The Alpha Group (SZSE:002292) share price has done very well over the last month, posting an excellent gain of 37%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

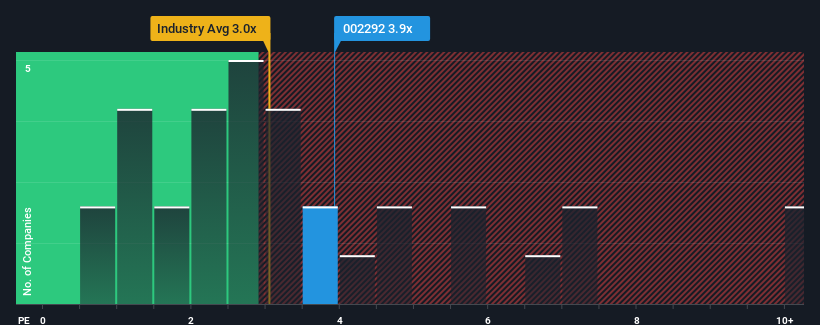

Following the firm bounce in price, you could be forgiven for thinking Alpha Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in China's Leisure industry have P/S ratios below 3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Alpha Group Has Been Performing

With revenue growth that's inferior to most other companies of late, Alpha Group has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Alpha Group will help you uncover what's on the horizon.How Is Alpha Group's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Alpha Group's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like Alpha Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.5% gain to the company's revenues. The latest three year period has also seen a 5.6% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 16% as estimated by the lone analyst watching the company. With the industry predicted to deliver 20% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Alpha Group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Alpha Group shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Alpha Group, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Alpha Group with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.