①"FOMO"と"TINA"という2つの英語の略語は、近年、グローバルな金融市場でよく使われる2つの用語となっています。②これらの単語は、米国株式市場の持続的な上昇の理由を共に説明しています。 ③現在のこの米国株式市場の牛相場が3年目に入る中、これらの業界用語の議論と解体について考察することは、市場の今後の方向性にとって重要となるかもしれません。

財聯社10月21日報道(編集 潇湘)"FOMO"と"TINA"という2つの英語の略語は、近年、グローバルな金融市場でよく使われる2つの用語となっています。

これらの単語は、米国株式市場の持続的な上昇の理由を共に説明しており、現在のこの米国株式市場の牛相場が3年目に入る中、これらの業界用語の議論と解体について考察することは、市場の今後の方向性にとって重要となるかもしれません。

私たちはまず、これら2つの用語の意味について科普します。"FOMO"は"Missing Out Fear"を意味し、市場に置いては、その意味は明らかです。つまり、人々はしばしば(米国株の大幅な上昇のチャンスを逃すことを恐れ)株を買い続けます。今年に入ってから、「FOMO」の効果は、S&P500指数の史上最高値を47回更新するのに役立っています。

さらに、この勢いが著しく弱まる兆候はほとんどありません。これは、"TINA"の影響にも帰るところがあります。

さらに、この勢いが著しく弱まる兆候はほとんどありません。これは、"TINA"の影響にも帰るところがあります。

"TINA"とは「株式を持つ以外に選択肢がない(There Is No Alternative to owning equities)」の意味です。そして、多くの米国株投資家にとって、ここでの株式とは単に米国株を指します。なぜなら、経済データや企業利益の相対的利点を導く投資家が、米国株に資本を投じるならば、それが最善の選択となると彼らは考えているからです。

多くの面で、後者の傾向(TINA)が前者の傾向(FOMO)を助長しているように見え、両者の共存と相乗効果はますます強くなっているようです。

米国株は「世界をリードしている」

事実、複数の比較から見ると、多くの人が「FOMO」や「TINA」という現象が米国株市場で流行している理由が理解しやすいことが確かだ。

s&p 500 indexとnasdaq composite indexの今年の利益率は20%を超えている。一方、対比として、今年第1四半期に歴史的な高値記録を打ち破ったnikkei 225 indexの年間利益率はわずか16%に過ぎず、3四半期末に勢いを取り戻したcsi 300 indexの利益率は約14%、ユーロストックス50指数の利益率は約10%で、uk ftse100 indexの利益率はわずか8%に過ぎない。

ワール街の今年の優れたパフォーマンスは、いくつかの大手テクノロジー企業のリードによるものであり、わずか数社のテクノロジー大手を代表するFAANG指数は今年34%に達する高い増加率を記録している。

しかし、s&p 500 index等の等重指数でさえ年初からの増加率は約15%で、これは今までほかの多くの市場で利得を得た投資家よりも優れている。

一方で、「一家独大」の利得率パフォーマンスは、アメリカ株式市場がすでに「過熱買い」状態にあることを示唆するかもしれないが、経済と企業利益の基本面的な反応はまだその段階に達していないようだ。例えば、名だたるアトランタ連邦準備銀行GDPNowモデルは、現在、第3四半期の米国のGDP成長率が年率3.4%に達すると予測しており、これは7月以来のこのモデルの初期推定値である。

アメリカ企業の見通しも非常に楽観的だ。LSEG I/B/E/Sによると、第3四半期のアメリカ株の総利益成長率は約5%と予想されているが、この数字は今後数四半期で再び二桁の数字に反発し、2025年には15%前後に達する見込みだ。

このため、ゴールドマンサックスグループを含むワール街の多くの投資銀行のストラテジストは、最近、アメリカ株の目標価格をさらに引き上げている。

ゴールドマンサックスグループは、最新の予想で、s&p 500 indexが今年の年末までに6000点に達する可能性があると予測している。その他、市場が過去に10月から12月にかけて一般的な選挙年モードを複製した場合、s&p 500 indexは6270点に達する可能性さえあると述べている。

当世“誰が最強か”?

グローバル他の地域の経済と市場の現状は、実際には現在の米国株式市場の長期上昇をよりよく反映しています。

ヨーロッパ最大で世界第四位の経済大国、ドイツは現在2年連続の経済縮小に直面しており、これはこの世界の先端製造業センターである20年以上の間に前例のない状況です。

日本では、国の意思決定層は現在、投資家が驚かされることを非常に心配しているようで、そのために利上げの一歩を踏み出すことがなかなかできない状況です。

多くの投資家は、米国外の投資家が現在、全米株式市場全体で史上最高の18%を占めていることに注目しているようです。高水のデータによると。

多くの視点から見ると、米国株式市場の地位は、グローバル債券市場での米国債券における「鏡像」に進化しているようです。両者ともそれぞれの資産クラスで最も流動性の高い市場であり、投資家にとって「最も安全な」証券を提供しています。彼らの地位とパフォーマンスは、主要競合他社を圧倒しています。

そのため、『FOMO』と『TINA』の影響で、米国株式市場はMSCIグローバル株式指数の時価総額の割合が記録の72%に達し、そうすることも不思議ではありません。誰もがその一部に分け前を望むのは当然ですよね?

しかしながら、このような集中度は永久に続くのでしょうか?現在の株式市場において、本当に米国株に匹敵する能力を持ったものはありますか?

一切明らかにこのように絶対的であることも決してありません。

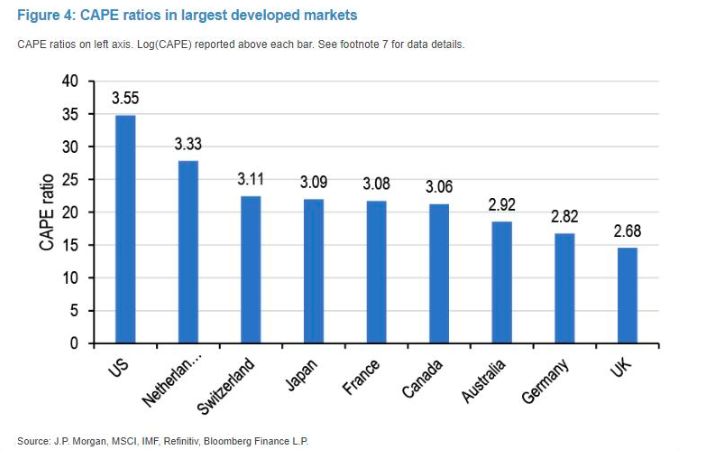

ノーベル経済学者ロバート・シラーによって考案されたサイクリカル調整PE(CAPE)によると、ちょうど牛市の2周年を迎えた米国株は、現在、先進国の中で最も高価な市場になっています。

注:各国のサイクリカル調整PE(CAPE)の比較

グローバル株式市場に対して、米国株の評価は過去20年で最も過大評価されている状態にあります。

注:上図の黄色の線はS&P500のPER、青色の線は米国株以外の国際株式のPER、下の赤色の線はその差を示しています

多くの視点から、投資家は短期間で大幅に資産を再配置する可能性は低いです。先週、ゴールドマンサックスのスコット・ルービナーは書きました:“'FOMU'(基準株価指数を大きく下回ることを心配する、FOMOに似)という理由で、機関投資家は現在市場に参入せざるを得ない状況。”しかし、もしも今後、より魅力的な標的や投資機会が世界中で現れた場合はどうでしょうか?

実際には、TINA(持ち株以外に選択肢なし)やFOMO(S&P500以外の国際株式のPER)という考え方の背後には、米国株市場は永遠に進歩するという暗黙の了解があるようです。世界の株式市場では、米国株以外にはほとんど機会がないとされていますが、もしもある日、投資家がS&P500以外の選択肢があることに気づいたらどうでしょうか?

今年の第1四半期に強い存在感を示した日本株は、一時的にそのような役割を果たしましたが、ここ半年で再び沈黙に包まれています。現在、A株は低い評価と政策支援を受け、新たなグローバルリーダーになる可能性があり、米国株の資金集め力に挑戦するかもしれず、これによっていくつかのグローバル投資家が高い期待を抱いています。

米国銀行が今月初めに発表したグローバルファンドマネージャー調査によると、「中国株の買い」が今回の調査で最も人気のある取引ランキング「TOP3」に上昇しました。「テクノロジー7大企業の買い」および金の買いに次いで、今後12ヶ月間の中国経済の強化が期待されているグローバルファンドマネージャーの純比率は48%に達し、これは2023年4月以来の最高水準です。

しかし、米国株式市場の長期的なブルランは、「FOMO」と「TINA」のどちらにおいても、市場参加者のブルランが前進し続け、永遠に高みを目指すという信頼と信念を反映しています。

そして、このような信頼と信念は、たった1カ月前にブル市に踏み入れたA株にも適用され、これからは政策の大きなサプライズパッケージが株式市場で具体的な効果を生むことを切望しています。市場が一時的な調整を経験した後、多くの人々を恐れさせることなく、依然として前進できるかどうかが問われます。すべては、意思決定者や投資家の勇気と知恵を厳しい試練に晒します。