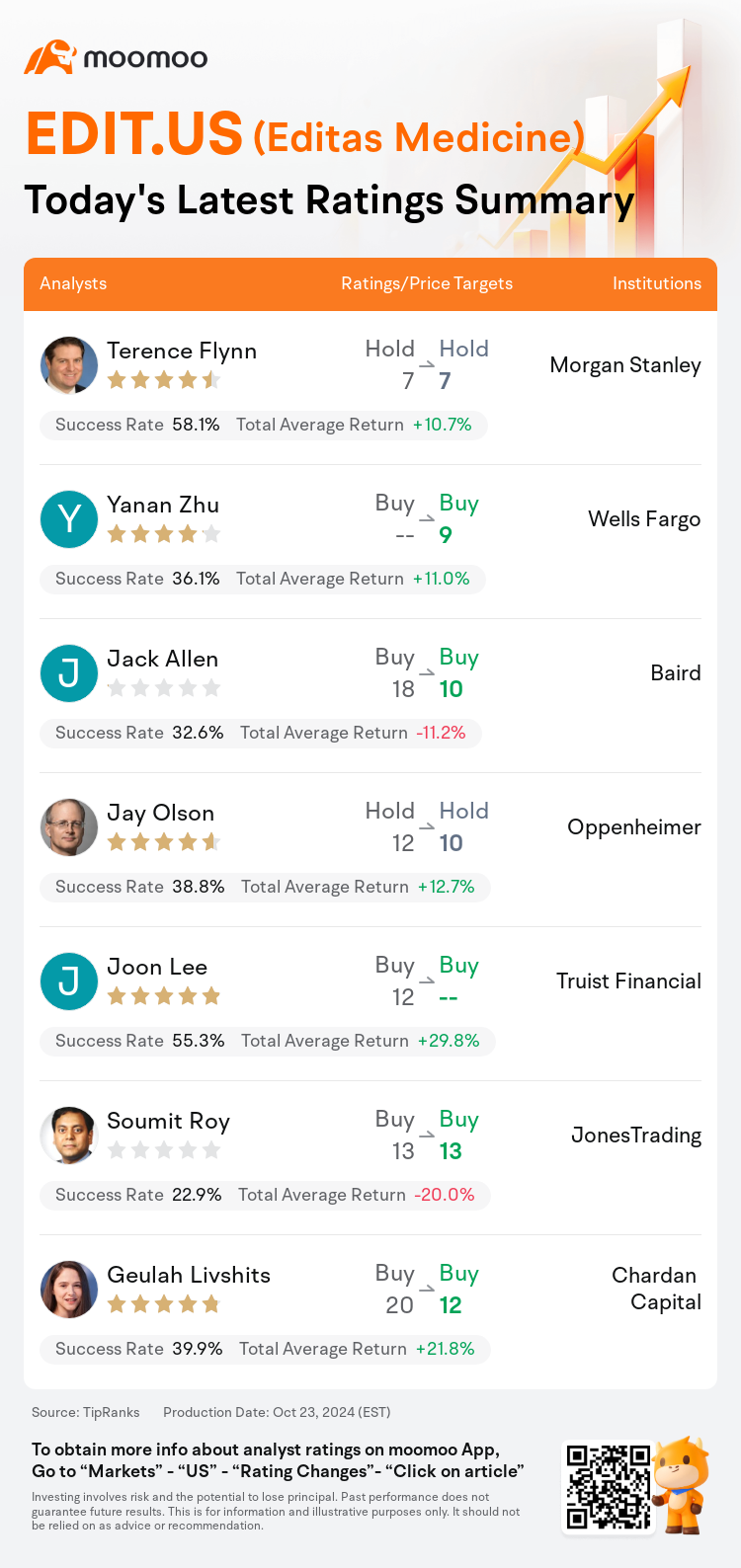

On Oct 23, major Wall Street analysts update their ratings for $Editas Medicine (EDIT.US)$, with price targets ranging from $7 to $13.

Morgan Stanley analyst Terence Flynn maintains with a hold rating, and maintains the target price at $7.

Wells Fargo analyst Yanan Zhu maintains with a buy rating, and sets the target price at $9.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $18 to $10.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $18 to $10.

Oppenheimer analyst Jay Olson maintains with a hold rating, and adjusts the target price from $12 to $10.

Truist Financial analyst Joon Lee maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Editas Medicine (EDIT.US)$'s main analysts recently are as follows:

The decision by Editas Medicine to shift focus to in vivo SCD approach and consider partnerships for reni-cel is seen as a potentially more strategic utilization of its knowledge and resources to generate value, following preclinical successes in in vivo editing of HSPCs.

Editas Medicine has shared preliminary results from its in vivo approach which focuses on using targeted lipid nanoparticle delivery to modify hematopoietic stem cells with the CRISPR-Cas12a enzyme. Simultaneously, the company has expressed an intent to form global partnerships for reni-cel, aiming to concentrate its resources on in vivo programs. Despite the promising early in vivo data, it is anticipated that investors may find it challenging to place significant value on a platform that is at such an early stage of development.

Here are the latest investment ratings and price targets for $Editas Medicine (EDIT.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月23日,多家华尔街大行更新了$Editas Medicine (EDIT.US)$的评级,目标价介于7美元至13美元。

摩根士丹利分析师Terence Flynn维持持有评级,维持目标价7美元。

富国集团分析师Yanan Zhu维持买入评级,目标价9美元。

贝雅分析师Jack Allen维持买入评级,并将目标价从18美元下调至10美元。

贝雅分析师Jack Allen维持买入评级,并将目标价从18美元下调至10美元。

奥本海默控股分析师Jay Olson维持持有评级,并将目标价从12美元下调至10美元。

储亿银行分析师Joon Lee维持买入评级。

此外,综合报道,$Editas Medicine (EDIT.US)$近期主要分析师观点如下:

editas medicine决定转变重心,专注于体内SCD方法,并考虑与reni-cel合作伙伴关系,被视为更有战略意义利用其知识和资源创造价值的潜在途径,旨在紧随HSPCs体内编辑的临床前成功之后。

editas medicine已经分享了其体内方法的初步结果,重点是使用有针对性的脂质纳米粒子输送来修改CRISPR-Cas12a酶的造血干细胞。同时,该公司已明确表达了要全球合作伙伴进行reni-cel,旨在集中其资源用于体内项目。尽管早期体内数据令人鼓舞,预计投资者可能会发现在这样一个开发初期阶段的平台上投放重要价值是具有挑战性的。

以下为今日7位分析师对$Editas Medicine (EDIT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

贝雅分析师Jack Allen维持买入评级,并将目标价从18美元下调至10美元。

贝雅分析师Jack Allen维持买入评级,并将目标价从18美元下调至10美元。

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $18 to $10.

Baird analyst Jack Allen maintains with a buy rating, and adjusts the target price from $18 to $10.