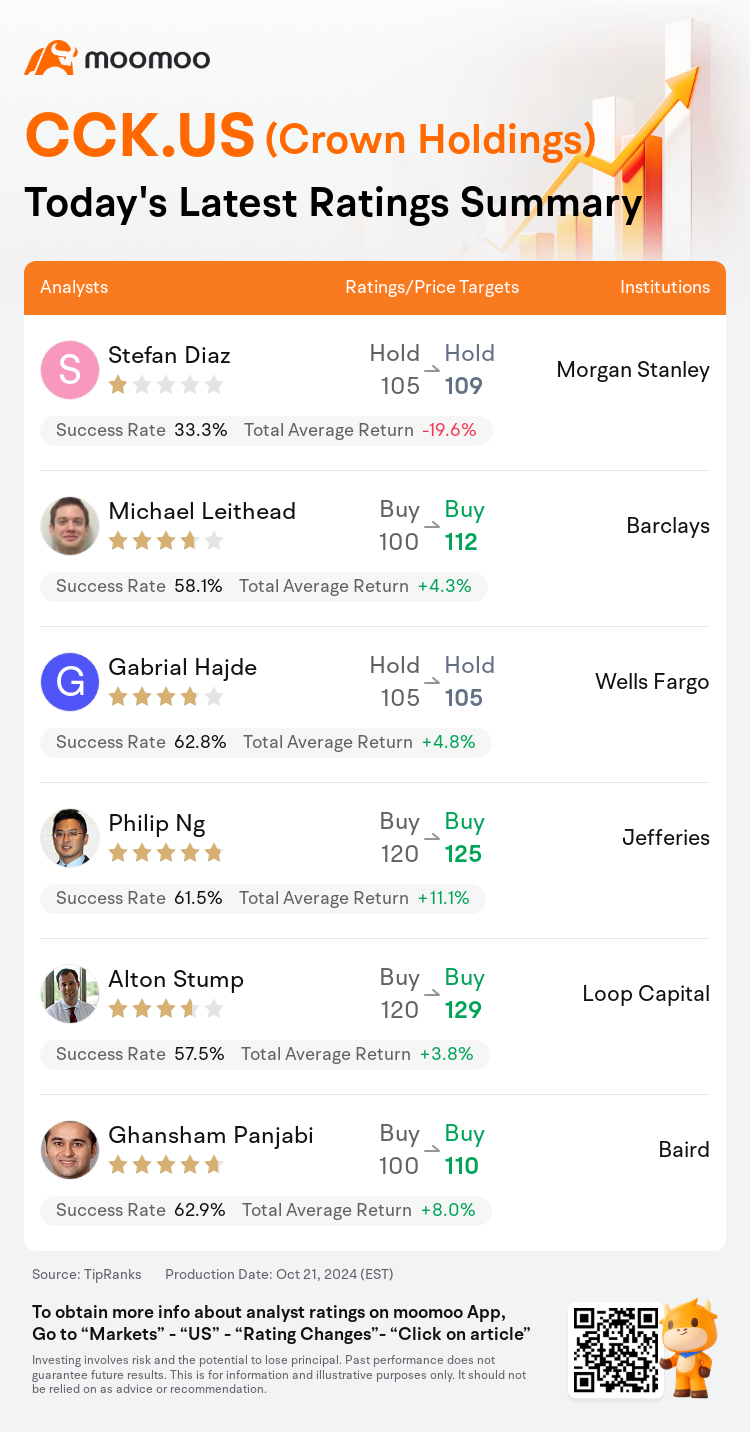

On Oct 21, major Wall Street analysts update their ratings for $Crown Holdings (CCK.US)$, with price targets ranging from $105 to $129.

Morgan Stanley analyst Stefan Diaz maintains with a hold rating, and adjusts the target price from $105 to $109.

Barclays analyst Michael Leithead maintains with a buy rating, and adjusts the target price from $100 to $112.

Wells Fargo analyst Gabrial Hajde maintains with a hold rating, and maintains the target price at $105.

Wells Fargo analyst Gabrial Hajde maintains with a hold rating, and maintains the target price at $105.

Jefferies analyst Philip Ng maintains with a buy rating, and adjusts the target price from $120 to $125.

Loop Capital analyst Alton Stump maintains with a buy rating, and adjusts the target price from $120 to $129.

Furthermore, according to the comprehensive report, the opinions of $Crown Holdings (CCK.US)$'s main analysts recently are as follows:

The firm acknowledges Crown Holdings' consistent performance for the third consecutive quarter, which is anticipated to bolster the narrative and its valuation multiple. They still consider Crown to be an attractive growth at a reasonable price opportunity, especially as the company increases the deployment of its surplus cash.

Crown Holdings remains well-regarded for its solid valuation relative to peers, consistent volume performance, progressive returns, and the possibility of strategic moves in the future. Although the company anticipates a net interest expense of $350M for the following year, it is believed that further repurchases could slightly elevate this figure. The recent adjustment in estimates has led to an increased valuation assessment.

The recent increase in expectations for Crown Holdings' annual earnings per share is driven by an impressive sharp uptick in third-quarter earnings per share and volumes that surpassed forecasts in both North America and Europe. This has led to an improved projection that takes into account the company's enhanced operating leverage.

Crown Holdings is positioned to consistently deliver on a competitive earnings algorithm, further catalyzed by share repurchases.

Here are the latest investment ratings and price targets for $Crown Holdings (CCK.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

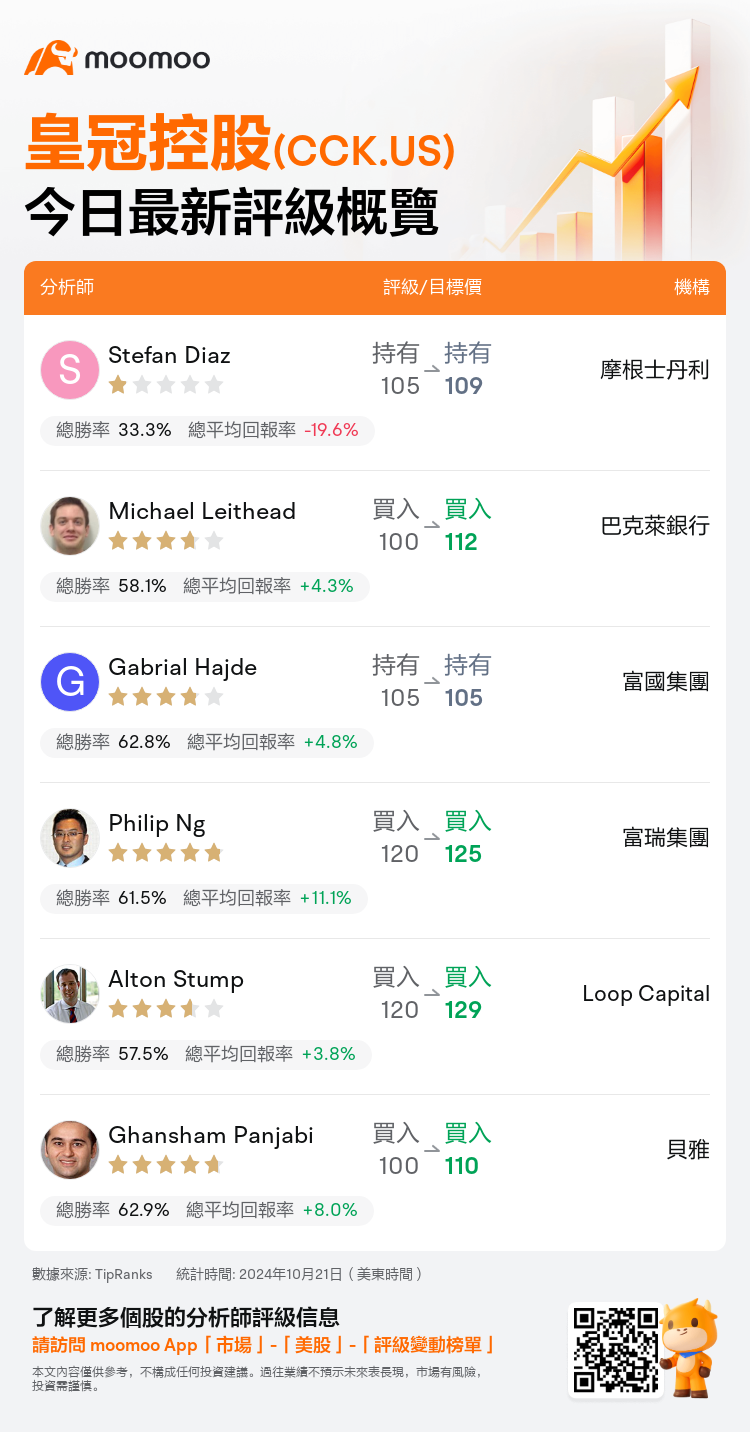

美東時間10月21日,多家華爾街大行更新了$皇冠控股 (CCK.US)$的評級,目標價介於105美元至129美元。

摩根士丹利分析師Stefan Diaz維持持有評級,並將目標價從105美元上調至109美元。

巴克萊銀行分析師Michael Leithead維持買入評級,並將目標價從100美元上調至112美元。

富國集團分析師Gabrial Hajde維持持有評級,維持目標價105美元。

富國集團分析師Gabrial Hajde維持持有評級,維持目標價105美元。

富瑞集團分析師Philip Ng維持買入評級,並將目標價從120美元上調至125美元。

Loop Capital分析師Alton Stump維持買入評級,並將目標價從120美元上調至129美元。

此外,綜合報道,$皇冠控股 (CCK.US)$近期主要分析師觀點如下:

該公司認可皇冠控股連續第三個季度的穩健表現,預計將增強敘述和估值倍數。他們仍然認爲皇冠是一個具有吸引力的價值投資機會,尤其是在公司增加盈餘現金部署的情況下。

皇冠控股因其相對同行的穩定估值、持續的成交量表現、漸進的回報以及未來戰略舉措的可能性而備受推崇。儘管公司預計下一年的淨利息支出爲35000萬美元,但進一步回購可能會略微提高這一數字。近期對估算的調整導致了估值評估的上升。

皇冠控股年度每股盈利預期的最近增加是由第三季度每股盈利和成交量出現驚人的大幅增長所推動,這一增長超過了在北美和歐洲的預測。這導致了一份改進的預測,考慮了公司增強的營運槓桿。

皇冠控股有望持續通過股份回購實現競爭性盈利算法。

以下爲今日6位分析師對$皇冠控股 (CCK.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Gabrial Hajde維持持有評級,維持目標價105美元。

富國集團分析師Gabrial Hajde維持持有評級,維持目標價105美元。

Wells Fargo analyst Gabrial Hajde maintains with a hold rating, and maintains the target price at $105.

Wells Fargo analyst Gabrial Hajde maintains with a hold rating, and maintains the target price at $105.