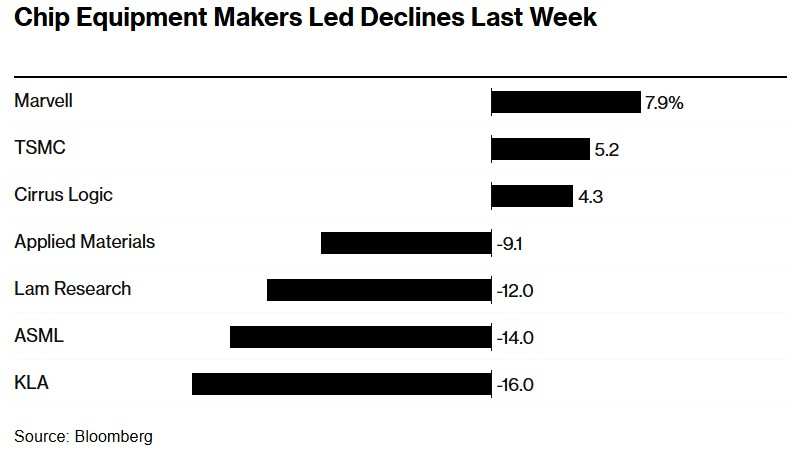

Semiconductor equipment giants led the decline last week, underperforming the entire US chip sector; Gabelli expects this divergence to persist long-term.

Wisdom Financial APP learned that the two core forces of the global chip industry, ASML.US and Taiwan Semiconductor (TSM.US), have entered a new round of financial reporting season for chip companies. In this top-of-the-line industry chain worth up to $530 billion globally, the stock prices and actual performance of chip companies riding the unprecedented wave of artificial intelligence enthusiasm are diverging significantly from those that have failed to join this AI craze, highlighting the market's bet on AI-related public chip companies with real money, rather than companies heavily tied to non-AI-related businesses. From the preliminary data of this financial reporting season, this price-performance gap may soon widen from a crack to an abyss.

"Without artificial intelligence, the entire chip market would be very challenging." Christophe Fouquet, CEO of Dutch lithography machine manufacturer ASML, stated on last week's earnings conference call. The company unexpectedly suffered in Q3 earnings last week mainly due to persistently weak demand for all chips except for artificial intelligence, resulting in a downward revision of the full-year sales forecast for 2025, as ASML's Q3 orders significantly fell short of market expectations due to sluggish demand in non-AI sectors.

ASML from the Netherlands is the world's largest scale lithography system manufacturer, with its lithography equipment playing a crucial role in the chip manufacturing process. ASML is the sole supplier of the most advanced extreme ultraviolet (EUV) lithography machines used by Taiwan Semiconductor, Samsung, and Intel to manufacture top-notch process chips.

ASML from the Netherlands is the world's largest scale lithography system manufacturer, with its lithography equipment playing a crucial role in the chip manufacturing process. ASML is the sole supplier of the most advanced extreme ultraviolet (EUV) lithography machines used by Taiwan Semiconductor, Samsung, and Intel to manufacture top-notch process chips.

If chips are the "pearl in the palm" of modern human industry, lithography machines are the essential tools needed to produce this "pearl". More importantly, ASML is the only global supplier of the EUV lithography equipment required for manufacturing the most advanced process chips in the world, such as 3nm, 5nm, and 7nm chips. The company's performance downgrade reflects the industry-wide demand still being in a weak recovery phase, at least for now, unable to achieve the "boom cycle" of chip industry demand.

The chip industry experiences a tale of two extremes: a surge in demand related to AI while non-AI remains in a "sluggish moment".

ASML's latest earnings release has sparked new concerns about the health of the chip industry. Despite the unprecedented AI boom, the demand for chips closely related to AI, especially data center AI chips, has seen explosive growth. US tech giants continue to heavily invest in AI GPUs, data center ethernet chips, and other artificial intelligence infrastructure to expand or build new data centers. However, the entire chip industry is still significantly impacted by weak demand in key markets such as personal computers, smartphones, and electric vehicles.

In addition, this lithography giant has long been trapped in the escalating geopolitical tensions between China and the US, which may further cut off more ASML lithography machines from entering the Chinese chip market, thereby continuing to impact ASML's performance. The Chinese market remains the largest semiconductor equipment market in the world.

From the perspective of rational investors, ASML's strong hit on the global chip stock price does not mean that the global frenzy of AI deployment is retreating or cooling down, and ASML's performance shows a continuous surge in demand for AI chips. However, this disappointing financial report does reveal the latest dynamics of the global chip industry, which is: the AI frenzy is still ongoing, especially the booming demand for all types of AI chips focused on the B-end data centers, while areas unrelated to AI, such as electric vehicles, industrial sectors, Internet of Things devices, and a wide range of consumer electronics products, are still experiencing soft demand or even significant declines in demand.

However, last Thursday, Taiwan Semiconductor Manufacturing Company, known as the 'King of Global Chip Manufacturing,' significantly raised its revenue expectations for 2024 and emphasized the extremely strong AI demand, greatly easing the market's concerns about overall chip demand and boosting market optimism about the demand for AI chips to a great extent. Both Apple and the AI chip superpower NVIDIA are core chip clients of Taiwan Semiconductor. CEO of Taiwan Semiconductor, Wei Zhejia, stated at the earnings conference that industry growth is being strongly driven by AI-related factors, and overall chip demand is already 'stable,' showing signs of improvement.

Taiwan Semiconductor's latest performance significantly reinforces the investment viewpoint that the AI boom is still in full swing and the demand for AI chips remains incredibly high. Speaking of the market demand for AI chips, Wei Zhejia, the helm of Taiwan Semiconductor, stated during the earnings conference that the outlook for AI chip demand is very optimistic, emphasizing that the demand of Taiwan Semiconductor's customers for CoWoS advanced packaging far exceeds the company's supply.

"The company will fully meet the demand for CoWoS advanced packaging capacity from customers. Even with a doubling of capacity this year and continuing to double next year, it is still far from enough." Wei Zhejia stated during the earnings conference. CoWoS advanced packaging capacity is crucial for a wider range of AI chips such as NVIDIA's Blackwell AI GPU. "Nearly all AI innovators are collaborating with Taiwan Semiconductor, and the demand related to AI is real, and I believe this is just the beginning."

Taiwan Semiconductor's management expects the company's full-year revenue to grow by nearly 30%, exceeding the general expectation of 20%-25% among analysts as well as the company's expectations from the previous quarter. The management also expects the revenue from data center AI server chips at Taiwan Semiconductor for this year (including NVIDIA's AI GPUs, Broadcom's AI ASIC, and other widely defined AI chips) to more than double.

The successive release of financial reports by ASML and Taiwan Semiconductor signifies the start of a new round of global chip company earnings season, and the performance of these two core giants in the chip industry jointly shows that the unstoppable wave of global AI investment provides extremely strong support to stocks closely related to AI chips. The rising trend of leaders in AI chips like NVIDIA may have far from stopped. Particularly for NVIDIA, the AI chip dominator that holds a market share as high as 80%-90% in the data center AI chip sector, its stock price may continue to hit historic highs, breaking through the widely expected $150 mark among Wall Street analysts.

In the U.S. stock market, there is a huge divergence in the performance of chip stocks.

The Philadelphia Semiconductor Index (SOX), known as the 'global chip stock barometer,' plummeted last week due to the unexpected performance failure of ASML, dropping significantly by 5.3% after ASML dramatically announced significantly below-expectation financial results on Tuesday. However, after Taiwan Semiconductor's performance announcement on Thursday, the index resumed a strong upward trend. However, in the entire US stock market, the core force driving the repeated new highs of US stocks - the chip sector, the individual stock trends within it have shown massive divergences.

Among them, semiconductor equipment company stocks significantly underperformed the Philadelphia Semiconductor Index. ASML, KLA Corp and Lam Research and other semiconductor equipment giants were rarely included in the 'leading decliners' list, while chip companies closely related to AI, including Taiwan Semiconductor, NVIDIA, and Broadcom, saw significant increases in stock prices.

Semiconductor equipment companies led the decline in the US chip sector last week.

The chip manufacturing equipment provided by semiconductor equipment companies focuses on core chip manufacturing processes such as lithography, etching, thin film deposition, multi-layer interconnects, and thermal management. Therefore, compared to chip companies like Taiwan Semiconductor, NVIDIA, AMD, and Broadcom which extensively benefit from the global AI layout, focusing on asset-heavy semiconductor equipment companies still heavily rely on overall chip industry demand rather than just AI-related chip demand. If PCs, smart phones and other end-side AI-driven large model trends become popular globally, it may drive the demand for the entire chip industry into prosperity. However, this situation clearly shows no obvious signs yet. ASML's latest performance highlights the overall sluggish trend in the chip industry demand, causing these company stock prices to collectively weaken.

"We expect this discrepancy to continue as assuming all of this is demand driven by artificial intelligence is entirely correct." Senior analyst Ryuta Makino from Gabelli Funds said, he expects this significant discrepancy path to still exist at least until 2025.

The financial data of chip companies are usually considered as a barometer of the global economy, as chips are crucial for manufacturing a wide range of electronic products from high-performance servers in data centers to smart phones, electric cars, and even dishwashers. Companies providing semiconductor equipment for manufacturing these chips are at the forefront of the industry.

Before chip manufacturers like Taiwan Semiconductor and Samsung start contract manufacturing chips, time is needed to build, install, and test large chip manufacturing machines. Therefore, semiconductor equipment companies like ASML and KLA have unusually long-term views on customer demand. Currently, they are issuing warnings signals in all chip areas outside of artificial intelligence. For example, due to continued increase in customer inventory, the demand for chips in electric cars and industrial ends continues to decline. As the demand for AI PC and AI smartphones has not significantly expanded yet, the overall chip demand for personal computers and smartphones remains sluggish since 2022.

In addition, intel, which holds an important position in the chip manufacturing field, is cutting costs and delaying the construction of new chip factories because the company is struggling to deal with the sharp decline in sales and significant increase in losses. This month, another chip manufacturing giant, Samsung, even directly apologized to investors, stating that the progress of the company's OEM business and the delay in shipments of HBM memory chips have disappointed investors.

Investors will closely monitor the financial report of Texas Instruments this week, as the company will announce its financial results after the close of trading on Tuesday Eastern Time. The company's analog chip products are widely used by a large customer base. Texas Instruments can be said to have the broadest customer base and the largest product range among chip manufacturers, so the company's performance and performance outlook data can be used as one of the predictive indicators for various industry demands. Texas Instruments is the world's largest analog chip manufacturer. Its products perform simple but crucial functions, such as converting power into different voltages in electronic devices. In addition, Texas Instruments' analog chips have played an indispensable role in various key function modules and systems of electric vehicles in recent years, including power management, battery management, sensor interfaces, audio and video processing, motor control, etc.

Overall, asml holding, kla corp, and other semiconductor equipment companies seem to be facing a more difficult path than expected, although the stocks of many semiconductor equipment companies such as kla and applied materials hit historic highs earlier this year. Some Wall Street traders have not chosen to wait for signals of a recovery in the entire chip industry demand, but have started selling shares of semiconductor equipment companies like asml.

Asml just experienced its worst week since early September, with its US stock price plummeting by 14%. The stock price of America's largest semiconductor equipment company, Applied Materials, dropped by 9.1%, while the decline for kla lam research exceeded 12%.

"We are obviously more cautious about other semiconductor equipment names." Analyst CJ Muse from Cantor Fitzgerald wrote in a research report. "We used to think that leading long-term participants like asml would perform better. Obviously, our assumption was wrong." After asml announced significantly lower-than-expected performance, the analyst expects the stock prices of semiconductor equipment companies to further decline.

Artificial intelligence spending continues to surge, and Nvidia may long dominate the title of 'biggest winner of the AI boom'.

For Taiwan Semiconductor, Nvidia, Broadcom, as well as AMD, Micron Technology, and other 'hot AI chip stocks' that have been attracting continuous investments since 2023, the situation of stock prices is completely different. These companies may continue to benefit from the continued large-scale spending of major tech companies in the development of artificial intelligence.

Wall Street statistics show that Microsoft, Google's parent company Alphabet, Amazon, and Facebook's parent company Meta spent over $50 billion on capital expenditures in the second quarter, with most of it used to purchase data center AI chips, such as Nvidia's H100/H200/Blackwell series AI GPUs and Broadcom's AI ASIC. Some tech giants have publicly stated their plans to invest larger amounts in the coming quarters to purchase AI GPUs, data center Ethernet chips, and other artificial intelligence infrastructure to expand or construct new data centers.

According to the well-known technology industry chain analyst Guo Mingchi from TF International Securities, the latest release of the industry chain order information for Nvidia's Blackwell GB200 chip indicates that Microsoft is currently the largest GB200 customer in the world, with Q4 orders surging 3-4 times, surpassing the total orders of all other cloud computing service providers.

In a recent report, Guo Mingchi stated that the capacity expansion of Blackwell AI GPU is expected to start in the early fourth quarter of this year, with shipments in Q4 between 0.15 million and 0.2 million units. It is anticipated that the shipment volume in Q1 2025 will significantly increase by 200% to 250%, reaching 0.5 million to 0.55 million units. This means that Nvidia may achieve its sales target of one million AI server systems in just a few quarters. Nvidia's founder and CEO, Huang Renxun, revealed in a recent interview that the Blackwell architecture AI GPU is already in full production and the demand is extremely high.

According to the latest forecast data from Citigroup, a Wall Street financial giant, by 2025, the capital expenditure related to datacenters of the four largest-scale technology giants in the USA is expected to grow by at least 40% year-on-year. These huge capital expenditures are mostly associated with generative artificial intelligence, meaning that the computational power demand for applications like ChatGPT in AI remains significant. Citigroup indicates that this implies that the spending scale of giants on datacenters is expected to continue to expand significantly on top of the already strong 2024 spending scale. The institution expects this trend to provide very significant positive catalysts for the AI GPU dominator Nvidia as well as the datacenter interconnect (DCI) technology providers.

In a research report, Citigroup referred to the four tech giants as global cloud computing giants Amazon, Google, Microsoft, along with social media Facebook and Instagram's parent company. In this latest research report, Citigroup predicts that by 2025, the data center capital expenditures of these four tech giants will grow by 40% to 50% year-on-year. The significant increase in tech giants' spending in data centers is expected to drive Nvidia, Arista Networks, and other data center network technology giants, which are considered 'shovel sellers' in the global AI field, to continue to be favored by international funds.

The Citigroup analysis team stated in a recent research report that Nvidia's servers GPUs in the AI infrastructure sector, as well as the overall hardware system of NVIDIA machines, are emphasized as core factors of concern for data center operators in terms of total cost of ownership (TCO) and return on investment (ROI). They emphasize the higher level efficiency of running various applications (including AI training/inference applications) on Nvidia's hardware and CUDA co-parallel acceleration software platform. The Citigroup analysis team also emphasized that the adoption of artificial intelligence (AI) is still in the early to mid-stage, especially driven by the hot AI application of 'AI proxy' in the enterprise end, leading to a surge in enterprise demand for AI applications, thereby stimulating significant expansion and new construction of data centers by tech giants.

Solita Marcelli, Chief Investment Officer for the Americas at UBS Global Wealth Management, stated that by 2025, the total sales of chip companies closely related to artificial intelligence will leap from this year's $168 billion to $245 billion. Marcelli advised clients to increase their positions in AI-related chip manufacturers' stocks after ASML announces its earnings.

"We continue to see strong growth prospects for AI chips and closely monitor management's guidance on future demand," she wrote in a research report last week.

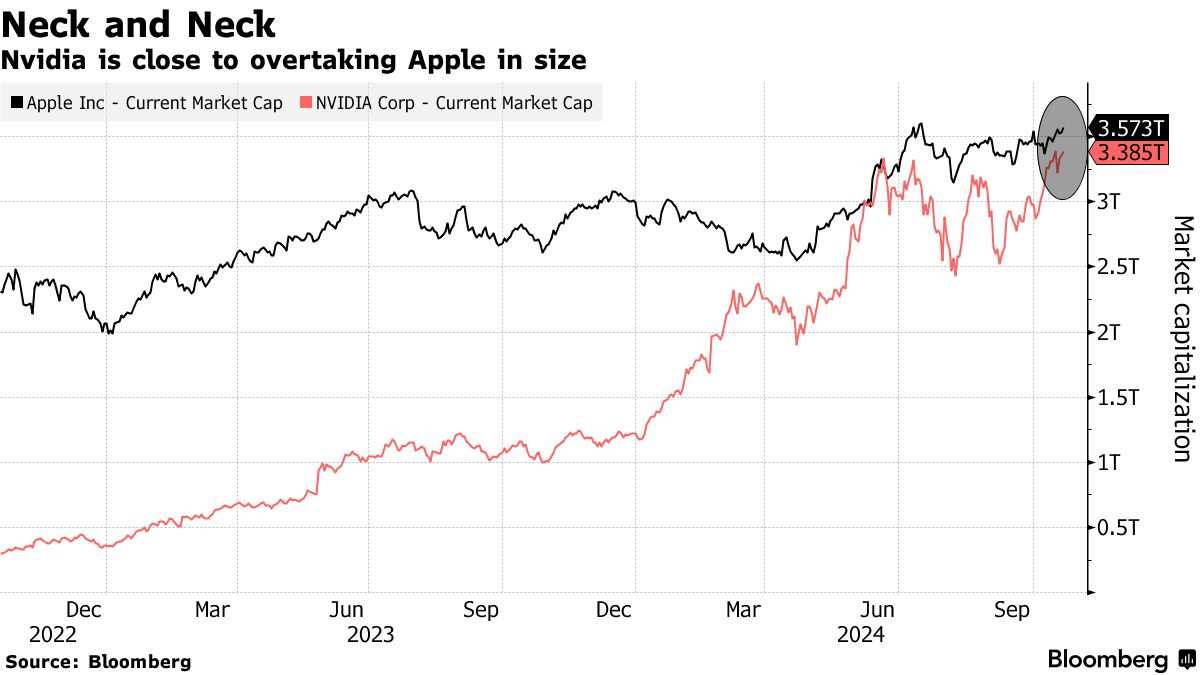

In the eyes of Wall Street analysts, the primary beneficiaries of all data center spending are Nvidia, who continue to dominate the broader AI chip market. CEO Huang Renxun assured that their new Blackwell chip is in full production and after seeing strong customer demand, the stock hit a historical high last week, surpassing the previous peak in June. Nvidia's stock has risen by over 175% in 2024, currently with a market cap close to $3.4 trillion, just a step away from surpassing Apple to become the 'world's most valuable company' once again.

TipRanks data compilation shows that 42 Wall Street analysts have an average target price expectation for NVIDIA of $153.86 within 12 months, indicating a potential upside of close to 10%. The Wall Street banking giant, Bank of America, has recently reiterated its "buy" rating for NVIDIA and significantly raised the target price from $165 to $190, exceeding the general target price on Wall Street. The Bank of America analysis team also raised NVIDIA's earnings per share expectations for fiscal year 2025 from $2.81 to $2.87; fiscal year 2026 expectations from $3.90 to $4.47; and fiscal year 2027 expectations from $4.72 to $5.67.

According to Wall Street analysts, other chip companies that can benefit from the AI spending boom include Taiwan Semiconductor, Broadcom, Arm, Micron Technology, and AMD, especially as AMD is trying to weaken NVIDIA's absolute control over the AI chip market.

AMD's flagship MI300X AI accelerator has significant advantages in memory bandwidth and capacity compared to NVIDIA's Hopper architecture AI GPU, especially suitable for AI parallel computing workload requirements in high-generating AI model training and inference tasks. Recently, some analysts believe that if AMD can continue to improve the NVIDIA CUDA competitor - the AMD ROCm software ecosystem, and accelerate its support for mainstream AI developer environments, it may further erode NVIDIA's market share in the data center AI GPU market.

However, even for "hot AI chip stocks," it seems inevitable to avoid the negative impact brought by the sluggish non-AI demand. For example, Broadcom, whose customized AI chips and Ethernet chips are mainly used in major data centers worldwide, but last month its stock price plummeted due to disappointing non-AI performance, and Broadcom's latest performance forecast basically indicates that the growth rate of its non-AI business is much slower than the market's expected recovery pace.

"Ultimately, this will inevitably provide value scenarios for non-AI chip companies, especially when economic strength implies a moment of demand recovery," said Tim Ghriskey, Senior Investment Portfolio Strategist at Ingalls & Snyder. "However, this is a timing issue. Artificial intelligence will remain a long-term focus for the market."

来自荷兰的阿斯麦是全球最大规模光刻系统制造商,阿斯麦所生产的光刻设备在制造芯片的过程中可谓起着最重要作用。阿斯麦是台积电、三星以及英特尔用于制造最高端制程芯片的目前最先进极紫外(EUV)光刻机的唯一供应商。

来自荷兰的阿斯麦是全球最大规模光刻系统制造商,阿斯麦所生产的光刻设备在制造芯片的过程中可谓起着最重要作用。阿斯麦是台积电、三星以及英特尔用于制造最高端制程芯片的目前最先进极紫外(EUV)光刻机的唯一供应商。