Zhejiang Xinhua Chemical Co.,Ltd (SHSE:603867) shares have had a really impressive month, gaining 35% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.8% over the last year.

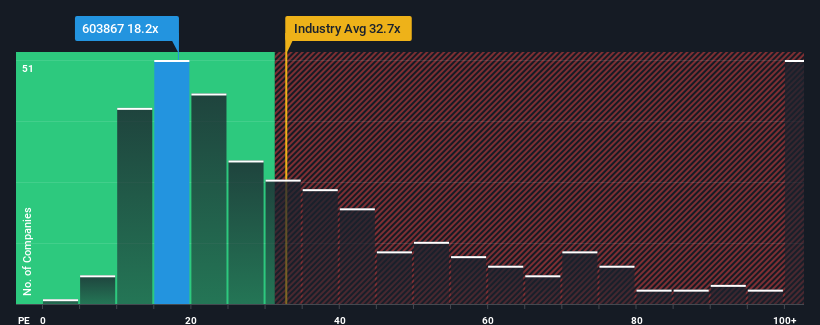

In spite of the firm bounce in price, Zhejiang Xinhua ChemicalLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.2x, since almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 64x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Zhejiang Xinhua ChemicalLtd has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Xinhua ChemicalLtd's is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Xinhua ChemicalLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.5%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 46% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 27% per year as estimated by the one analyst watching the company. With the market only predicted to deliver 18% per annum, the company is positioned for a stronger earnings result.

With this information, we find it odd that Zhejiang Xinhua ChemicalLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Zhejiang Xinhua ChemicalLtd's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhejiang Xinhua ChemicalLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - Zhejiang Xinhua ChemicalLtd has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.