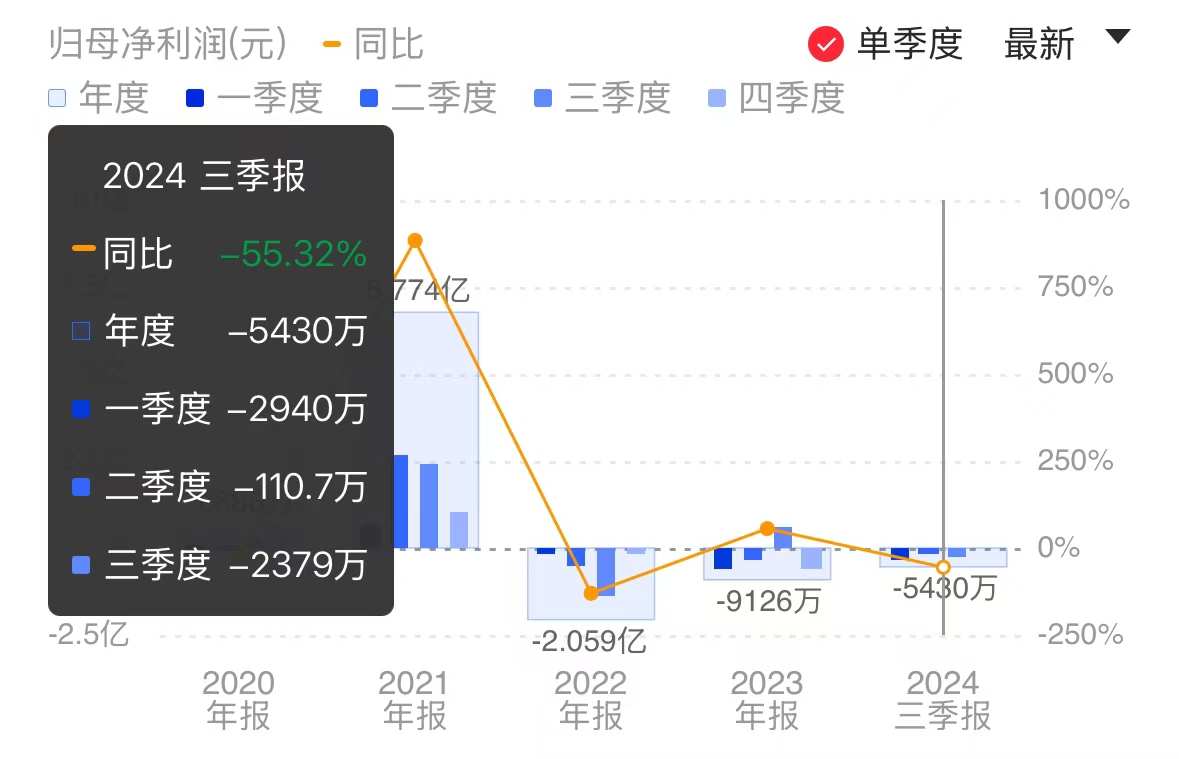

①晶丰明源第三季度财报显示,营收实现3.53亿元,同比增长17.51%,归母净利润为-2379万元;②晶丰明源同时宣布筹划以发行股份、发行定向可转换公司债券及支付现金方式购买四川易冲控制权,同时拟募集配套资金。

《科创板日报》10月21日讯(记者 郭辉)又一例半导体并购。

今日(10月21日)晚间,*晶丰明源发布2024年第三季度财报,并宣布一项重大资产重组事项并公告停牌。

拟并购四川易冲 标的曾融资15轮

拟并购四川易冲 标的曾融资15轮

晶丰明源作为一家老牌的模拟芯片厂商,通过内生+外延式拓展丰富产品线,成为其在近年发展中抓住市场机遇的重要战略。

就在今日(10月21日)晚间,晶丰明源宣布筹划以发行股份、发行定向可转换公司债券及支付现金方式购买四川易冲科技有限公司(下称“四川易冲”)控制权,同时拟募集配套资金。

经初步测算,该项交易预计构成《上市公司重大资产重组管理办法》规定的重大资产重组。晶丰明源公告,自明日(即:10月22日)开市起将停牌,预计停牌时间不超过5个交易日。

该交易的具体交易方式、交易方案等内容暂未披露。公告显示,此次交易对手方包括了标的四川易冲的前三大股东等,并已于今日签署了《股权收购意向协议》。

四川易冲成立于2016年2月,总部位于四川,是一家无线充电芯片和解决方案服务商,主要产品是无线充电芯片和智能硬件。据了解,该公司创始团队以清华系海归为主,核心团队来自欧美国际厂商。

其中,四川易冲董事长兼总经理潘思铭是一名85后创业者,清华大学本科毕业,并在密苏里科技大学取得硕博学位,为IEEE高级会员及国家青年特聘专家,研究方向是电力电子设计和电磁兼容与高速系统设计,曾任职于Cisco、Apple等公司。

四川易冲主要客户包括来自欧、美、日、韩和中国本土的多家知名企业,其无线充电解决方案曾被丰田汽车、谷歌、微软、索尼、泽宝、海尔等公司采用。

在消费级领域,四川易冲产品曾获得终端全球大客户全面大规模出货;在车规级领域,早于2022年已有多款产品完成车规级认证,导入多款车型,并与车厂和Tier 1同步开发新型高端产品。

财联社创投通数据显示,从2016年至今,四川易冲已进行15轮融资。其中于2023年底完成的F+轮融资,投资方包括深创投、韦豪创芯、建信投资、深圳资本、吉利控股等;而在2023年中完成的F轮融资,则聚集了上汽集团、尚颀资本、中金资本、蔚来资本等资本方。

晶丰明源表示,该交易目前尚处于筹划阶段,交易各方尚未签署正式的交易协议,具体交易方案仍在商讨论证中,仍存在较大不确定性。同时本次交易尚需提交公司董事会、股东大会审议及监管机构批准。

净利润环比亏损扩大

晶丰明源此前也有并购案例。

2023年4月,晶丰明源完成对南京凌鸥创芯61.61%股权收购。据了解,凌鸥创芯专注于电机控制领域,核心产品为MCU,终端市场面向电动车、家用电器、工业控制等。通过对凌鸥创芯的并购,晶丰明源扩展了在电机控制芯片领域的技术能力并扩大产品组合。

晶丰明源同步披露的财报显示,今年第三季度,该公司电机控制驱动芯片销售收入0.76亿元,占总收入比重为21.53%。另外,Q3产生股份支付费用0.14亿元,对第三季度的净利润数据产生一定影响。同时该公司去年第三季度因预期无法达到业绩考核指标,冲回股份支付费用1.76亿元。

毛利率方面,晶丰明源Q3主营业务产品综合毛利率37.52%,较上年同期上升13.58个百分点。晶丰明源表示,毛利率提升,源于成熟市场产品技术迭代,毛利率较高的“第二曲线”收入占比提升,以及供应链成本下降多重因素叠加。

分产品来看,今年第三季度,晶丰明源LED照明电源芯片实现销售收入1.99亿元、AC/DC电源芯片销售收入0.64亿元、电机控制驱动芯片销售收入0.76亿元、DC/DC电源芯片销售收入0.14亿元。

晶丰明源方面表示,该公司在夯实LED照明电源芯片市场份额的同时,也在积极发展第二增长曲线,持续提升AC/DC电源芯片、电机控制驱动芯片,在整体业务中占比;同时基于40V BCD工艺平台成功量产,逐步提升DC/DC电源芯片销售收入。

在今年9月,晶丰明源接受机构调研时表示,今年以来照明产品价格下降主要系市场景气度恢复不及预期、行业竞争格局变化等多重因素导致。相关产品价格整体随行就市,未来变化趋势还将继续受到市场供需关系的波动影响、以及一定的生产成本和利润空间的考量。

晶丰明源AC/DC电源芯片产品在各细分市场相继取得了业务突破,正处于快速上量阶段,今年上半年已在大家电白电品牌厂商、小家电客户、国内品牌手机厂多个功率段产品中取得突破或进展。另外其DC/DC电源芯片产品已进入市场推广阶段,目前已获得两家国外知名主芯片厂商以及国内多家主芯片厂商认证,在AIC、PC、服务器等领域实现量产。

晶丰明源第三季度财报显示,该公司Q3实现营收3.53亿元,同比增长17.51%,不过环比Q2的4.16亿元有所下滑;归母净利润方面,第三季度为-2379万元,较去年同期由盈转亏,下降143.82%,环比今年第二季度亏损有所扩大。