Since December last year, Xishan Technology has already carried out three rounds of share buybacks. Among them, two rounds have been completed, and the third round is ongoing. As of now, the company has repurchased a total of 0.44 billion yuan of shares.

Editor's note: "US Stock Gold Mining" Keep up with daily market trends, insight, and consolidate hot and outstanding stocks, providing multi-dimensional investment opportunities for Mooer and helping them grasp investment opportunities with one chart! Focus on: 1. Performance and stock prices take off! Global fast fashion giant $Gap Inc (GPS.US)$ soared nearly 29% after its performance, reaching a new high for the year. Gap announced its first fiscal 2023 first-quarter results, with net sales of $3.4 billion, exceeding analysts' expectations of $3.28 billion, and earnings per share of $0.41, with overall comparable sales growth of 3%, better than expected 0.91%. In addition, the gross profit margin for the quarter reached 41.2%, higher than analysts' forecast of 38.5%. Its subsidiary brand Old Navy's same-store sales grew by 3%, exceeding market expectations of 2.5%. Based on this, Gap raised its sales and operating profit outlook for the year. Baird has recently raised its target share price for Gap from $23 to $28, and Goldman Sachs has raised its target share price for Gap from $20 to $27. 2. US electric power stocks collectively agitated! The largest wind and solar power generator developer in the United States $NextEra Energy (NEE.US)$, the fourth largest power plant in the United States $Southern Company (SO.US)$, the power and natural gas company $CenterPoint Energy (CNP.US)$, and the electrical production and transmission company $Edison International (EIX.US)$ have all reached new highs for the year. On the news front, as AI technology often requires a lot of energy to develop and operate, utility stocks are becoming a new opportunity for investors. 3. Low-key AI beneficiaries! Data storage giant

On January 25-26, 2024, China Securities Regulatory Commission held the 2024 System Work Conference and emphasized that it should highlight the concept of investor orientation. To help investors better understand the real development situation and value of the enterprise, further protect the legitimate rights and interests of investors, etc., Caijing.com and 'Science and Technology Innovation Board Daily' jointly created the 'Shareholders Meeting in Perspective' column.

The 'Shareholders Meeting in Perspective' column is reported on site, focusing on the core management of the chairman of the listed company and others at the shareholders meeting, focusing on the long-term strategy, major decisions, and operational policies of the enterprise, aiming to enhance the image of the enterprise in the capital market, optimize investor relations management, and improve the governance and development of the listed company.

Current Enterprise:

Current Enterprise:

Xishan Technology

Company profile

Established in December 1999, Xishan Technology went public on the star market in June 2023. It is a national high-tech enterprise specializing in the research and development, manufacturing, sales, and services of digital minimally invasive surgical equipment and consumables. Positioned as a provider of overall solutions for minimally invasive surgical tools, it offers products such as surgical power equipment, consumables for surgical power equipment, endoscopic systems, and energy surgical equipment.

Company Highlights

Xishan Technology is a "National Intellectual Property Demonstration Enterprise", a national "specialized, special and new" "small giant" enterprise, winner of the "China Patent Excellence Award", and the drafting unit of the national medical industry standard for "Electric Bone Tissue Surgical Equipment" (Standard No.: YY/T0752-2016). It has led the drafting of 7 national medical device industry standards related to surgical power devices and is one of the leading enterprises in China's surgical power device sector.

Business model

Relying on the market plan of "based in China, expanding overseas", the company's products have been used in more than 3,000 domestic hospitals, covering 31 provinces in China, and exported to more than 43 countries including Germany, Spain, Russia, Brazil, Mexico, Chile, South Korea, India, Kenya, and Ethiopia.

"Star Daily" reported on October 23rd (Reporter: Huang Xiumei) Recently, Xishan Technology held its 2024 second extraordinary general meeting of shareholders at the company's headquarters in the Woodstar Technology Development Center in the northern part of the Chongqing North New Area. The meeting reviewed and approved the "Proposal for Cancellation of Share Repurchase" and the "Proposal for Capital Reduction and Amendment of the Articles of Association".

A person in charge of the company secretariat of Xishan Technology stated in an exchange with a reporter from "Star Daily" before the meeting that based on confidence in the company's future sustainable development and recognition of the company's value, and to effectively enhance shareholder equity, the company has significantly repurchased shares three times since the end of last year, with each share buyback proportion being considerable relative to the total share capital.

As a leading domestic enterprise in the field of minimally invasive surgical equipment and consumables, relevant personnel of Xishan Technology believe that as various local medical insurance bureaus and health commissions gradually include disposable tools for surgical power devices in medical service price items, disposable tool consumables are expected to have a larger market space.

The 'consumable' trend in tools brings growth opportunities.

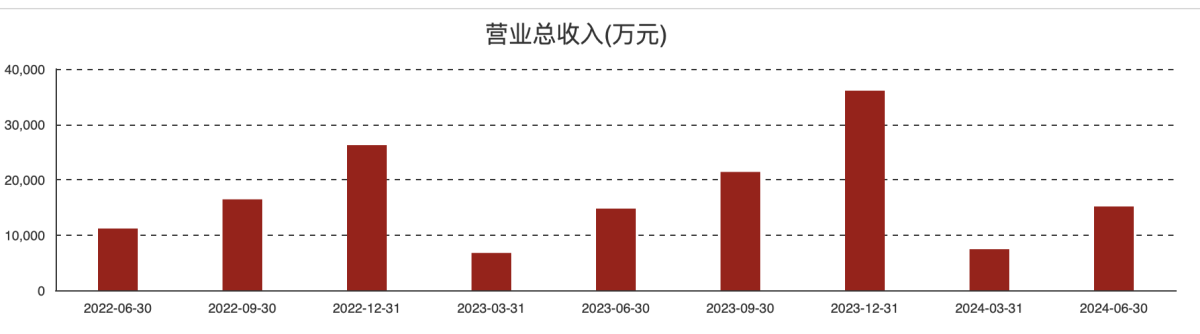

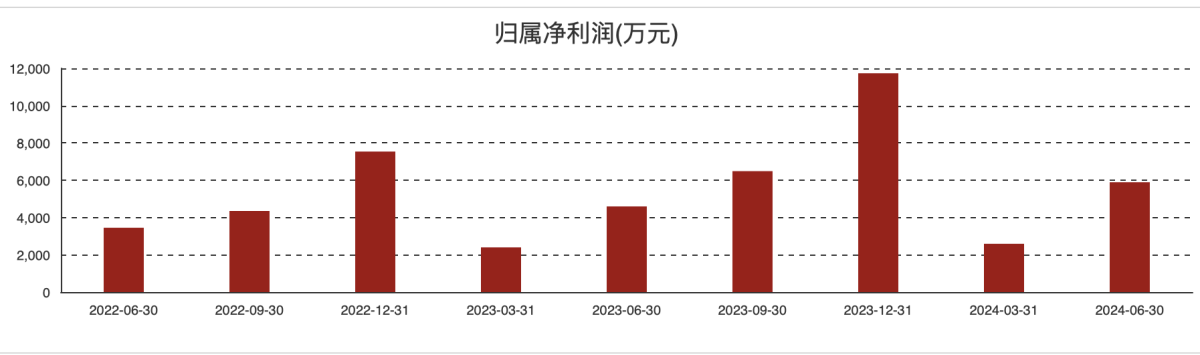

According to the financial report, in the first half of this year, Xishan Technology achieved a revenue of 0.151 billion yuan, a slight increase of 2.60% year-on-year, and a net income of 58.89 million yuan attributable to the parent company, an increase of 28.25% year-on-year.

In terms of products, during the same period, the company's surgical power unit equipment was affected by external environmental factors such as delayed bidding and price reduction of equipment, leading to a decrease in revenue year-on-year; however, the disposable surgical power unit equipment achieved steady growth, with a year-on-year growth rate exceeding 20%.

Regarding the current market demand and accounts receivable of the surgical power unit equipment, the secretary of the board of Xishan Technology stated, 'Due to the impact of equipment service life, the market for the company's surgical power unit equipment has entered a stable period, and the possibility of significant growth is not high. However, there is a relatively fast growth rate for equipment consumables like tools and other products such as endoscopes.'

(Revenue for Xishan Technology in each reporting period)

(Net income attributable to the parent company for Xishan Technology in each reporting period)

The above-mentioned company secretary explained that the so-called 'consumable' of surgical power tool devices refers to transforming reusable tools into disposable consumables. For example: In a craniotomy operation, if a tool can be used 100 times, there will be certain differences in the safety and accuracy of the surgery between the first and the 100th use of this tool.

The company also mentioned in the semi-annual report that most domestic surgical power tool devices consumables are for repetitive use. Due to the precise design and complex structure of the tools, there are many problems with tool reusability. For example: inadequate disinfection leading to the risk of cross-infection, performance degradation or even failure in sharpness, flexibility, etc. after multiple reuses.

It is understood that after years of practical application, academic promotion, and market cultivation, the habits of doctors and patients have begun to change, with increasing acceptance of disposable tools in clinical treatment.

"From the perspective of patients' surgical costs, the consumable cost of a single surgery is approximately around 1-2 thousand yuan. Compared to the more expensive surgical fees themselves, and considering the risks associated with reusing tools, many patients have a high tolerance for consumable prices," the above-mentioned company secretary said.

"Star Market Daily" reporters noticed that in recent years, some local medical insurance bureaus and health commissions have gradually included disposable tools for various surgical power devices in the pricing of medical services, promoting the process of consumables becoming disposable.

"However, the current rate of consumableization of surgical power device tools in China is relatively low, with most provinces still focusing on repetitive use, so this is an important foundation for the continued growth of our business income," the company secretary mentioned.

According to the data disclosed in the prospectus of XiShan Technology, it is expected that by 2025, the domestic market size of surgical power device systems will reach 0.586 billion yuan, and the consumables market size will reach 5.488 billion yuan.

Three share buybacks cost 0.44 billion yuan.

According to the previous regulations, the company can only conduct share buybacks after being listed for a year. However, since the second half of last year, the capital markets have introduced new policies, and the regulatory authorities also encourage companies to repurchase shares. Therefore, we started repurchasing shares about six months after listing, a spokesperson for Xishan Technology told the 'Star Market Daily'. 'Behind the share buyback, there are also considerations at the company's operational and financial strategy levels.'

From the agenda approved at the shareholder meeting of Xishan Technology, it is intended to reduce the registered capital and lawfully cancel related shares, which were part of the second repurchase of shares completed on September 10th this year, involving nearly 3.3742 million shares, accounting for 6.37% of the total share capital, and a total amount of nearly 0.2 billion yuan (excluding transaction costs).

In addition, on June 17th this year, Xishan Technology completed the first round of repurchase plan with an amount close to 0.1 billion yuan, involving over 1.31 million shares, representing 2.48% of the total share capital. The repurchased shares are intended to be used in the future for employee shareholding plans or stock-based incentives at the appropriate time.

On the evening of August 27th this year, Xishan Technology announced again that it plans to use 0.15 billion yuan (inclusive) to 0.3 billion yuan (inclusive) of its own funds to repurchase 1.875 million shares to 3.75 million shares through centralized bidding trading, with the repurchased shares accounting for 3.54% to 7.08% of the total share capital, intended to reduce the registered capital and lawfully cancel.

The above-mentioned third repurchase plan is currently being implemented: approximately 2.1922 million shares have been repurchased, accounting for 4.14% of the total share capital, with a total amount of approximately 0.139 billion yuan paid (excluding transaction costs).

After consulting professional institutions, the aforementioned spokesperson said they proceeded with the share buyback at the right time.

In their view, besides macro policies and stock-based incentive plans, there are multiple considerations on how the company conducts share buybacks: first, whether the repurchase and cancellation actually benefit small and medium investors, enhancing their equity value; second, considering the company's financial situation, sources of repurchase funds, etc.; third, anticipating the company's stock price returning to its true value over the medium to long term.

Regarding whether Xishan Technology has a 'share buyback and shareholding special rediscount plan,' the spokesperson mentioned, 'If the company is financially sound and considering from a financial perspective, the company actually prefers to use its own funds.'

《直击股东会》栏目以现场报道的形式,通过在股东大会现场直面上市公司董事长等核心管理层,聚焦企业长期战略、重大决策、经营方针等,旨在提升企业资本市场形象,优化投资者关系管理,完善上市公司相关治理与发展等。

《直击股东会》栏目以现场报道的形式,通过在股东大会现场直面上市公司董事长等核心管理层,聚焦企业长期战略、重大决策、经营方针等,旨在提升企业资本市场形象,优化投资者关系管理,完善上市公司相关治理与发展等。