Recently, the gem's new stocks like "Daruqian" are coming out frequently, with Topcloud Agriculture, Shangda Stock, and Changlian Technology all soaring on the first day of trading, demonstrating a significant "money-making effect" for new stocks.

Today, there is another IPO subscription in the gem!

Gelonghui learned that on October 21, China Merchants Securities Co., Ltd. sponsored the subscription of Shenzhen Qiangda Circuit Co., Ltd. (referred to as "Qiangda Circuit").

Qiangda Circuit (301628) has an IPO price of 28.18 yuan per share, with a PE ratio of 24.98, lower than the industry PE ratio of 33.94. Given the recent good atmosphere for new stock offerings and speculation in the A-share market, it is expected that Qiangda Circuit will likely rise on its first day of trading.

Qiangda Circuit (301628) has an IPO price of 28.18 yuan per share, with a PE ratio of 24.98, lower than the industry PE ratio of 33.94. Given the recent good atmosphere for new stock offerings and speculation in the A-share market, it is expected that Qiangda Circuit will likely rise on its first day of trading.

The prospectus shows that the company's predecessor Qiangda Limited was established in 2004 and transformed into a joint-stock company in 2021, becoming the Qiangda Circuit of today. The company is dedicated to meeting the professional needs of customer electronic products in research, development, testing, and small-batch stages for PCBs, widely used in industrial control, communications equipment, automotive electronics, consumer electronics, medical health, and semiconductor testing, among other application areas.

Specifically, Qiangda Circuit's main business is PCB products, accounting for an average of 99.74% of its total business income. The company's PCB products are categorized by order area into samples, small batch boards, and large batch boards, and by product layers into single/double-sided boards and multilayer boards.

In terms of performance, in the reporting periods of 2021, 2022, 2023, and the first half of 2024, Qiangda Circuit achieved revenues of approximately 0.71 billion yuan, 0.731 billion yuan, 0.713 billion yuan, and 0.389 billion yuan, with corresponding net profits of 68.0691 million yuan, 90.9007 million yuan, 91.0641 million yuan, and 56.0195 million yuan, respectively.

The company predicts that in 2024, the revenue will be approximately 0.788 billion yuan, a year-on-year increase of 10.52%; and the net profit attributable to the parent company's shareholders for the same period is expected to be 99.2757 million yuan, a year-on-year increase of 9.02%.

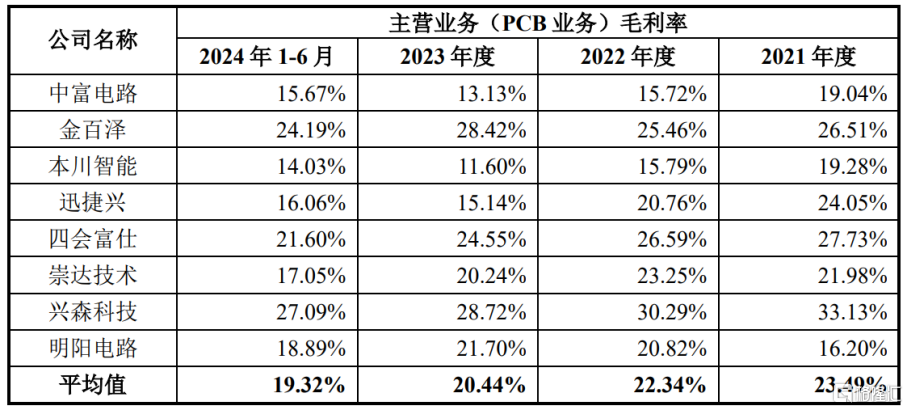

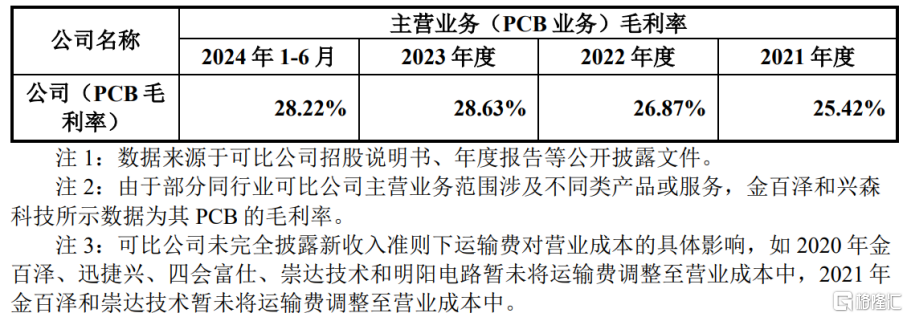

During the reporting period, Strong Circuit's main business PCB business gross margin rates were 25.42%, 26.87%, 28.63%, and 28.22%, higher than the average of comparable companies in the same industry.

Comparison of the company's gross margin with comparable companies in the same industry, image source: prospectus

During the reporting period, the proportion of direct material costs to Strong Circuit was over 47%, with a higher proportion of copper-containing materials such as copper clad laminate, copper foil, and copper balls. In the future, if major raw material prices rise, it may increase the company's production costs, thereby affecting the company's gross margin.

The global PCB industry competition landscape is relatively fragmented with many manufacturers. In recent years, with domestic printed circuit board companies building and expanding factories, large PCB enterprises may gain more advantages in competitive batch boards, intensifying future market competition leading to industry consolidation and increasing industry concentration.

Strong Circuit focuses on the mid-to-high-end samples and small batch board market. Compared with leading companies in the industry, the company has certain gaps in terms of business scale and market share. In the future, if the company fails to continuously improve its technical level and product quality, it may affect its competitiveness. If the overall demand for the PCB market slows down or declines, or if the company cannot enhance its competitive advantage, it may affect its operational performance.

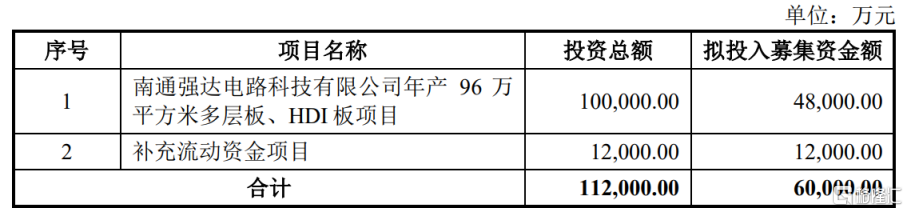

The funds raised in this IPO will mainly be used for the annual production of 0.96 million square meters of multilayer boards, HDI board projects, and supplementary working capital projects for Nantong Strong Circuit Technology Co., Ltd.

Use of raised funds, image source: Prospectus

强达电路(301628)发行价格28.18元/股,发行市盈率为24.98倍,低于33.94倍的行业市盈率。鉴于近期A股打新、炒新氛围较好,预计强达电路上市首日大概率能收涨。

强达电路(301628)发行价格28.18元/股,发行市盈率为24.98倍,低于33.94倍的行业市盈率。鉴于近期A股打新、炒新氛围较好,预计强达电路上市首日大概率能收涨。