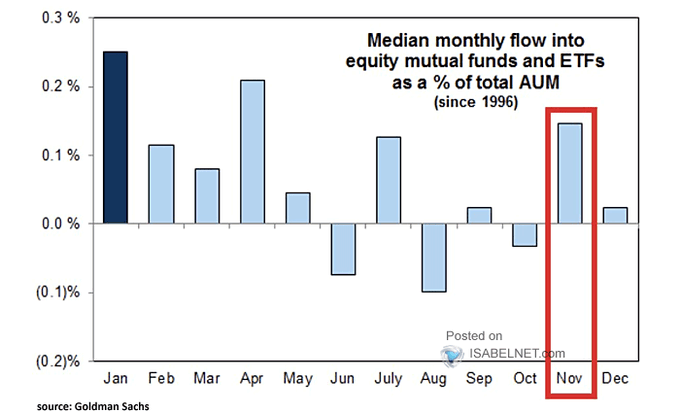

Historically, November is a period of increased stock market investor activity, which usually leads to a significant inflow of funds.

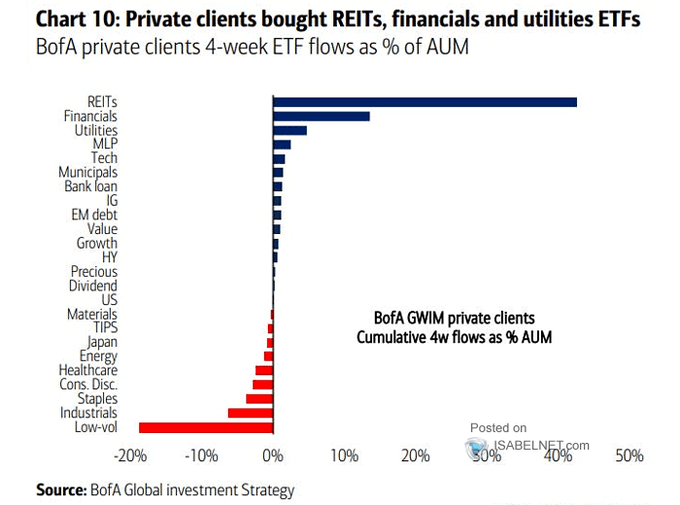

Over the past four weeks, private clients of Bank of America have been buying real estate investment trusts (REITS), financials, and utility sector ETFs while selling industrial sector and major product ETFs with lower trading volume.

Company news.

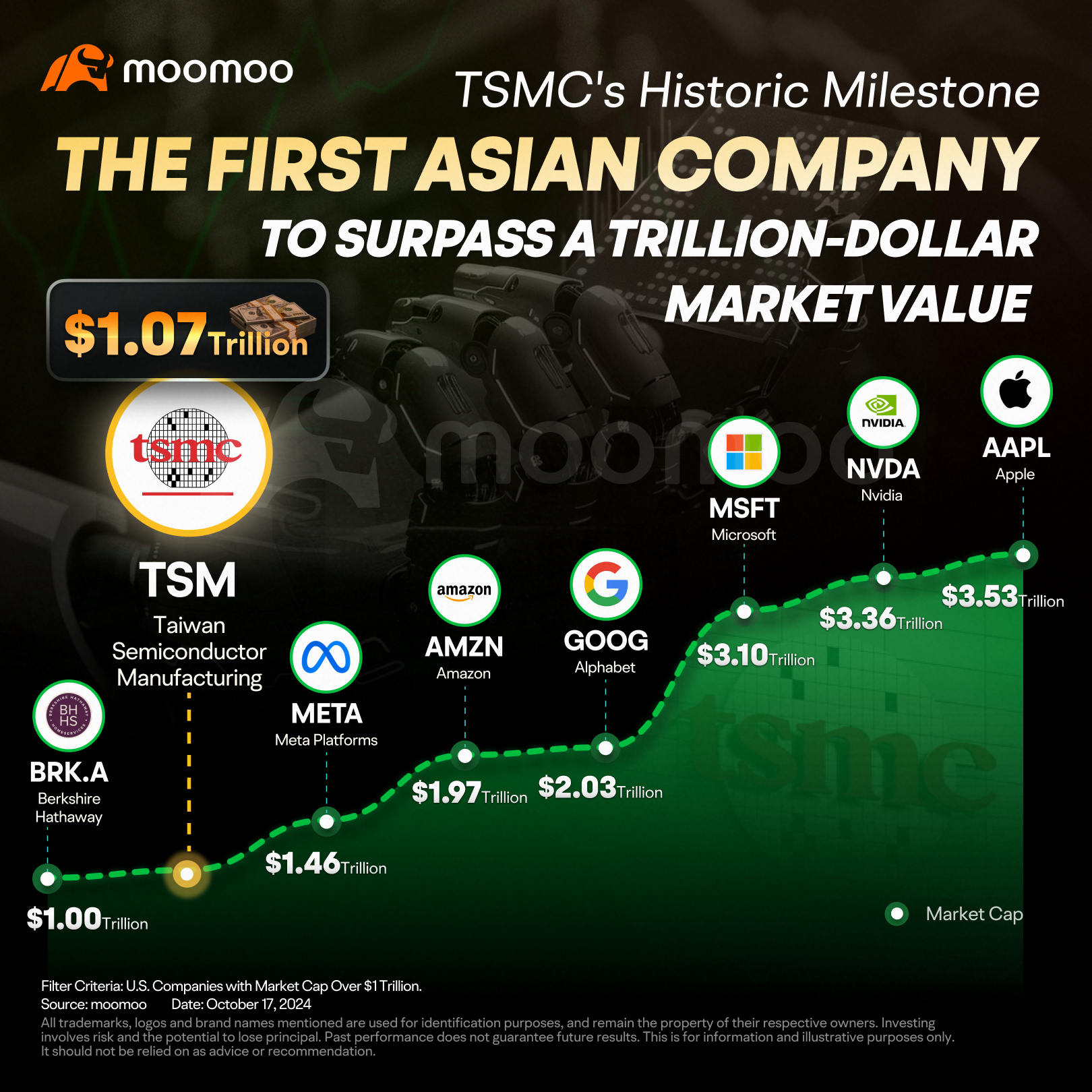

Taiwan Semiconductor's market cap has surpassed $1 trillion, setting a new benchmark for Asia enterprises.

TSMC announced on Thursday that its net income for the September quarter increased significantly by 54% to NT$325.3 billion (approximately $10.1 billion), exceeding expectations. The company also expects revenue in the fourth quarter to be between $26.1 billion and $26.9 billion, surpassing the expected $24.9 billion.

In the third quarter, revenue from 3-nanometer wafer shipments accounted for 20% of the total shipments, while 5-nanometer and 7-nanometer technologies contributed 32% and 17% respectively. Advanced technologies including 7-nanometer and more complex processes accounted for 69% of total wafer revenue. CFO Wendell Huang noted, 'Our third-quarter performance benefited from strong demand for cutting-edge 3nm and 5nm technologies, primarily driven by the smart phone and AI applications.'

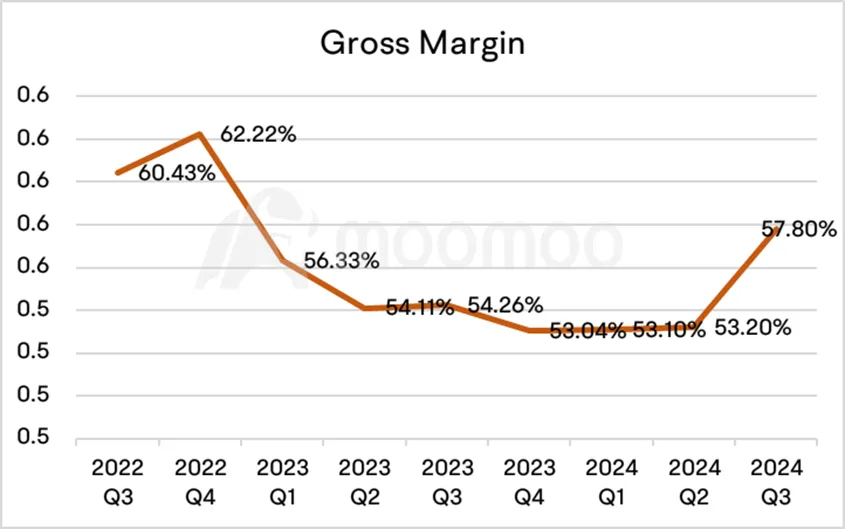

According to Bloomberg analyst Charles Shum, TSMC's fourth-quarter gross margin is expected to exceed 57%, higher than the consensus of 54.7%, highlighting the sustained robust demand for its AI chips, especially from Nvidia and other customers. TSMC further forecasts a gross margin of 57.0% to 59.0% in the fourth quarter. Shum stated that with the support of TSMC's proprietary CoWoS semiconductor packaging technology, achieving a 25% increase in revenue by 2025 is possible.

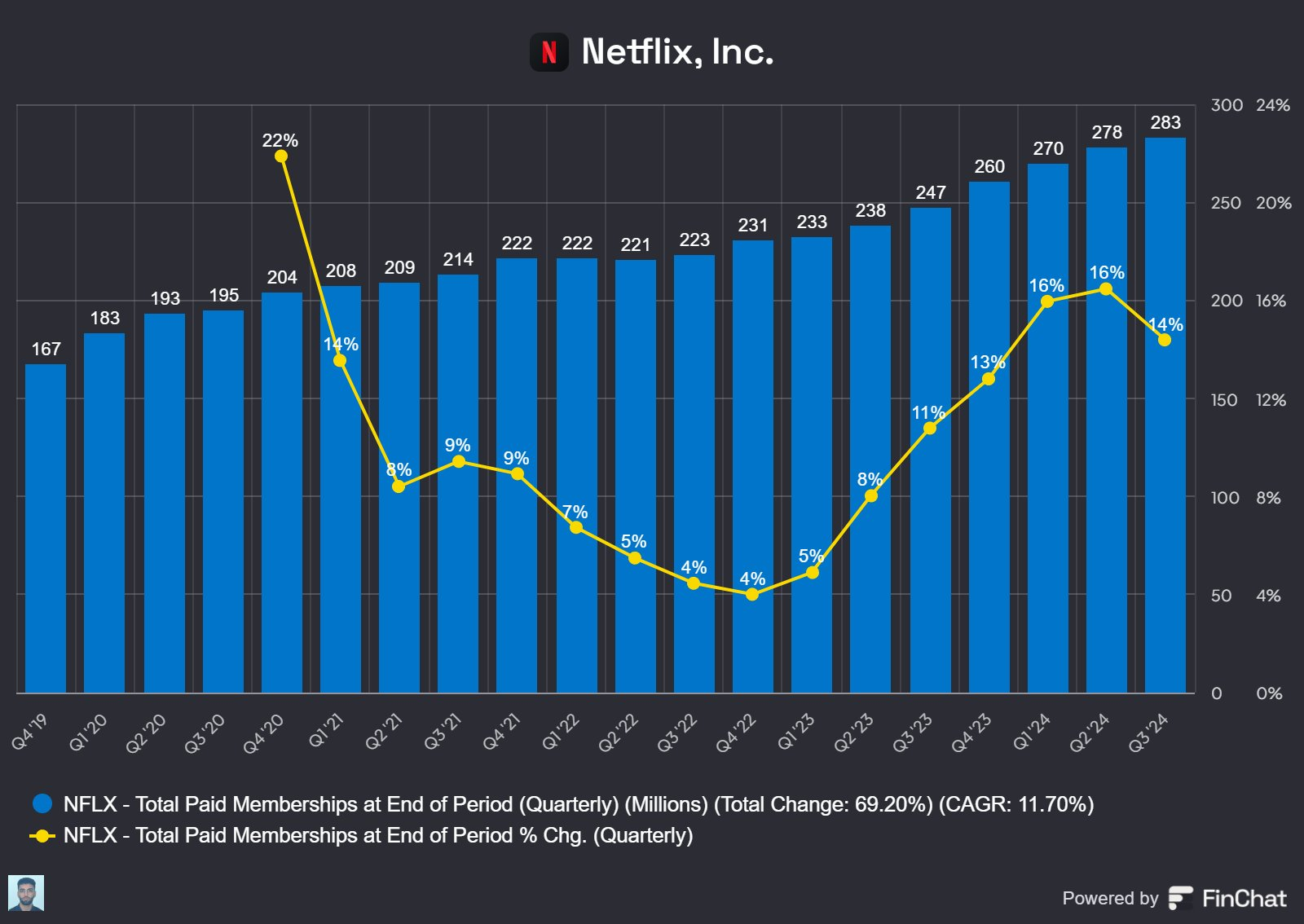

Netflix added 5.1 million subscribers, surpassing expectations, alleviating concerns about its ability to produce compelling new content.

The streaming giant reported earnings per share of $5.40, higher than $3.73 a year ago and beating FactSet's expectation of $5.12. Revenue rose from $8.54 billion to $9.83 billion, exceeding the expected $9.77 billion.

Netflix expects user growth to accelerate in the fourth quarter, driven by seasonal trends, the release of 'Squid Game' Season 2, and highly anticipated content like the Jack Paul/Mike Tyson fight.

ASML's stock price dropped significantly after the company issued a semiconductor recovery warning.

On Tuesday, chip equipment manufacturer ASML led the decline in Nasdaq technology stocks, after the company warned that the semiconductor market recovery would slow down. The company unexpectedly released its financial report a day early. In the third quarter, ASML's net bookings (an indicator of customer orders) were 2.6 billion euros, well below analysts' expectations of over 5 billion euros. Stifel analysts stated in a report to clients that the order volume was "very weak".

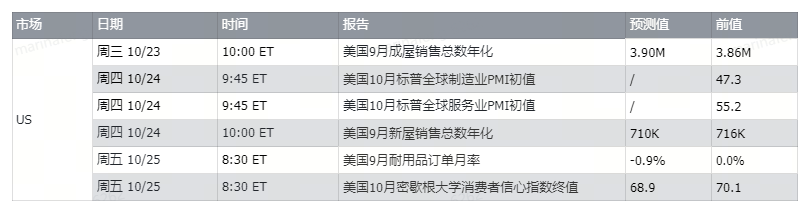

Important economic data of the week.

This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any particular security or investment strategy. The information contained in this content is for illustrative purposes only and may not be suitable for all investors. This content does not consider the investment objectives, financial situation, or needs of any specific person and should not be regarded as individual investment advice. It is recommended that you consider the suitability of the information for your individual circumstance before making any investment decisions in any capital market product. Past investment performance is not indicative of future results. Investment involves risk and the possibility of loss of principal.

On moomoo, investment products and services in the United States are provided by Moomoo Financial Inc, a licensed entity regulated by the US Securities and Exchange Commission (SEC). Moomoo Financial Inc. is a member of Financial Industry Regulatory Authority (FINRA) and of Securities Investor Protection Corporation (SIPC).

资料来源:Trading Economics

资料来源:Trading Economics