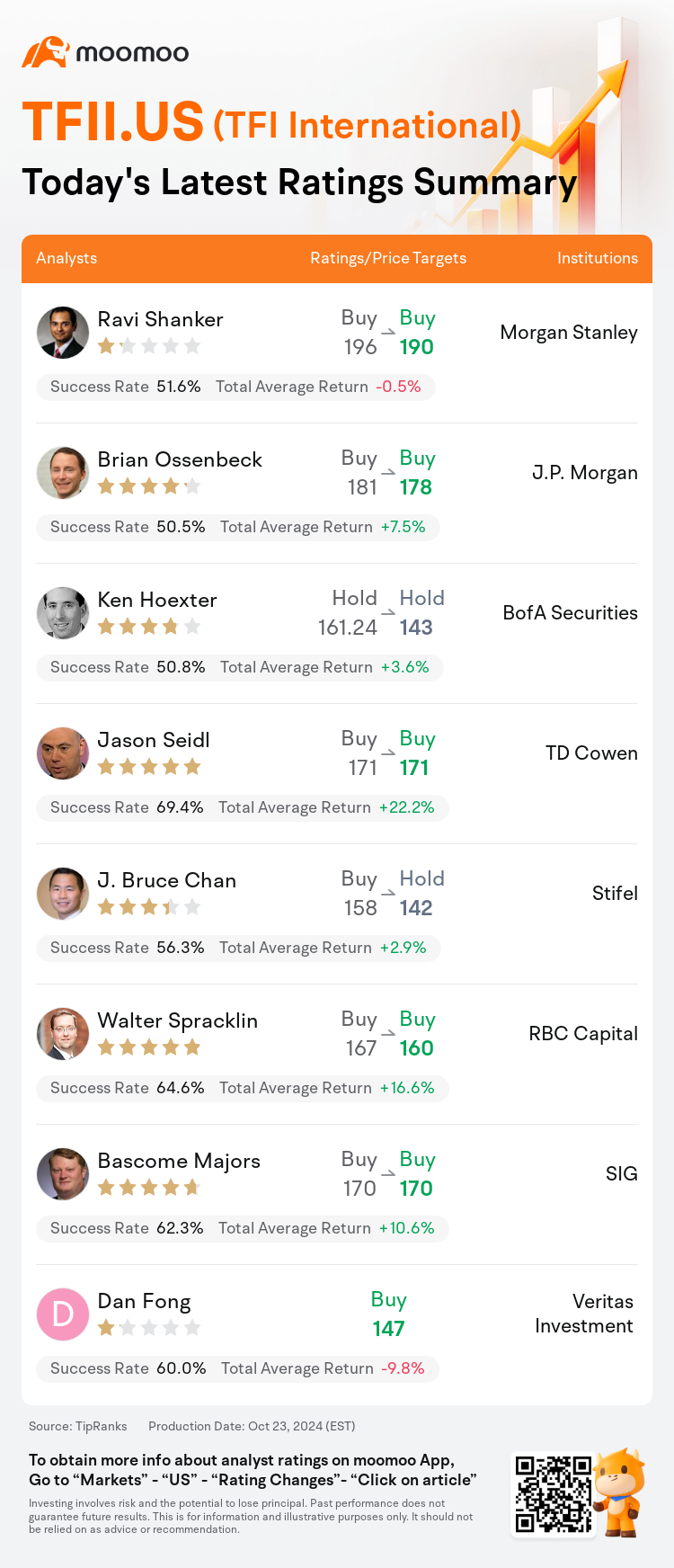

On Oct 23, major Wall Street analysts update their ratings for $TFI International (TFII.US)$, with price targets ranging from $142 to $190.

Morgan Stanley analyst Ravi Shanker maintains with a buy rating, and adjusts the target price from $196 to $190.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $181 to $178.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.

TD Cowen analyst Jason Seidl maintains with a buy rating, and maintains the target price at $171.

Stifel analyst J. Bruce Chan downgrades to a hold rating, and adjusts the target price from $158 to $142.

Furthermore, according to the comprehensive report, the opinions of $TFI International (TFII.US)$'s main analysts recently are as follows:

Following TFI International's release of Q3 adjusted EPS at $1.60, which fell short of the anticipated $1.76 and the market's $1.77 expectation, estimates for Q4, 2024, and 2025 EPS have been reduced by 7%, 4%, and 4%, respectively.

TFI International reported quarterly results that fell short of expectations, prompting a significant revision of future projections. Despite this, the company's robust generation of free cash flow has culminated in an exceptionally healthy balance sheet, providing ample flexibility for potential mergers and acquisitions as well as strategic share repurchase opportunities.

TFI International's Q3 results fell short of expectations due to operational ratio pressures from pricing discrepancies and service challenges. Additionally, the company's aim for a 90 operational ratio in Q4 appears to be unattainable, and there has been a reduction in the earnings per share guidance.

TFI International faces a challenging operating environment and network turnarounds. Analysts acknowledge the early progress following the company's UPS deal, yet they suggest that more ingrained issues may temper and postpone the anticipated margin enhancements in the less-than-truckload segment, potentially overshadowing advancements in other areas of the business. Additionally, expectations for a favorable outcome from a potential spinoff may be delayed until there is significant growth in market capitalization.

Here are the latest investment ratings and price targets for $TFI International (TFII.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

10月23日(米国時間)、ウォール街主要機関のアナリストが$TFI インターナショナル (TFII.US)$のレーティングを更新し、目標株価は142ドルから190ドル。

モルガン・スタンレーのアナリストRavi Shankerはレーティングを強気に据え置き、目標株価を196ドルから190ドルに引き下げた。

J.P.モルガンのアナリストBrian Ossenbeckはレーティングを強気に据え置き、目標株価を181ドルから178ドルに引き下げた。

バンク・オブ・アメリカ証券のアナリストKen Hoexterはレーティングを中立に据え置き、目標株価を161.24ドルから143ドルに引き下げた。

バンク・オブ・アメリカ証券のアナリストKen Hoexterはレーティングを中立に据え置き、目標株価を161.24ドルから143ドルに引き下げた。

TD CowenのアナリストJason Seidlはレーティングを強気に据え置き、目標株価を171ドルに据え置いた。

スティーフル・フィナンシャルのアナリストJ. Bruce Chanはレーティングを中立に引き下げ、目標株価を158ドルから142ドルに引き下げた。

また、$TFI インターナショナル (TFII.US)$の最近の主なアナリストの観点は以下の通りである:

TFIインターナショナルがQ3の調整後のEPSを$1.60で発表したが、予想された$1.76および市場の$1.77の期待に達しておらず、Q4、2024年、2025年のEPSの見通しはそれぞれ7%、4%、4%減少しました。

TFIインターナショナルは期待に届かない四半期の業績を報告し、将来の予測の大幅な修正を促しました。それにもかかわらず、同社の堅実なフリーキャッシュフローの生み出しは非常に健全なバランスシートにつながり、潜在的な合併・買収や戦略的な株式取得の機会に十分な柔軟性を提供しています。

TFIインターナショナルのQ3の業績は、価格の不一致やサービスの課題からの運用比率のプレッシャーにより期待に届かなかった。さらに、同社がQ4に90の運用比率を目指していることは実現不可能であり、株式の利益予想が削減されました。

TFIインターナショナルは厳しい運営環境とネットワークの変革に直面しています。アナリストは同社のUPSとの契約に続く早期の進展を認めていますが、より根深い問題が予想される限り、トラックロード未満セグメントでの利益の向上が抑制され、他のビジネス領域の進展を大きく上回る可能性があります。さらに、ポテンシャルな分割の好結果への期待は、市場資本増加が大きくなるまで遅れる可能性があります。

以下の表は今日8名アナリストの$TFI インターナショナル (TFII.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

バンク・オブ・アメリカ証券のアナリストKen Hoexterはレーティングを中立に据え置き、目標株価を161.24ドルから143ドルに引き下げた。

バンク・オブ・アメリカ証券のアナリストKen Hoexterはレーティングを中立に据え置き、目標株価を161.24ドルから143ドルに引き下げた。

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $161.24 to $143.