Chongqing Rural Commercial Bank and Bank of Beijing both adjusted their deposit benchmark interest rates on the same day, with the largest reduction being 25 basis points each. After the adjustment, the fixed deposit rates of Chongqing Rural Commercial Bank are still lower than some city commercial banks and joint-stock banks, but on par with state-owned major banks. In this round of interest rate cuts, small and medium-sized banks have significantly accelerated their response speed, indicating an improvement in the efficiency of policy transmission within the industry.

Caifinance News October 22nd (Reporter Zou Juntao) Following state-owned banks and joint-stock banks, chongqing rural commercial bank has also started a new round of deposit interest rate cuts.

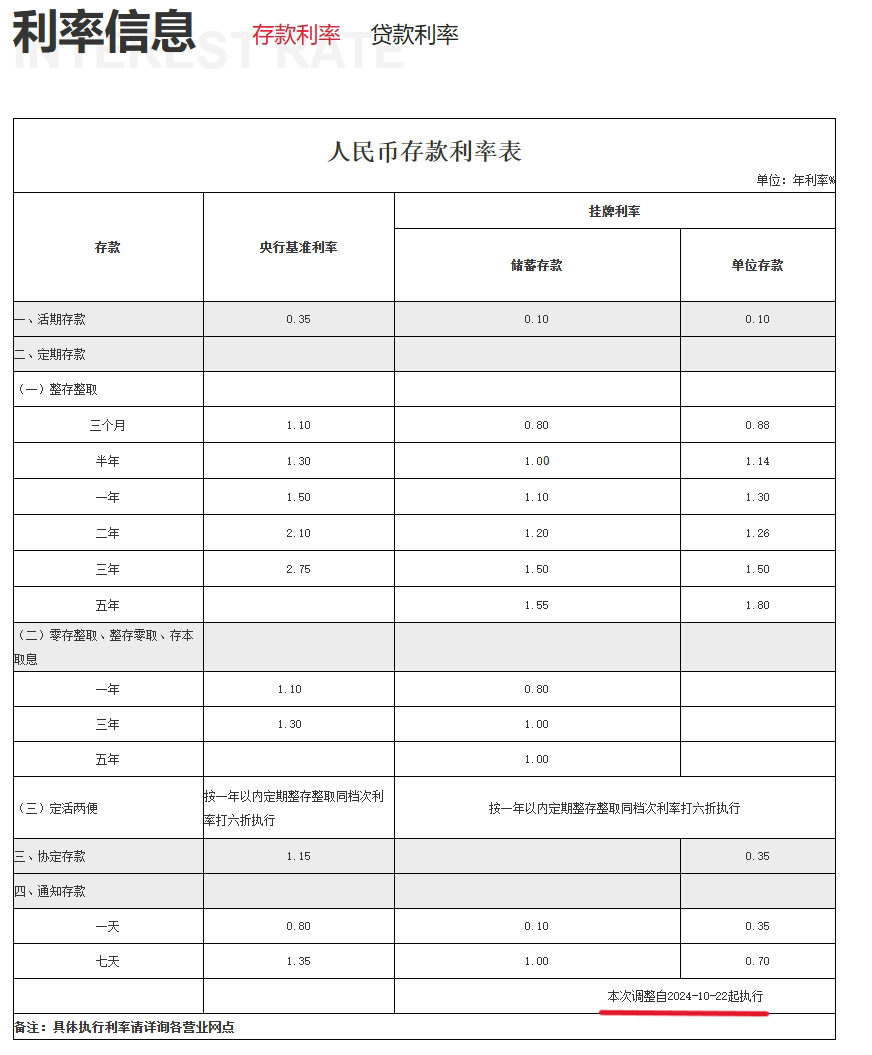

On October 22nd, Chongqing Rural Commercial Bank (Chongqing Rural Commercial Bank) disclosed on its website that a new RMB deposit interest rate table will be implemented starting today. The fixed deposit interest rates are uniformly cut by 25 basis points, with a reduction magnitude basically in line with the previous maximum decrease of state-owned banks and joint-stock banks. At the same time, Chongqing Rural Commercial Bank's demand and notice deposit interest rates have also been cut by different extents.

Screenshot from Chongqing Rural Commercial Bank website

Screenshot from Chongqing Rural Commercial Bank website

On the same day, Bank of Beijing also announced a new round of adjustments to the RMB savings deposit benchmark interest rates. Caifinance reporters noticed that since state-owned banks took the lead in starting a new round of deposit interest rate cuts on the 18th of this month, in less than 3 working days, the "rate cut trend" has covered state-owned banks, joint-stock banks, and chongqing rural commercial bank.

Guangda Bank's Macro Research Department analyst Zhou Maohua stated in an interview with Caixin reporters today that compared to previous rounds, the speed of deposit rate adjustments by small and medium-sized banks in this round has accelerated, reflecting an increase in the efficiency of domestic policy transmission. At the same time, he also mentioned that to some extent, institutions also hope to quickly unleash the effects of the deposit rate adjustment.

This round of "interest rate cut wave" has spread to city commercial banks.

Chongqing Rural Commercial Bank disclosed on its website today that it has lowered the interest rate on demand deposits by 5 basis points to 0.10%; the benchmark interest rates for three-month, six-month, one-year, two-year, three-year, and five-year fixed-term deposits have all been reduced by 25 basis points to 0.80%, 1.00%, 1.10%, 1.20%, 1.50%, 1.55%; the interest rate for 7-day notice deposits is also reduced by 25 basis points to 1.00%.

In addition, the benchmark interest rates for Chongqing Rural Commercial Bank's zero saving, fixed saving, and saving with interest withdrawal have also been lowered by 25 basis points, with the one-year, three-year, and five-year term benchmark rates dropping to 0.80%, 1.00%, and 1.00% respectively.

On the same day, Bank of Beijing announced on its website that it will implement new RMB savings deposit interest rates starting from October 22, with the interest rate for demand deposits lowered by 5 basis points to 0.10%, and the benchmark interest rates for three-month, six-month, one-year, two-year, three-year, and five-year fixed-term deposits reduced by 25 basis points to 0.85%, 1.10%, 1.30%, 1.45%, 1.55%, 1.60%; the interest rate for 7-day notice deposits is also decreased by 25 basis points to 0.45%.

Furthermore, Bank of Beijing has also lowered the benchmark rates for zero saving, fixed saving, and saving with interest withdrawal by 25 basis points, bringing the one-year, three-year, and five-year term benchmark rates down to 0.87%, 1.11%, and 1.20%.

In terms of the rate reduction magnitude, the reduction range of the two city commercial banks is consistent with the previous five major state-owned banks as well as joint-stock banks such as CMB and Ping An, all showing a maximum decrease of 25 basis points.

It is worth mentioning that after the adjustment, the fixed deposit interest rates of Chongqing Rural Commercial Bank will be consistent with those of Industrial and Commercial Bank of China and other large state-owned banks, but significantly lower than city commercial banks represented by Bank of Beijing and some other joint-stock banks. It is understood that after this round of adjustments, the five-year fixed-term deposit interest rate of Ping An Bank, China Everbright Bank, Minsheng Bank and other joint-stock banks is 1.6%.

Zhou Maohua pointed out that the decision to adjust deposit interest rates in different banking institutions needs to fully consider the deposit market situation, the institution's own customer base, brand effect, debt capacity, and net interest margin, among other aspects. He stated that considering the current similarities in business among banks, the differences in deposit rates are expected to not be very significant.

Chongqing Rural Commercial Bank disclosed in this year's interim report that it aims to enhance the precision management level of active liabilities, flexibly arrange the size and structure of active liabilities, and promote continuous decrease in liability costs. During the reporting period, to consolidate the advantage in liability costs and further optimize the balanced development of liability quantity, price, and structure, the interest rate on liabilities decreased by 8BP compared to the end of the previous year, easing some downward pressure on interest spreads.

Smaller banks have significantly accelerated their pace in following the trend of interest rate cuts.

On October 18, industrial and commercial bank, agricultural bank, bank of china, china construction bank corporation and other state-owned large banks took the initiative to reduce the deposit benchmark interest rates based on the current situation and their own operational needs. Almost simultaneously, cm bank, ping an bank followed suit by lowering the deposit benchmark interest rates on October 18 and 19.

On October 22nd, Chongqing Rural Commercial Bank and Bank of Beijing lowered the deposit listed interest rates on the same day, with a gap of less than 3 working days from the state-owned banks and joint-stock banks. Caixin reporters noted that in this round of "interest rate cuts", the speed of follow-up by small and medium-sized banks has significantly accelerated.

It is understood that in the previous round of "interest rate cuts", initiated by state-owned banks on July 25th and followed by Bank of Beijing on August 2nd, there was a gap of almost a week.

Zhou Maohua pointed out that the main reason for small and medium-sized banks to follow up is the structural imbalance in the current deposit market. Banks generally face pressure from net interest margins and the downward shift in market interest rates. Regarding the swift action, he stated, "After the previous few rounds of 'step-by-step reduction' in deposit rates, institutions have accumulated reliable experience in the process of repricing and lowering deposit rates, and depositors and the market have fully digested and anticipated the reduction in deposit rates."

截图来自渝农商行网站

截图来自渝农商行网站