Morgan Stanley raised the target price of Bubble Mart to HK$81, believing that factors such as the potential for overseas markets such as Europe and the US, innovative product lines, and the recovery of the Chinese market are expected to drive Bubble Mart to continue to grow rapidly. Goldman Sachs raised the target price for Bubble Mart to HK$70, but is conservative about its profit margin prospects due to the current retail environment and uncertainty about spending power.

Thanks to strong revenue boosted by overseas markets and e-commerce platforms, Bubble Mart's third quarter results exploded, and international investment banks were optimistic and raised their target prices sharply.

On October 21, Morgan Stanley raised the target price of Bubble Mart to HK$81 and reaffirmed the “overrated” rating. Analysts such as Dustin Wei said that factors such as the potential of overseas markets such as Europe and the US, innovative product lines, and the recovery of the Chinese market are expected to drive Bubble Mart to continue to grow rapidly.

Damo said that although the high base in 2024 may make some investors worry about the room for growth in 2025, they believe Bubble Mart's ability to create explosions to continue to drive its intellectual property product Flywheel.

Damo said that although the high base in 2024 may make some investors worry about the room for growth in 2025, they believe Bubble Mart's ability to create explosions to continue to drive its intellectual property product Flywheel.

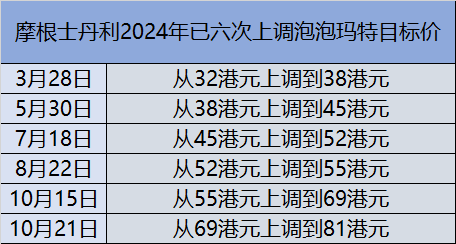

There is still room for a 28% increase in Damo's latest price target compared to Bubble Mart's closing price of HK$63.45 on October 22. It is worth mentioning that this is the sixth time that Damo has raised Bubble Mart's target price during the year, less than a week since the last increase.

Goldman Sachs raised the target price for Bubble Mart to HK$70, maintaining a neutral rating. Analysts such as Goldman Sachs Michelle Cheng mentioned in the report that despite Bubble Mart's strong IP momentum, they are conservative about its profit margin prospects due to the current retail environment and uncertainty about consumption power. Jefferies also maintained its buy rating and raised its target price by 52% to HK$80.5.

On Wednesday, the Hong Kong stock Bubble Mart rose more than 20% during the intraday period, and the year-to-date increase is more than 270%.

Damo: Optimistic about the three major drivers of overseas markets, product innovation, and China's recovery

According to the latest financial report, Bubble Mart's third-quarter revenue increased 120%-125% year on year. Among them, revenue from mainland China increased 55%-60% year on year, and revenue from Hong Kong, Macao, Taiwan and overseas increased 440%-445% year over year.

Damo said that this strong growth far exceeded the bank's expected growth of 70-75% and is expected to further boost Bubble Mart's operating profit. Damo believes that three drivers will bring good sales growth to Bubble Mart in 2025-26:

Overseas potential: Strong overseas sales in 2024 were mainly driven by Asia, and Bubble Mart is also speeding up the opening of stores in the US and Europe. Although US store revenue is lower than the Southeast Asian market, it has recently risen to over 2.5 million yuan per month. More importantly, the space to set up a store in the US is much larger than in Southeast Asia. Management emphasized that the US will be a key source of long-term overseas growth.

Continuously expanding business line: The Bubble Mart building block product line has only three series in 2024, all based on Labubu's intellectual property rights. In 2025, the company will launch more products with different intellectual property rights, including building blocks, jewelry, dessert shops, cards, etc. If one of them succeeds, the incremental revenue could be huge in the long run. This will reflect Bubble Mart's intellectual property product flywheel — better products strengthen its intellectual property rights, and stronger intellectual property rights make products more popular.

Upside from China: Despite the challenging macro context, Bubble Mart's sales in mainland China increased by about 40% year over year. As the likelihood of an improvement in consumer sentiment increases in 2025, Bubble Mart is expected to benefit from this potential improvement.

Damo raised Bubble Mart's earnings per share (EPS) forecast for 2024, 2025 and 2026 by 27%, 18%, and 14%, respectively, to raise the target price to HK$81, reconfirmed the excess rating, and continued to apply multiples of 30 times to the target price-earnings ratio (P/E) for 2025.

Damo also mentioned that a very high base in 2024 may cause some investors to worry about the room for growth in 2025, but Damo reiterated their belief in Bubble Mart's intellectual property product Flywheel.

Goldman Sachs: Raised target price to HK$70, but has a conservative view on interest rate prospects

Goldman Sachs believes that Bubble Mart's strong performance in the third quarter showed its strong intellectual property momentum and solid category expansion execution, which enabled it to achieve significant increases in store productivity amid fluctuations in the offline retail environment.

Goldman Sachs was pleasantly surprised by Bubble Mart's overseas and online revenue growth rate:

According to management, overseas sales accounted for more than 45% in September, a significant increase compared to 30% in the first half of the year, which will bring further mixed benefits and stronger operating leverage.

Bubble Mart's e-commerce channel grew by 135% to 140% in the third quarter. Among them, TikTok continued to grow rapidly, and the growth of the Tmall flagship store also accelerated significantly.

Goldman Sachs pointed out that as a star product, Labubu contributed 10% of sales in the first half of the year, with an annual growth rate of 10 times. Goldman Sachs's latest tracker shows that the price premium in the secondary market continues despite increased supply.

Goldman Sachs said that as a pioneer in intellectual property development in the toy sector in China, Bubble Mart's leading market share position is supported by three core competencies: 1) mature experience in creating/obtaining intellectual property; 2) commercialization capabilities; and 3) strong consumer engagement. It is evolving into a platform with enhanced intellectual property portfolios and new ways to monetize.

Goldman Sachs raised Bubble Mart's target price for the next 12 months to HK$70, but maintained a “neutral” rating. Goldman Sachs has a conservative view on Bubble Mart's profit margin prospects. Goldman Sachs believes that the decline in consumption capacity will affect the visibility of the company's revenue, and that the schedule for introducing intellectual property rights may also be affected by fluctuations in offline traffic.

大摩表示,尽管2024年的高基数可能让一些投资者担心2025年的增长空间,但他们相信泡泡玛特创造爆款继续推动其知识产权产品飞轮的能力。

大摩表示,尽管2024年的高基数可能让一些投资者担心2025年的增长空间,但他们相信泡泡玛特创造爆款继续推动其知识产权产品飞轮的能力。