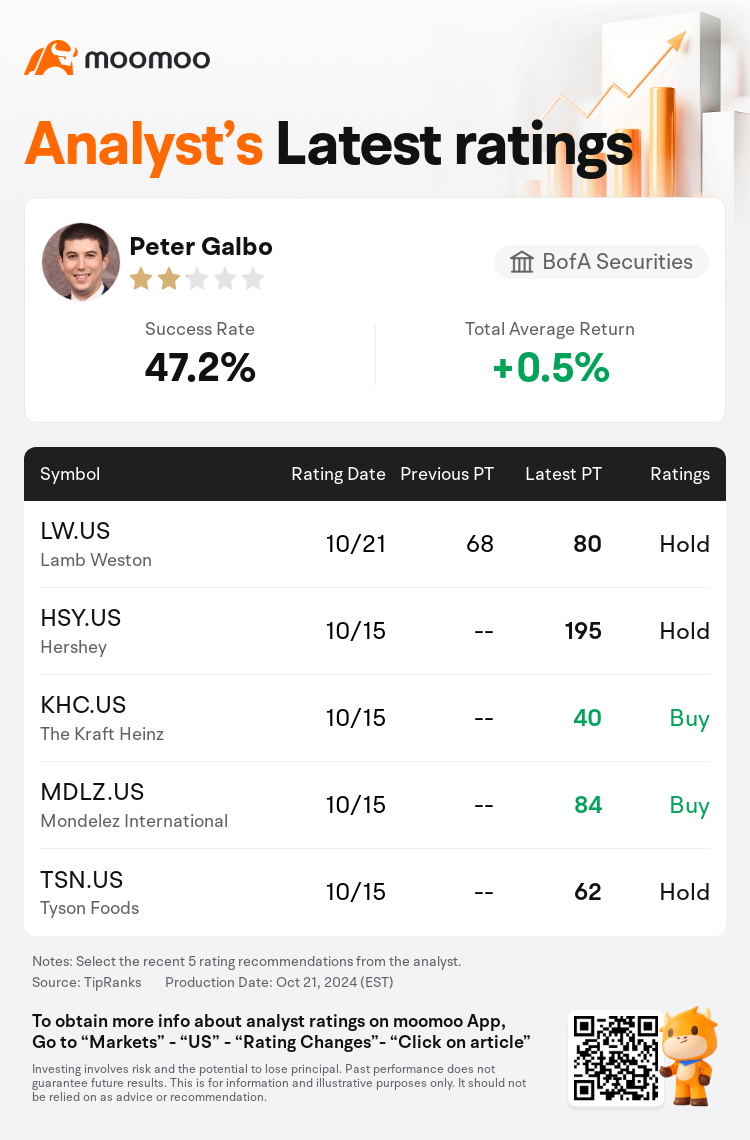

BofA Securities analyst Peter Galbo maintains $Lamb Weston (LW.US)$ with a hold rating, and adjusts the target price from $68 to $80.

According to TipRanks data, the analyst has a success rate of 47.2% and a total average return of 0.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

The interest shown by an activist investor who has recently acquired a 5% stake in Lamb Weston and intends to engage in discussions with the company's board and management about various self-inflicted missteps has been noted. The company's stock has not performed well so far this year, and the involvement of the activist, along with another entity known for its agricultural industry expertise, is seen as significant.

Following the announcement that an investment firm has acquired a substantial stake in Lamb Weston and intends to suggest the consideration of a sale, there's an increased emphasis on the company's management, particularly as shares have seen a notable decline before the news. It is considered somewhat improbable that there would be considerable interest from any major branded companies in the sector. Lamb Weston has significant ties to the foodservice channel and tends to experience greater fluctuations in its financial outcomes compared to established packaged food manufacturers, due to the potential influence of broad economic trends and the annual quality of the potato harvest on its performance.

The disclosure of an activist stake in Lamb Weston has been seen as a positive development, potentially intensifying the company's urgency to enhance its operational performance. Discussions regarding strategic alternatives are anticipated, which could lead to further corporate actions aimed at driving shareholder value.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美銀證券分析師Peter Galbo維持$Lamb Weston (LW.US)$持有評級,並將目標價從68美元上調至80美元。

根據TipRanks數據顯示,該分析師近一年總勝率為47.2%,總平均回報率為0.5%。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

最近收購lamb weston 5%股份並打算與公司董事會和管理層就各種自身失誤進行討論的激進投資者所展現的興趣已經引起注意。公司股價今年迄今表現不佳,激進投資者的參與以及另一家以其農產品行業專業知識聞名的實體被視爲重要。

隨着投資公司收購lamb weston的大量股份並打算提議考慮出售的公告,公司管理層受到了更多關注,尤其是在此前股價出現顯著下跌的消息之前。人們認爲任何主要品牌公司在該板塊中產生極大興趣的可能性相對較低。lamb weston與餐飲渠道有着密切聯繫,並往往會在財務結果上經歷較大波動,這與成熟包裝食品製造商相比,受廣義經濟趨勢和土豆年度收成質量對其績效的潛在影響。

披露lamb weston激進股權的消息被視爲一個積極的發展,可能加劇公司加強運營績效的緊迫性。預計將進行有關戰略替代方案的討論,這可能導致進一步的旨在推動股東價值的公司行動。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of