李寧の第三四半期の運営はどうでしたか?機関は、李寧の合弁会社設立及び将来の業績についてどのように考えていますか?

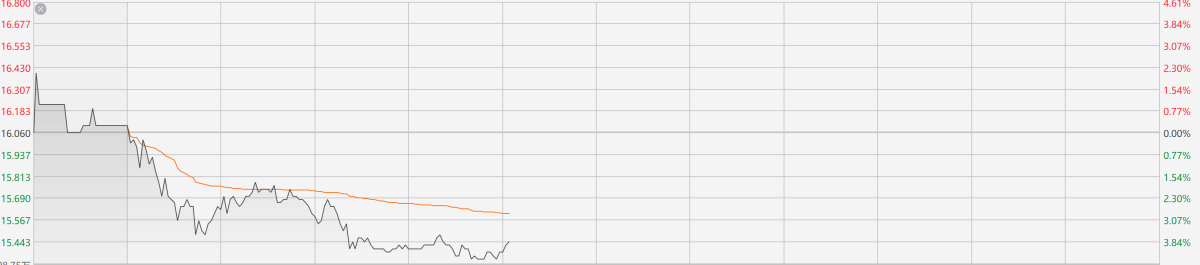

財聯社10月23日、李寧(02331.HK)は昨日の第三四半期の運営状況を公表した後、株価が下落しました。執筆時点で、3.86%下落し、15.46香港ドルでした。

注:李寧のパフォーマンス

最新の第三四半期の運営データによると、9月30日現在、李寧は全体の小売流動性が前年同期比中一桁の減少となり、特にオフラインチャネル、特に卸売チャネルが大きな圧力を受けており、一方、eコマースの仮想ストアビジネスは中一桁の成長を記録しています。中国の実店舗では、6281店舗があり、今年に入って41店舗増加しています。

最新の第三四半期の運営データによると、9月30日現在、李寧は全体の小売流動性が前年同期比中一桁の減少となり、特にオフラインチャネル、特に卸売チャネルが大きな圧力を受けており、一方、eコマースの仮想ストアビジネスは中一桁の成長を記録しています。中国の実店舗では、6281店舗があり、今年に入って41店舗増加しています。

注:公告

同時に、李寧は一連の戦略調整を行いました。会社は10月22日に、紅杉中国などのパートナーと協力し、海外市場の展開を加速するための合弁会社の設立を発表しました。合弁会社の資本総額は2億香港ドルで、そのうち李寧はその間接的完全子会社LN Coを通じて5800万香港ドルを出資し、総資本の29%を占めています。

注:公告

機関投資家はこの業績と企業の戦略変化をどのように評価していますか?

モルガンスタンレーはそのレポートで、第三四半期の李寧の業績が予想に沿っており、小売販売は前年比で単位数で下落しており、予想通りです。モルガンスタンレーは李寧の目標株価を21元、格付けを“保有”としており、合弁会社が李寧の2025年から2026年の利益に与える影響が限定的であると予想しています。

huaxiは、今年の収益成長が低い単位数を維持し、李寧がおそらく児童服と1990年代シリーズの店舗数を増やし続け、電子商取引ビジネスが第四四半期に向けて改善することを期待しています。

soochowは、第三四半期がマクロ消費環境の弱化の影響を受けていますが、10月以降の販売の改善トレンドに基づき、第四四半期の売上改善と在庫圧力の緩和が期待されると述べています。同券商は、李寧が国際ビジネスを発展させる合弁会社を設立し、29%の持株比率を保有しており、現在の国際ビジネスの規模は小さく、会社の財務に対する影響も小さいと指摘しています。

根据最新公布的三季度运营数据,截至9月30日,李宁在整个平台的零售流水按年录得中单位数下降,线下渠道尤其是批发渠道面临较大压力,而电子商务虚拟店铺业务则录得中单位数增长。在实体店铺方面,在中国的销售点数量为6281个,本年迄今净增加41个。

根据最新公布的三季度运营数据,截至9月30日,李宁在整个平台的零售流水按年录得中单位数下降,线下渠道尤其是批发渠道面临较大压力,而电子商务虚拟店铺业务则录得中单位数增长。在实体店铺方面,在中国的销售点数量为6281个,本年迄今净增加41个。