Looking At Arista Networks's Recent Unusual Options Activity

Looking At Arista Networks's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Arista Networks. Our analysis of options history for Arista Networks (NYSE:ANET) revealed 19 unusual trades.

金融巨头们在Arista Networks上做出了明显的看跌举动。我们对Arista Networks(NYSE:ANET)的期权历史进行分析,发现了19笔异常交易。

Delving into the details, we found 21% of traders were bullish, while 68% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $93,490, and 16 were calls, valued at $738,260.

深入细节,我们发现21%的交易员看好,而68%显示出看淡倾向。在我们发现的所有交易中,有3笔看跌期权,价值$93,490,有16笔看涨期权,价值$738,260。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $500.0 for Arista Networks over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,看起来大户们在过去3个月一直将Arista Networks的目标价区间锁定在$200.0至$500.0之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

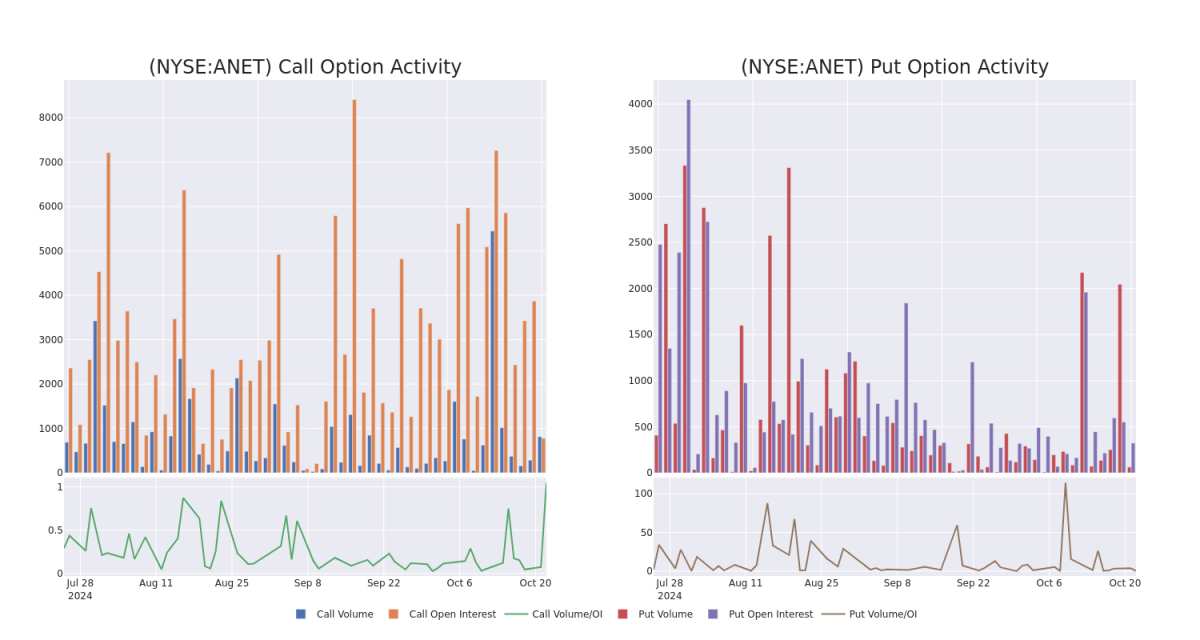

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Arista Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks's whale trades within a strike price range from $200.0 to $500.0 in the last 30 days.

在期权交易中,查看成交量和未平仓合约量是一个很有效的举措。这些数据可以帮助您追踪Arista Networks特定行权价的期权的流动性和人气。下面,我们可以观察过去30天内Arista Networks所有大户交易中$200.0至$500.0行权价区间内看涨和看跌期权的成交量和未平仓合约量的变化。

Arista Networks 30-Day Option Volume & Interest Snapshot

Arista Networks 30天期权成交量和未平仓合约快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | SWEEP | BEARISH | 06/20/25 | $26.6 | $25.0 | $25.0 | $500.00 | $107.5K | 75 | 117 |

| ANET | CALL | TRADE | BEARISH | 02/21/25 | $63.9 | $62.0 | $62.0 | $370.00 | $62.0K | 91 | 0 |

| ANET | CALL | TRADE | BEARISH | 11/15/24 | $24.4 | $23.5 | $23.5 | $397.50 | $58.7K | 0 | 3 |

| ANET | CALL | TRADE | BEARISH | 11/29/24 | $60.0 | $57.5 | $57.5 | $350.00 | $57.5K | 16 | 0 |

| ANET | CALL | TRADE | BEARISH | 06/20/25 | $26.6 | $24.1 | $25.0 | $500.00 | $50.0K | 75 | 186 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | 看涨 | SWEEP | 看淡 | 06/20/25 | $26.6 | $25.0 | $25.0 | $500.00 | $107.5K | 75 | 117 |

| ANET | 看涨 | 交易 | 看淡 | 02/21/25 | 63.9 | $62.0 | $62.0 | $370.00 | $62.0K | 91 | 0 |

| ANET | 看涨 | 交易 | 看淡 | 11/15/24 | $24.4 | $23.5 | $23.5 | $397.50 | $58.7K | 0 | 3 |

| ANET | 看涨 | 交易 | 看淡 | 11/29/24 | $60.0 | $57.5 | $57.5 | $350.00 | $57.5K | 16 | 0 |

| ANET | 看涨 | 交易 | 看淡 | 06/20/25 | $26.6 | $24.1 | $25.0 | $500.00 | $50.0K | 75 | 186 |

About Arista Networks

关于Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

Arista Networks是一家网络设备提供商,主要销售以太网交换机和软件给数据中心。它的招牌产品是可扩展操作系统EOS,可以在所有设备上运行单个映像。该公司以一个报告段来运营。自2004年成立以来,它稳步增加市场份额,专注于高速应用。Arista的最大客户是微软和Meta Platforms,大约三分之三的销售来自北美。

Having examined the options trading patterns of Arista Networks, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

经过调查Arista Networks的期权交易模式,我们现在将直接转向该公司的市场现状和表现。这种变化使我们能够深入了解其现在的市场地位和表现。

Present Market Standing of Arista Networks

Arista Networks的当前市场地位

- Trading volume stands at 311,791, with ANET's price down by -2.01%, positioned at $397.84.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 16 days.

- 交易量为311,791股,ANET的价格下跌了-2.01%,位于397.84美元。

- RSI指标显示该股票可能接近超买。

- 预计将在16天内公布收益公告。

Professional Analyst Ratings for Arista Networks

Arista Networks的专业分析师评级

In the last month, 3 experts released ratings on this stock with an average target price of $438.3333333333333.

在过去的一个月中,有3位专家发布了对该股票的评级,平均目标价为438.3333333333333美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Arista Networks, which currently sits at a price target of $425. * Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Arista Networks, targeting a price of $430. * Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Arista Networks with a target price of $460.

Benzinga Edge的期权异动板块能够在市场变动发生之前发现潜在的市场波动者。查看大资金在您喜爱的股票中的持仓情况。点击这里访问。* 来自Evercore ISI Group的分析师决定维持对arista networks的跑赢市场评级,目标价为425美元。* 继续保持立场,高盛的一位分析师仍然认为arista networks值得买入,并将目标价设定为430美元。* 在评估上保持一贯性,花旗集团的一位分析师继续维持对arista networks的买入评级,目标价为460美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Arista Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks's whale trades within a strike price range from $200.0 to $500.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Arista Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks's whale trades within a strike price range from $200.0 to $500.0 in the last 30 days.