Guangdong Haomei New Materials Co.,Ltd (SZSE:002988) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.1% in the last twelve months.

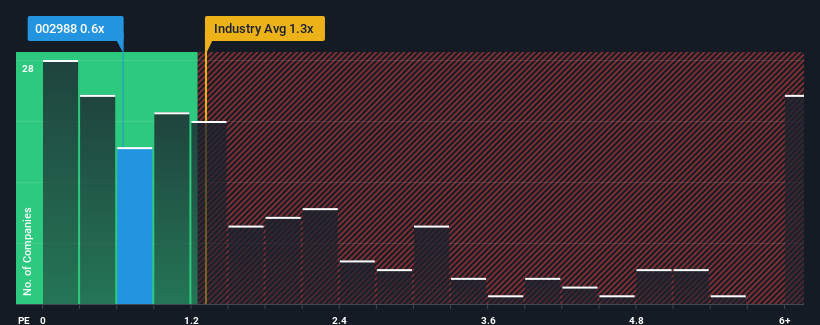

Although its price has surged higher, considering around half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Guangdong Haomei New MaterialsLtd as an solid investment opportunity with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Guangdong Haomei New MaterialsLtd's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Guangdong Haomei New MaterialsLtd has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Guangdong Haomei New MaterialsLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Guangdong Haomei New MaterialsLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Guangdong Haomei New MaterialsLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an excellent 44% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Guangdong Haomei New MaterialsLtd's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Guangdong Haomei New MaterialsLtd's P/S

Despite Guangdong Haomei New MaterialsLtd's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Guangdong Haomei New MaterialsLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Guangdong Haomei New MaterialsLtd (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of Guangdong Haomei New MaterialsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.