As a company listed in Hong Kong, Reer Group reviewed that the average daily market cap during the period was lower than the Hong Kong stock through train standard, apparently initiating the 'protect-listing' battle.

During trading on September 24th, Reer Group (06639) stock price hit a new low of 2.85 Hong Kong dollars, setting a new record low since its listing. However, it quickly surged to a high of 5.04 Hong Kong dollars on October 8th under the influence of the Hang Seng 'National Day Rally', with a maximum range increase of 76.84%.

However, as this round of market performance was not driven by internal factors of the company, therefore, following the volatility of the Hang Seng Index, Reer Group's stock price quickly declined again. Observations from zhitong finance app showed that although the company's stock price reached a high point in the range on October 8th, it seemed more like a lure for block orders to sell at a high, with the company experiencing a significant drop in volume on that day, ending with a 15.59% decline. In the following trading days, Reer Group's stock price continued to decline, closing at 3.28 Hong Kong dollars on October 17th. To stabilize the stock price, Reer Group was forced to restart its buyback plan that had been suspended for nearly 2 months.

In fact, since the beginning of this year, Reer Group's stock price has been continuously fluctuating. In response, the company has been continuously repurchasing shares in order to stabilize market confidence. From the beginning of the year until now, Reer Group has cumulatively repurchased 17.3135 million shares, accounting for 2.99% of the total share capital, with a total buyback amount of 95.8632 million Hong Kong dollars.

In fact, since the beginning of this year, Reer Group's stock price has been continuously fluctuating. In response, the company has been continuously repurchasing shares in order to stabilize market confidence. From the beginning of the year until now, Reer Group has cumulatively repurchased 17.3135 million shares, accounting for 2.99% of the total share capital, with a total buyback amount of 95.8632 million Hong Kong dollars.

However, the frequent buyback operations have not provided much support to its stock price. The price has fallen by more than 50% since the beginning of the year, with the market cap falling below the 2 billion Hong Kong dollar threshold. As a company listed in Hong Kong, Reer Group reviewed that the average daily market cap during the period was lower than the Hong Kong stock through train standard, apparently initiating the 'protect-listing' battle.

Winning the 'protect-listing' battle is as difficult as reaching the sky for Reer Group.

For Reer Group, the company's stock price has been declining all the way since the beginning of this year, with a cumulative decline of 52.51% as of October 23rd. Currently, the company's market cap is only 1.922 billion Hong Kong dollars, and the pressure from 'protect-listing' is evident.

Intelligence Financial APP learned that the situation of Hong Kong stocks through train mainly includes: Hong Kong stocks through train stocks no longer belong to the Hang Seng Composite Index components due to adjustments in related indices; Hong Kong stocks through train stocks that belong to the Hang Seng Composite SmallCap Index components, the stocks adjustment inspection date is the average month-end market value of Hong Kong stocks in the previous twelve months (also known as the "review period") lower than HK$4 billion (the market value is calculated based on the actual listing time for companies listed for less than twelve months), and not listed in Hong Kong by A+H listed companies in the Hong Kong Stock Exchange H shares, will be removed from the Hong Kong stocks through train stocks.

Ryerson Group is a h股 stock listed in the hang seng composite smallcap index, currently subject to a review rule of having an average month-end market cap of less than HK$4 billion at the end of February next year, Hang Seng Index company is expected to announce the results of the Hang Seng Index series quarterly review as of December 31, 2024. As of October 23, there is less than 2 months before the end of the latest review period for the h股 connect.

For Ryerson Group, the current market cap almost certainly means it will be 'removed from the h股 connect'. According to the Smart Finance APP calculation, Ryerson Group's average month-end market cap during the current review period is HK$2.955 billion, which is HK$1.045 billion below the minimum HK$4 billion standard.

If Ryerson Group wants to maintain its h股 connect status by the end of this December review period, it means the company's month-end market cap in the next 2 months needs to reach HK$9.3 billion, which is around HK$16.36 per share to successfully 'retain connectivity'. Based on the current stock price, Ryerson Group needs to increase the stock price by about 3.8 times within a month, which is almost impossible whether from the large cap market or internal driving forces.

Looking at Ryerson Group's h股 connect holding percentage, since the beginning of this year, its h股 connect holding percentage has been declining and had dropped to 9.71% by October 22.

According to the rules, once a company is removed from the h股 connect, mainland investors cannot buy shares but can only sell the company's stocks they hold. In other words, as a company is removed from the h股 connect, mainland investors not only can't contribute to liquidity but may become selling pressure. Based on Ryerson Group's current h股 connect holding percentage, if the company is removed from the h股 connect, the selling pressure of nearly 10% shares could further negatively impact the stock price.

Fundamentals Are Hard to Save Stock Price

Zhitan Finance and Economics APP observed that starting from the intraday low of HK$5.88 on November 4, 2022, Reer Group's stock price actually also experienced a wave of uptrend, reaching a phase high of HK$14.18 on February 24 last year, with a cumulative increase of 141.16% during that period.

During the uptrend of its stock price, Reer Group also received multiple 'buy' ratings from many institutions. West Securities commented that in the 2023 fiscal year, the company officially opened three clinics, expecting to build over 160 dental chairs throughout the year. The expansion of these stores will ensure business growth for the company in the next 3 years.

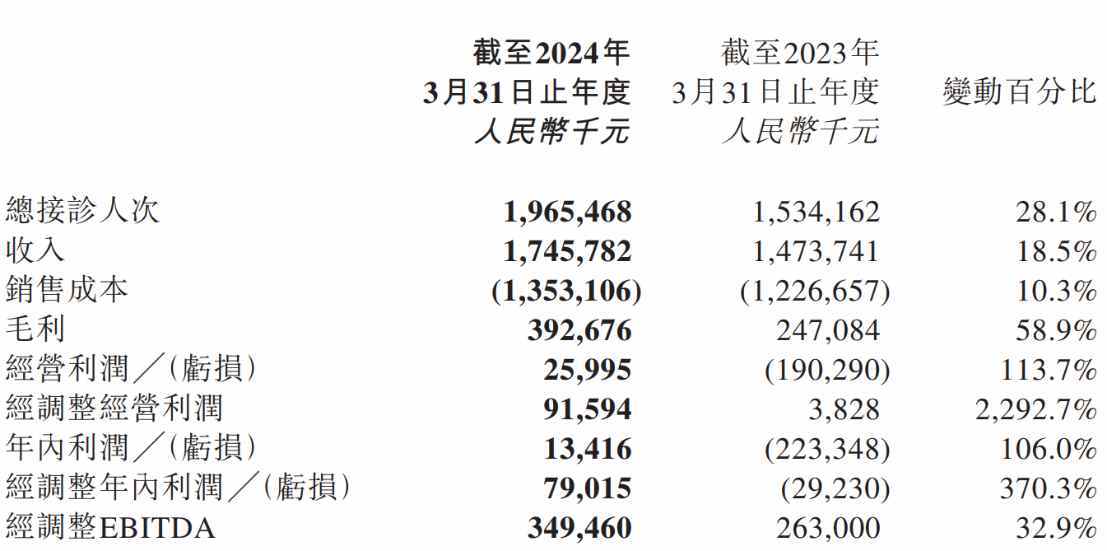

It is not difficult to see that the core logic of the current uptrend in Reer Group lies in the rebound growth driven by post-epidemic market expansion, despite its poor financial performance at the time. Data shows that from the 2019 fiscal year to the 2021 fiscal year, Reer Group's revenues were RMB 1.08 billion, RMB 1.1 billion, and RMB 1.515 billion respectively. During the same period, the company reported net losses of RMB 0.304 billion, RMB 0.325 billion, and RMB 0.598 billion. Although the company's rebound growth in the 2023 fiscal year was impressive, it was still in a loss-making state with a net loss of RMB 0.223 billion for that period.

However, with the negative impact of the epidemic fading in the 2024 fiscal year, Reer Group's performance achieved further growth, with current revenue reaching RMB 1.746 billion, an 18.5% year-on-year increase; turning the loss into a profit on a year-on-year basis, achieving a net profit of RMB 79.015 million; and the total number of patients served also increased by 28.1% year-on-year to reach 1.965 million.

However, the secondary market does not seem satisfied with this performance. On the two trading days following Reer Group's financial report disclosure on June 28 this year, its stock price fell by 4.25% and 13.51% respectively. The reason for this seems to be that Reer Group's current profitability challenge lies in its gross margin, which although improving, is still relatively low compared to peers, not only lower than A-share listed company Topchoice Medical's 40%, but also far below similar medical service companies listed in Hong Kong.

According to Zhitan Finance and Economics APP, unlike ophthalmic treatments that mainly rely on drugs and equipment, dental treatment processes are complex and highly dependent on manual operations by doctors, which also determines the high proportion of fixed costs in dental care. The 2024 financial report data shows that the company's current sales costs reached RMB 1.353 billion, with 'employee welfare expenses and depreciation and amortization' accounting for over 70% of the company's sales costs. This also means that continued expansion will lead to insufficient profitability from new clinics dragging down the company's profits.

Additionally, one of the reasons for Reer Group's low profit level is the 'high salary for doctors.' This phenomenon is fundamentally caused by the supply-demand gap in the industry. According to Zhitan Finance and Economics APP, the growth of China's oral medical service market will still be dominated by the growth of doctors. There is a large gap in China's dental physician resources, with no publicly available number of dental clinics domestically, and the number of dental doctors is represented by dental practitioner certificates. In this context, China's number of dental doctors per 100,000 people was only 22 in 2021, lagging behind developed countries and regions.

Some projects have high technological barriers, leading to a steep learning curve, which is the main cause of the gap between supply and demand for dentists. For example, invisible orthodontic technology requires a high level of expertise from doctors. Doctors need to rely on their own experience to predict the steps and distances of tooth movement in patients, and then obtain treatment plans through computer simulations. According to research, a doctor who has not been exposed to orthodontic treatment needs to undergo 3-6 months of training and observation to initially master invisible orthodontic technology, which incurs a time cost in developing invisible orthodontists.

In order to retain experienced dentists as much as possible, Rui Er Group continues to improve the salary and benefits of dentists. The latest financial report shows that the proportion of dentists employed for more than 5 years has reached 40%, leading to the current operating situation of "poor temple, rich monk" for Rui Er Group.

According to the future corporate strategy of Rui Er Group, after reaching the inflection point of profitability, its future development strategy of "targeting scale must be adjusted, and profitability must become our top priority for future development." However, at present, the company being kicked out of the Hong Kong Stock Connect is almost a foregone conclusion. If Rui Er Group loses the liquidity support of the Hong Kong Stock Connect, even if it achieves stable scale profits in the future, whether the valuation can rebound in sync remains an unknown factor.

实际上在今年以来,瑞尔集团的股价便波动不断。为此,公司持续回购以期稳定市场信心。年初至今,瑞尔集团已累计回购1731.35万股,占总股本比例达到2.99%,回购总金额达到9586.32万港元。

实际上在今年以来,瑞尔集团的股价便波动不断。为此,公司持续回购以期稳定市场信心。年初至今,瑞尔集团已累计回购1731.35万股,占总股本比例达到2.99%,回购总金额达到9586.32万港元。