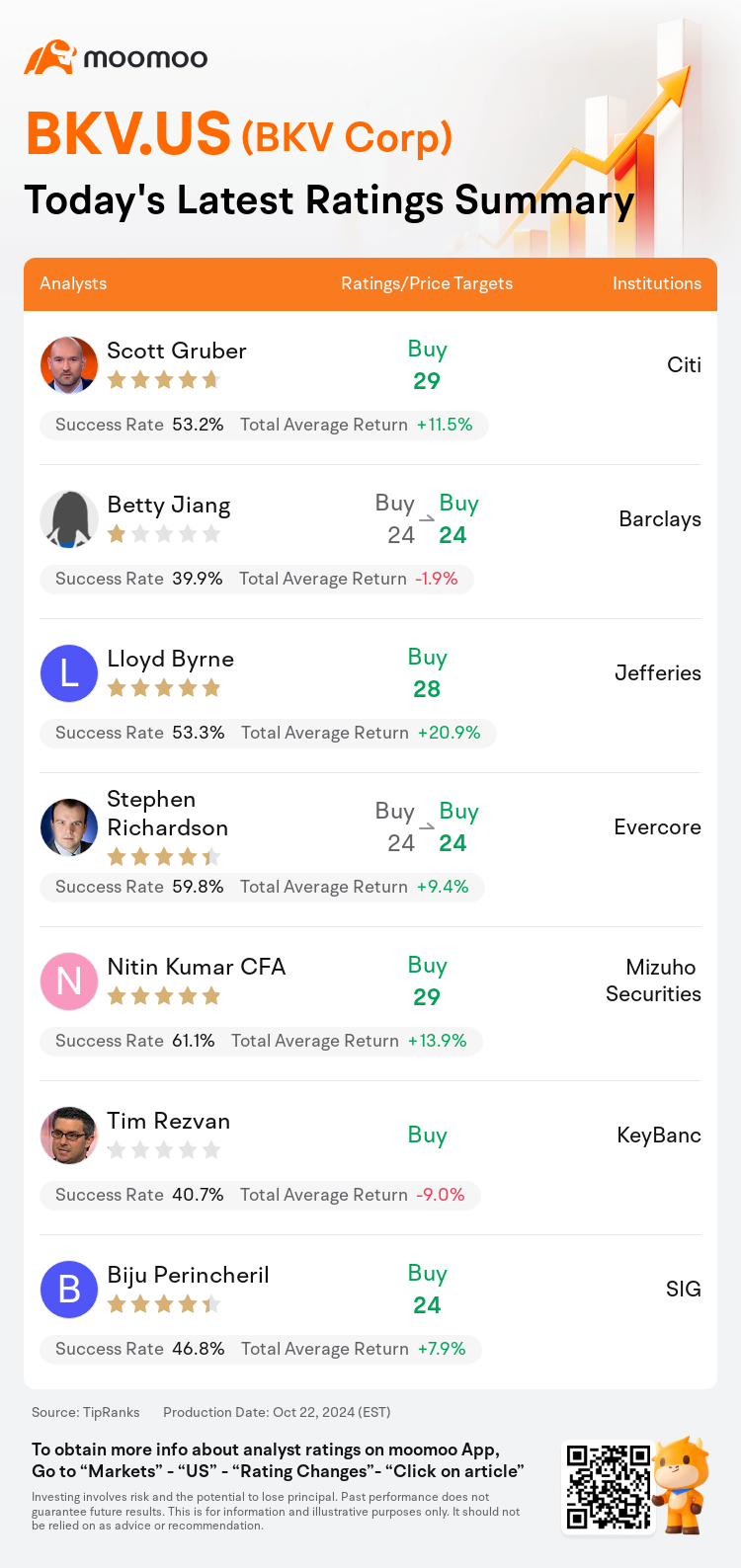

On Oct 22, major Wall Street analysts update their ratings for $BKV Corp (BKV.US)$, with price targets ranging from $24 to $29.

Citi analyst Scott Gruber initiates coverage with a buy rating, and sets the target price at $29.

Barclays analyst Betty Jiang maintains with a buy rating, and maintains the target price at $24.

Jefferies analyst Lloyd Byrne initiates coverage with a buy rating, and sets the target price at $28.

Jefferies analyst Lloyd Byrne initiates coverage with a buy rating, and sets the target price at $28.

Evercore analyst Stephen Richardson maintains with a buy rating, and maintains the target price at $24.

Mizuho Securities analyst Nitin Kumar CFA initiates coverage with a buy rating, and sets the target price at $29.

Furthermore, according to the comprehensive report, the opinions of $BKV Corp (BKV.US)$'s main analysts recently are as follows:

BKV Corp. distinguishes itself in the exploration and production sector by merging its core gas production operations with an expansion strategy that emphasizes power and carbon capture. Despite concerns regarding the complexity of the business and the risks associated with growth given the current valuation, the potential for growth in the company's segments, which command higher multiples, seems to be remarkably underappreciated.

BKV Corp. is seen to provide a unique exposure to the expansion of power and carbon capture sectors, which is anticipated to propel the share value higher through a sum-of-the-parts valuation method. With BKV's relatively modest scale, investors are thought to obtain a significant exposure to two enduring trends: the surge in power demand and the shift towards energy transition.

The U.S. natural gas producer is noted for its integrated operations, which encompass midstream natural gas activities as well as downstream operations, including the direct ownership of a power plant complex in Texas. In the previous year, the company successfully commenced its inaugural carbon capture project. In June, the company revealed an agreement to sell Carbon Sequestered Gas (CSG) to an industrial end-user, which allows for premium pricing compared to Henry Hub. It is anticipated that the company will publicize additional CSG sales agreements as it continues to expand its carbon capture, utilization, and storage (CCUS) business.

The individual valuation of BKV Corp.'s three business units might reflect a fair market value. However, when considered as a unified entity, they present a unique investment proposition that leverages converging market trends and could yield superior margins across various energy value chains. The combined value proposition exceeds that of its individual components. The long-term potential of BKV's assets might appeal to investors who exhibit patience, particularly in light of the company's modest financial leverage and strategic hedging approach.

BKV Corp., being principally concentrated on natural gas exploration and production, is positioned to leverage its operations to benefit from several positive long-term trends. The company's growth potential is linked to rising natural gas demand, prospects in carbon capture, and the possibility of enhancing utilization rates for its merchant power assets by engaging with the emerging data centers in Texas.

Here are the latest investment ratings and price targets for $BKV Corp (BKV.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月22日,多家華爾街大行更新了$BKV Corp (BKV.US)$的評級,目標價介於24美元至29美元。

花旗分析師Scott Gruber首次給予買入評級,目標價29美元。

巴克萊銀行分析師Betty Jiang維持買入評級,維持目標價24美元。

富瑞集團分析師Lloyd Byrne首次給予買入評級,目標價28美元。

富瑞集團分析師Lloyd Byrne首次給予買入評級,目標價28美元。

Evercore分析師Stephen Richardson維持買入評級,維持目標價24美元。

瑞穗證券分析師Nitin Kumar CFA首次給予買入評級,目標價29美元。

此外,綜合報道,$BKV Corp (BKV.US)$近期主要分析師觀點如下:

BKV公司通過將其核心燃料幣生產業務與強調電能實業和碳捕捉的擴張策略相結合,在勘探和開採領域脫穎而出。儘管存在對業務複雜性以及與當前估值相比增長風險的擔憂,但公司板塊的增長潛力,尤其是那些佔比較高倍數的板塊,似乎被大大低估了。

BKV公司被認爲提供了獨特的機會,可以在電能實業和碳捕捉板塊的擴張中獲得暴漲的股票價值,這預計將通過部分估值方法帶動股價上漲。由於BKV規模相對較小,投資者有望獲得巨大機會,參與了兩個持續趨勢:電力需求激增和能源過渡。

這家美國天然氣生產商以其綜合運營而聞名,涵蓋了中游天然氣業務以及下游業務,包括直接擁有德克薩斯州的一個電廠綜合體。在上一年,該公司成功啓動了首個碳捕捉項目。6月份,公司宣佈與工業終端用戶簽訂了出售碳固定氣體(CSG)的協議,相較於Henry Hub,價格更高。預計該公司將公佈更多的CSG銷售協議,同時繼續擴大碳捕捉、利用和儲存(CCUS)業務。

BKV公司三個業務部門的個別估值可能反映了公平市場價值。然而,當作爲一個統一實體考慮時,它們呈現出一個獨特的投資機會,利用趨勢收斂的市場趨勢,並可能在各種能源價值鏈上產生卓越的利潤率。綜合價值主張超過其個別元件。BKV資產的長期潛力可能吸引那些具有耐心的投資者,特別是鑑於公司財務槓桿較小和戰略套期保值方法。

BKV公司主要集中在天然氣勘探和生產領域,定位利用其經營來受益於數個積極的長期趨勢。該公司的增長潛力與不斷增長的天然氣需求、碳捕集前景以及通過與德克薩斯新興數據中心合作,提高其商業電能實業利用率的可能性相關聯。

以下爲今日7位分析師對$BKV Corp (BKV.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Lloyd Byrne首次給予買入評級,目標價28美元。

富瑞集團分析師Lloyd Byrne首次給予買入評級,目標價28美元。

Jefferies analyst Lloyd Byrne initiates coverage with a buy rating, and sets the target price at $28.

Jefferies analyst Lloyd Byrne initiates coverage with a buy rating, and sets the target price at $28.