The SUFA Technology Industry Co., Ltd., CNNC (SZSE:000777) share price has done very well over the last month, posting an excellent gain of 42%. The last 30 days bring the annual gain to a very sharp 48%.

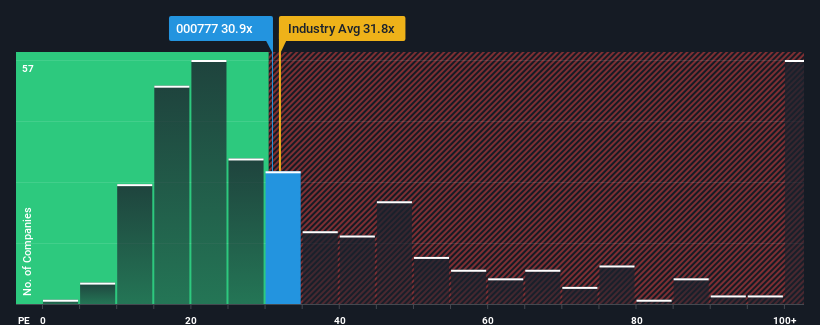

Even after such a large jump in price, it's still not a stretch to say that SUFA Technology Industry CNNC's price-to-earnings (or "P/E") ratio of 30.9x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 33x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The recently shrinking earnings for SUFA Technology Industry CNNC have been in line with the market. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

Is There Some Growth For SUFA Technology Industry CNNC?

In order to justify its P/E ratio, SUFA Technology Industry CNNC would need to produce growth that's similar to the market.

In order to justify its P/E ratio, SUFA Technology Industry CNNC would need to produce growth that's similar to the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 127% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 18% per annum growth forecast for the broader market.

With this information, we find it interesting that SUFA Technology Industry CNNC is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

SUFA Technology Industry CNNC appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of SUFA Technology Industry CNNC's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for SUFA Technology Industry CNNC that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.