List of Expected Listed Companies for Mergers and Acquisitions.

After a series of policies were introduced, the SSE Composite Index rapidly rose in the short term, hitting an emotional high on October 8th. Subsequently, sector rotation has become a norm. If the transition between industries carries uncertainty, then the sustained high temperature of merger concept stocks can be seen as a relatively certain undercurrent in the current market.

Shortly after Hainan Shuangcheng Pharmaceuticals announced the acquisition of Ola Semiconductors, its market cap surged rapidly from 2 billion yuan to 12 billion yuan. Following this, Optics Technology Holding's acquisition of Xindao Electronics also saw eight consecutive daily limit up movements, while the recent H.B. Fuller has shown no signs of loosening on the limit up board.

In the current high-spirited environment, the market's pricing of merger concept stocks is also quite aggressive, with acquisitions resembling a large swallowing a smaller entity being priced based on performance multiples or valuation multiples of the target company.

In the current high-spirited environment, the market's pricing of merger concept stocks is also quite aggressive, with acquisitions resembling a large swallowing a smaller entity being priced based on performance multiples or valuation multiples of the target company.

For example, before the trading halt, Hainan Shuangcheng Pharmaceuticals had a market cap of around 2.1 billion yuan, while Ola Semiconductors' valuation in the final round of equity transfer in 2021 was 10 billion yuan. Therefore, on October 22nd, it directly reached a total market cap of 12.9 billion yuan, only to hit the limit down as soon as trading began today (October 23rd). Although it is uncertain whether there will be further funds to continue participating in the game, based on market cap calculations, the risks ahead are relatively high.

The recent M&A market exhibits two characteristics: the integration of assets under the same controlling shareholder and a more prevalent trend of large companies acquiring smaller ones. The latest hot company, Sciencore Pharmaceutical, happens to embody both of these characteristics.

On the evening of October 21st, publicly traded company Sciencore Pharmaceutical (301297.SZ) announced the acquisition proposal, planning to acquire 99.42% of the equity of Shandong Hongjitang Pharmaceutical Group Co., Ltd. ('HJ Tang'), and raise supporting funds. After resuming trading on October 22nd, it has hit the daily limit up for two consecutive days.

Prior to this acquisition, the main business of publicly traded company Sciencore Pharmaceutical was the research, production, and sales of chemical raw materials, chemical drug formulations, and intermediates. After acquiring HJ Tang, Sciencore Pharmaceutical's main business will expand to Chinese patent medicine, gelatin products, musk ketones, and other areas.

Both Ke Yuan Pharmaceutical and Hongjitang are backed by the same ultimate controller, Gao Yuankun, also known as the 'former richest man in Jinan'. He holds these two companies through his subsidiary, Linuo Group, making this acquisition a related party transaction.

Public information shows that Linuo Group was established in 1994, with industries covering areas such as health, new energy, and new materials. Currently, Linuo Group owns Ke Yuan Pharmaceutical (301297.SZ) and Linuo Tebo (301188.SZ), two listed companies.

With a broad industrial layout, Gao Yuankun has twice been the richest man in Jinan in 2008 and 2018.

01

Since going public for a little over a year, Ke Yuan Pharmaceutical's profits have been affected by centralized procurement.

The acquiring party, Ke Yuan Pharmaceutical, was listed on the Growth Enterprise Market (GEM) on April 4, 2023. Its main business is the research, development, production, and sales of chemical raw materials and formulation products, focusing on key disease areas such as hypoglycemic, anesthetic, cardiovascular, and mental health.

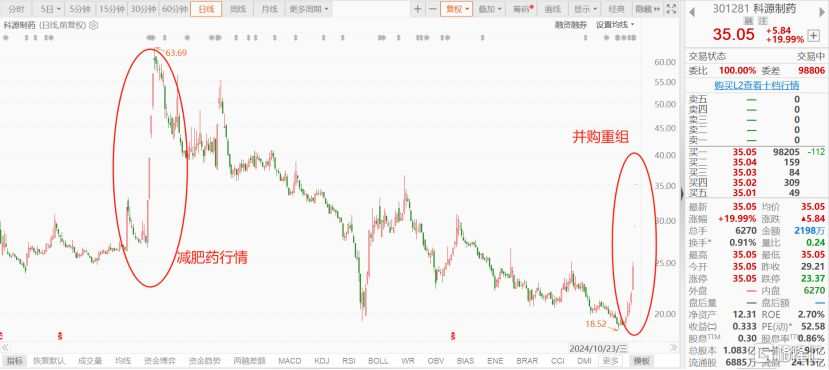

When it comes to Ke Yuan Pharmaceutical, many people's first reaction may be weight loss drugs. In August last year, due to its business covering the active pharmaceutical ingredient of metformin for hypoglycemia, Ke Yuan Pharmaceutical was hyped in the market as a weight loss drugs concept stock, achieving a 120% increase in just 5 trading days.

Afterwards, Ke Yuan Pharmaceutical issued a stock trading abnormality notice, stating that the company's metformin hydrochloride tablet is indicated for the treatment of type 2 diabetes, a hypoglycemic drug, not related to obesity indications, and currently has no revenue from products claiming weight loss effects. After a brief hype, Ke Yuan Pharmaceutical's stock price quickly returned to its original level.

The stock price trend of Koyuan Pharmaceutical (as of October 23, 2024), source: East Money Information

The stock price trend of Koyuan Pharmaceutical (as of October 23, 2024), source: East Money InformationIn terms of financial data, prior to 2021, Koyuan Pharmaceutical's performance growth rate was relatively stable, with revenue growth rate dropping to single digits in 2022. In the year of listing in 2023, net income fell by 15.6%, mainly due to salary increases for sales and management personnel, as well as increased research and development investment, leading to an increase in all three major expenses.

In the first half of 2024, the company achieved revenue of 0.237 billion yuan, a 5.64% increase from the same period last year, and achieved a net income attributable to shareholders of the listed company of 36.0911 million yuan, a decrease of 29.52% from the same period last year. The main reason was the impact of the national centralized procurement policy and intensified market competition on the company's main products, resulting in a decrease in selling price and a decline in gross margin.

Key financial indicators of Koyuan Pharmaceutical, source: East Money Information

Key financial indicators of Koyuan Pharmaceutical, source: East Money InformationAs of the date of this proposal, Lino Investment holds 34.39% of the company's shares, making it the controlling shareholder of the company. Gaoyuankun indirectly controls 34.48% equity of the listed company through Lino Group and Lino Investment, and is the actual controller of the listed company.

The equity structure of Koyuan Pharmaceutical, source: acquisition plan.

The equity structure of Koyuan Pharmaceutical, source: acquisition plan.02

Hongjitang sought listing several times without success, and instead sought acquisition by a 'sister company.'

The target assets of this acquisition are 99.42% of the equity of Hongjitang, and the transaction plan includes issuing shares, paying cash to purchase assets, and raising matching funds. Among them, the trading parties for issuing shares and paying cash to purchase assets include 39 trading parties such as Linuo Investment and Linuo Group, and the trading parties for raising matching funds include no more than 35 specific investors.

When it comes to Hongjitang, one cannot help but mention a TV drama 'Da Zhai Men' that was popular over 20 years ago throughout China. Hongjitang is actually the prototype of Hei Qilang Jiaozhuang (Hei Qitang) founded by Bai Jingqi in the TV drama 'Da Zhai Men.'

As early as 1907, Beijing Tongrentang's 12th generation descendant, Le Jingyu, founded Hongjitang, primarily engaged in the research, production, and sales of Chinese patent medicine, donkey-hide gelatin products, musk ketone, and other products. In 2006, the Ministry of Commerce identified 'Hongjitang' as one of the first batch of 'China Time-Honored Brands,' and Hongjitang's traditional Chinese medicine culture was included in the national intangible cultural heritage list.

Times have changed, and now the controlling rights of Hongjitang are no longer in the hands of the Le family.

In 2002, Gao Yuen Kun integrated state-owned pharmaceutical companies in Jinan and pharmaceutical companies in five county districts through a contract with the Jinan local government, successfully acquiring Hongjitang. As of the signing date of this acquisition plan, Linuo Investment and Linuo Group collectively hold 38.48% of Hongjitang's equity. The controlling shareholder of Hongjitang is Linuo Investment, with the actual controller being Gao Yuen Kun.

The shareholding status of the top 7 shareholders of Hongjitang, source: acquisition proposal

The shareholding status of the top 7 shareholders of Hongjitang, source: acquisition proposalHongjitang has a wide range of products. As of the signing date of the acquisition proposal, Hongjitang has obtained a total of 150 drug registration certificates, including 35 products in the national essential drug list, 90 products in the medical insurance list, 7 drugs as exclusive varieties, and 2 drugs as exclusive drug dosage forms.

According to the Minet database, Hongjitang's Donkey-hide gelatin and Angong Niuhuang Pill ranked third in market share in 2023, with high market visibility; Hongjitang is the national exclusive supplier of the core raw material Musk Ketone for the state-secret artificial musk technology. The project "Research and Industrialization of Artificial Musk" by Hongjitang won the first prize of National Science and Technology Progress Award.

In terms of financial data, Hongjitang's revenue for the first 6 months of 2022, 2023, and 2024 respectively was 1.217 billion yuan, 1.375 billion yuan, and 0.938 billion yuan, with net profits reaching 0.209 billion yuan, 0.151 billion yuan, and 133 million yuan respectively.

Looking at 2023, Hongjitang's revenue is 3.07 times that of Keyuan Pharmaceutical, and net profit is 1.96 times; based on the financial data for the first half of 2024, Hongjitang's revenue is 3.95 times that of Keyuan Pharmaceutical, and net profit is 3.69 times.

Therefore, similar to the acquisitions of Orla Semiconductor by Hainan Shuangcheng Pharmaceuticals, Xinda Digital Technology by Optics Technology Holding, and Fuller by H.B. Fuller, this acquisition is also a case of small acquisitions leading to significant gains.

Hongjitang's main financial data, source: acquisition plan.

Hongjitang's main financial data, source: acquisition plan.It is worth noting that before this acquisition, Hongjitang had tried to go public several times without success.

In September 2016, Hongjitang was listed on the national equities exchange and quotations, but it was delisted in less than a year. At the end of 2019, the listed company ST Yaxing announced that it planned to purchase 100% of the shares of Shandong Key Source Pharmaceutical and Hongjitang Pharmaceutical through the issuance of shares, but this deal fell through six months later.

Subsequently, Key Source Pharmaceutical and Hongjitang sought separate listings, with Key Source Pharmaceutical successfully listing on the gem in April 2023. While Hongjitang started IPO guidance in September 2021 and January 2024 respectively, but nothing came of it.

The acquisition of Hongjitang by Key Source Pharmaceutical may be the best path for Hongjitang to quickly enter the capital markets and for Luno Group to internally consolidate resources.

According to the acquisition plan, after the completion of this transaction, Hongjitang will become a subsidiary controlling company of the listed company. Key Source Pharmaceutical's main business will extend to Chinese patent medicines, gelatin products, and other areas. This will help achieve synergies in procurement, production, and sales, create a large-scale medical health platform, and enhance the overall strength of the listed company.

03

Which other listed companies have expectations for mergers and reorganizations?

In recent years, the State Council, China Securities Regulatory Commission, and stock exchanges have successively introduced a series of policies to encourage and support restructuring and integration, creating favorable conditions for the capital markets.

In October 2020, the State Council issued the "Opinions on Further Improving the Quality of Listed Companies," emphasizing the role of the capital market as the main channel for mergers and acquisitions, encouraging listed companies to revitalize existing assets, improve quality and efficiency, and transform their development.

In April 2024, the State Council issued the new "Nine Articles", clearly stating the promotion of listed companies to enhance investment value, encouraging listed companies to focus on their main business, and comprehensively use mergers and acquisitions, stock-based incentives, and other methods to enhance development quality. The series of documents mentioned above encourage companies to integrate resources, improve quality and efficiency, and transform development through merger and reorganization.

In September 2024, the China Securities Regulatory Commission issued the "Opinions on Deepening the Reform of the Listed Company Merger and Reorganization Market," proposing support for listed companies to transform towards new quality productive forces, encouraging listed companies to strengthen industrial integration, improve regulatory inclusiveness, enhance the efficiency of the reorganization market transactions, raise the level of intermediary services, strengthen supervision in six aspects in accordance with the law. The aim is to further stimulate the vitality of the mergers and acquisitions market, support economic transformation and upgrading, and promote high-quality development.

Under the strong promotion of policies, the M&A market has experienced unprecedented enthusiasm. According to public information, GenkiHu has compiled a list of listed companies with expected mergers and acquisitions based on conditions such as the lack of successful IPOs of high-quality companies under the actual controllers, promises by actual controllers to resolve inter-industry competition or reorganization, and unsuccessful reorganizations of listed companies for reference only.

In addition, Huachuang Securities recently outlined companies with the ability to acquire and be acquired in a report. The main selection criteria include the company's market value and cash strength (cash and equivalents / total market value) in the top 90% percentile of the industry, with GEM and STAR Market relaxed to above 80%; medium-term profitability and positioning in the industry need improvement, i.e., average annual net profit attributable to the parent in the last 3 years is positive and below the 90th percentile within the industry; short-term profitability, i.e., positive ROE-TTM.

Huachuang Securities also sorted out the possible targets for acquisition among listed companies. In addition to considering the conditions required by the Exchange's "Guidelines for the Major Asset Restructuring of Listed Companies", additional screening criteria include total market capitalization below 10 billion; the shareholding of listed companies is relatively dispersed, with the shareholding of the largest shareholder less than 30%, and the shareholding of the top ten shareholders less than 60%; inadequate profitability, with ROE in the past 3 years and the latest ROE-TTM both below 5%; and an asset-liability ratio exceeding 60%.

Of course, the capital markets are ever-changing, and not all companies with expectations of merger and reorganization may come to fruition. The hottest track at the moment may cool down later, and the market's pricing methods may also change; therefore, regardless of the type of investment, one must always remain vigilant.

情绪高涨的当下,市场对并购概念股的定价也比较激进,

情绪高涨的当下,市场对并购概念股的定价也比较激进,