The performance has shown a declining trend in the past two years.

Under the pressure of being the "first tea stock in the US stock market", Min Donghong Group (ORIS.US) not only did not struggle, but made a stunning appearance.

On the first day of listing on October 17th, Min Donghong Group soared by 50%, with a trading volume of 1.6552 million shares. In the following two trading days, the stock's performance continued to rise. By the close of October 21st, the stock price of Min Donghong Group was $8.74, with a total market value of 0.19 billion dollars, soaring by 118.5% from the issue price of $4.

Can the fundamentals of Min Donghong Group support the skyrocketing stock price? Analyzing its prospectus may provide some insights.

Can the fundamentals of Min Donghong Group support the skyrocketing stock price? Analyzing its prospectus may provide some insights.

The performance has shown a declining trend in the past two years.

The prospectus shows that Min Donghong Group grows, processes, and refines white and red tea in Fujian Province, China, and sells tea to distributors and end consumers in China. Processing white tea is its main product. The tea gardens operated by Min Donghong Group are located in Tuorong County, Ningde City, Fujian Province. Up to now, the company has signed contracts for the management and planting rights of tea gardens covering approximately 7.212 million square meters with Fujian Province. The company is one of the top ten tea companies in tea garden area in Ningde City, one of the cities with the highest tea production in Fujian Province.

The historical growth of the company is mainly driven by the expansion of the domestic white tea market. According to a China Investment Report, the domestic sales of white tea in mainland China experienced strong growth from approximately $0.4 billion in 2017 to around $1.3 billion in 2021, with a compound annual growth rate of about 32.8%. It is estimated to grow to around $2.4 billion by 2026, with a compound annual growth rate of about 11.9% from 2021 to 2026.

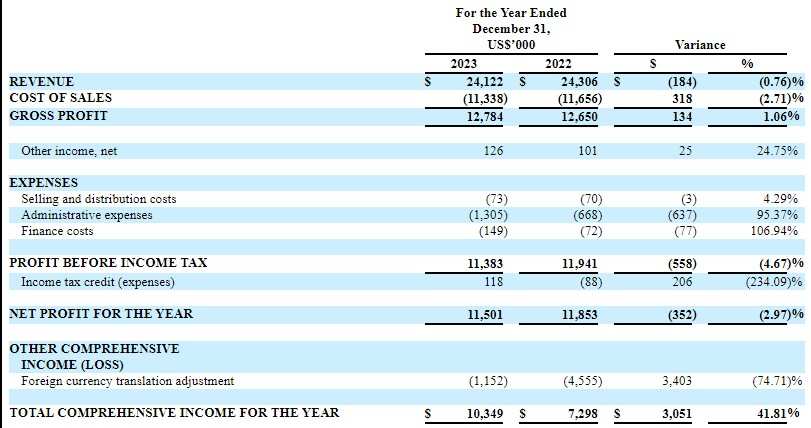

As a supplier of white tea products, Mindong Hong Group has taken advantage of the industry's growth momentum to develop. However, in the past two years, the company's performance has shown signs of decline. From 2022 to 2023, the company's revenue was $24.3 million and $24.1 million respectively, with a slight decrease of 0.8% year-on-year; during the same period, the net income was $11.501 million and $11.853 million respectively, a decrease of 2.97% year-on-year.

As mentioned earlier, primary processing of white tea is the core product of Mindong Hong. The total revenue from 2022 to 2023 was $20.2 million and $19.9 million, accounting for 83.2% and 82.4% of its total revenue during the same period respectively; primary processing of black tea accounted for 16.7% and 15.7% of the total revenue. Therefore, the company's performance fluctuation is largely related to the sales performance of primary processed white tea.

In the past two years, the processed white tea has experienced a decline in selling price. In terms of volume, from 2022 to 2023, the sales volume of processed white tea was 0.4719 million kilograms and 0.4886 million kilograms respectively; the average selling price per kilogram during the same period was $43 and $41 respectively. Despite some growth in sales, it still cannot make up for the income gap caused by the price decrease.

However, it is comforting that the company's gross profit recorded a moderate increase during the reporting period, with gross profits of approximately $12.65 million and 12.78 million yuan respectively. The gross margin for the same period was approximately 52% and 53% respectively. The growth in gross profit was mainly due to the profitability brought by refined tea products. It is worth noting that the average selling prices of refined tea in the past two years were $125 and $228, almost doubling. To capture the growth in the refined tea segment, the company plans to expand the sales volume of refined tea.

In addition to the weak growth and even decline in performance, the company's key financial indicators are also lackluster.

During the period, the company's sales and distribution expenses were approximately 0.07 million yuan and 0.073 million yuan respectively, a slight increase of 4.3% year-on-year; financial expenses surged by 42.8% year-on-year, mainly due to a large increase in depreciation and amortization. In the past two years, the company's depreciation and amortization were 0.044 million yuan and 0.252 million yuan respectively, representing a 472.7% year-on-year growth.

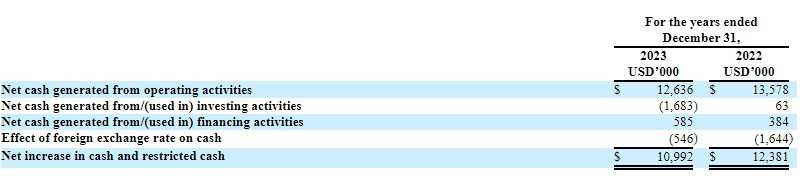

In addition, the company's net cash generated from operating activities in the past two years was approximately 13.578 million yuan and 12.636 million yuan respectively; narrowing year-on-year, consistent with the decline in the company's performance. During the same period, the company's accounts receivable were approximately 0.859 million yuan and 0.936 million yuan respectively, a slight increase of 9% year-on-year.

It is worth noting that the majority of the company's business is conducted on an order basis, and its financial performance depends on the relationships with key customers and the ability to develop new opportunities with potential customers. As of the fiscal years ending in 2022 and 2023, revenue from the top five customers accounted for approximately 40.5% and 39.3% of total revenue respectively. According to the CITIC report, leading primary tea drink manufacturing companies often exhibit high revenue concentration from key customers. Revenue from the top five customers typically ranges from 20% to 50%.

However, despite the decline in performance and narrowing cash flow, Mingdong Hong Group's accounts receivable continue to show a growing trend, indicating the company's lack of industry influence, which impacts its collection and fund operation capabilities.

National "Bai Style Tea" landscape enhances capacity expansion

White tea is an important category of Chinese tea. In recent years, white tea has gradually become a favorite in the tea industry due to its fresh, delicate, sweet, and lingering taste. White tea is mainly produced in Fujian province. Compared to other white tea plantation areas such as Hubei and Guizhou, white tea produced in Fujian also commands a higher price premium. In 2021, white tea produced in Fujian, Guizhou, and Hubei accounted for approximately 67.2%, 12.3%, and 5.9% of the total production of white tea in mainland China. Within Fujian, most of the white tea is produced in Fuding, accounting for about 48% of the total production in Fujian in 2021.

According to JD.com's Big Data Research Institute's "2021 Spring Tea Consumption Trends Report," the post-95s generation also prefers white tea. As white tea becomes the "new favorite" among the young consumer group, in addition to the main white tea production area of Fujian province, more and more provinces are entering the white tea market. Provinces such as Yunnan, Sichuan, Guizhou, Hubei, and others are intensifying their production of white tea varieties, creating a nationwide "white tea fever." In 2023, the national white tea production reached 0.1002 million tons, with a production increase of 538.22% over the past 10 years, ranking first in the growth rates among the six major tea categories in China.

The prospectus shows that the estimated domestic sales value of white tea in mainland China will increase to $2.4 billion (16 billion RMB) by 2026, with a compound annual growth rate of 11.9% from 2021 to 2026. However, in terms of competitive landscape, the tea production and sales market in China is a highly fragmented market. According to Mindong Hong Group, the number of competitors in the white tea market had already reached 1,000 in 2020.

In order to seize the growth opportunities in the white tea market, Mindong Hong is actively increasing its production capacity.

On one hand, the company plans to increase its production by acquiring tea gardens. In the past two years, the company has received but not accepted purchase orders of approximately $13.26 million (91.76 million RMB) and $14.26 million (92.3 million RMB) respectively. The inability to accommodate all purchase orders from customers has limited the company's growth potential. Acquiring additional capital to purchase and upgrade tea gardens will be an effective and efficient strategy to increase output, sales, revenue, and profits. However, acquiring tea gardens will also significantly increase depreciation and amortization.

On the other hand, the company plans to construct a new production plant and purchase four automated production lines for the primary processing of white tea. It is reported that the company intends to expand its production facilities by establishing a new production plant in the Zherong Tea Industry Zone in Zhejiang, with an initial estimated total building area of approximately 9783.0 square meters. The initial phase of the new production plant will be used for primary processing of white tea, refined tea, and product storage. The company has signed a letter of intent with the Zherong Tea Industry Zone Management Committee, with an estimated tender price of approximately $5 million (approximately 33.7 million RMB).

Despite the increase in production capacity, which is positive for expanding market share in the white tea market, the intensification of homogeneous competition is worsening with more new entrants. Moreover, in 2023, the total sales volume of white tea was 0.083 million tons, accounting for 3.4% of the six major tea categories. While the growth rate is impressive, the actual total volume still lags significantly behind red tea, green tea, and other varieties with over 10% market share.

While the overall market size has not yet expanded significantly, more regions are entering the market, posing increasingly significant challenges to the white tea market. In addition, with the increase in supply, the resilience of white tea market prices remains a test. As mentioned earlier, if white tea prices decline, the low growth in sales volume may not be able to compensate for the price drop. Whether Mindong Hong Group can revitalize its growth through expansion and production remains to be tested over time.

闽东红集团基本面能否支撑得起暴涨的股价呢?拆解其招股书,或可以为我们解惑。

闽东红集团基本面能否支撑得起暴涨的股价呢?拆解其招股书,或可以为我们解惑。