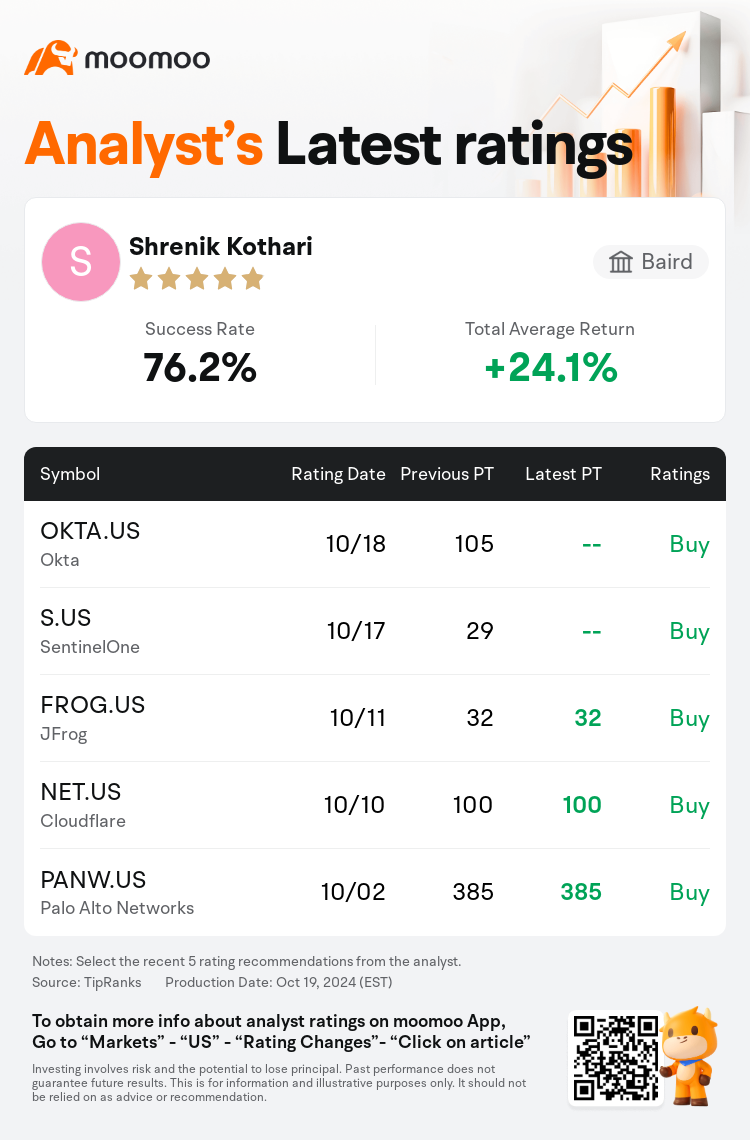

Baird analyst Shrenik Kothari maintains $Okta (OKTA.US)$ with a buy rating.

According to TipRanks data, the analyst has a success rate of 76.2% and a total average return of 24.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Okta (OKTA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Okta (OKTA.US)$'s main analysts recently are as follows:

The firm noted that Okta's conference attendance indicated that historically delayed product rollouts and a lack of full maturity or complexity, especially with PAM, have raised some concerns regarding new announcements.

The sentiment following Okta's user event was one of a balanced perspective from management. It's anticipated that challenges in seat counts within workforce identity and monthly active users in customer identity will continue into the first half of 2026. The projection has been adjusted to reflect that Okta's efforts to gain better engagement with major enterprise clients, introduce new offerings, and broaden market reach are expected to unfold over an extended period.

Okta maintains a pivotal position in the essential identity management sector, with its stock valuation appearing quite reasonable. Nevertheless, the company is experiencing intensifying competition from a major industry player, has displayed inconsistent execution in recent years, and there remains a hesitancy to foresee a reliable fundamental recovery at present.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

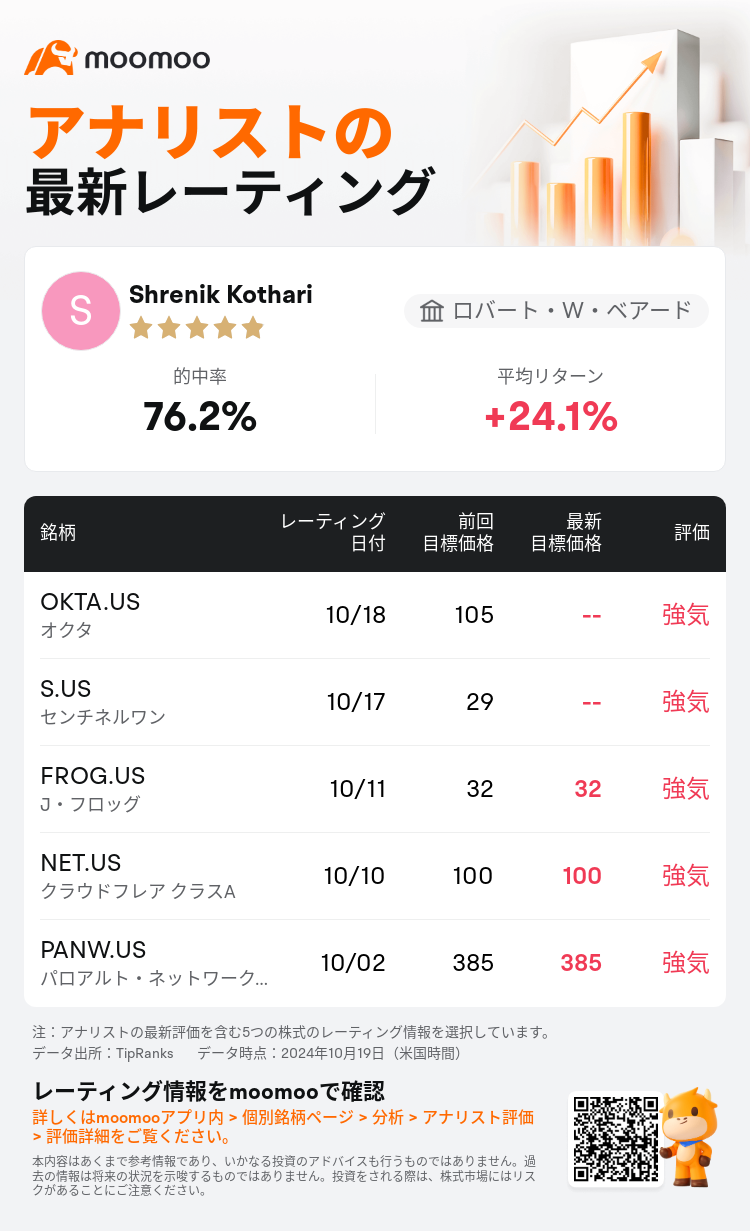

ロバート・W・ベアードのアナリストShrenik Kothariは$オクタ (OKTA.US)$のレーティングを強気に据え置き。

TipRanksのデータによると、このアナリストの最近1年間の的中率は76.2%、平均リターンは24.1%である。

また、$オクタ (OKTA.US)$の最近の主なアナリストの観点は以下の通りである:

また、$オクタ (OKTA.US)$の最近の主なアナリストの観点は以下の通りである:

同社は、Oktaの会議への出席から、製品の展開が歴史的に遅れており、特にPaMの場合、完全な成熟度や複雑さの欠如が、新しい発表に関する懸念を引き起こしていることを示していると指摘しました。

Oktaのユーザーイベント後の感情は、経営陣から見たバランスのとれた見方でした。ワークフォースアイデンティティにおける座席数と顧客アイデンティティにおける月間アクティブユーザー数の課題は、2026年の前半まで続くと予想されます。予測は、大手企業顧客との関わりを深め、新しいサービスを導入し、市場リーチを拡大するためのOktaの取り組みが、長期間にわたって展開すると予想されることを反映して調整されました。

Oktaは、重要なID管理分野で中心的な地位を維持しており、株価評価額はかなり妥当なようです。とはいえ、同社は主要な業界プレーヤーとの競争が激化しており、近年、実行に一貫性がなく、現時点で確実なファンダメンタル回復を予測することには依然として躊躇しています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$オクタ (OKTA.US)$の最近の主なアナリストの観点は以下の通りである:

また、$オクタ (OKTA.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of