① China Life Insurance further reduced its shareholding in Zhejiang Wanfeng Auto Wheel by 1%, marking the fourth reduction this year with a cumulative reduction of 3%, accelerating the reduction in the third quarter. ② Zhejiang Wanfeng Auto Wheel's stock price has reached a historical high this year, with a year-to-date increase of 261.92%.

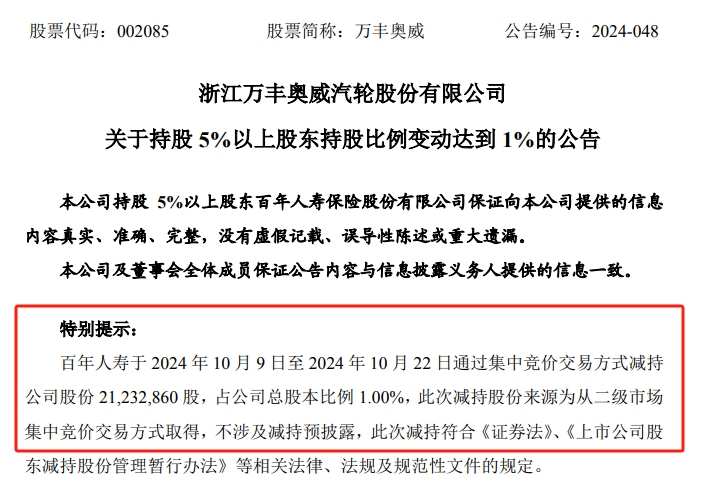

The China Life Insurance continues to reduce its holdings in Zhejiang Wanfeng Auto Wheel. Tonight, Wanfeng Auto Wheel announced that China Life Insurance reduced its holdings by 21.2329 million shares through block trading from October 9, 2024 to October 22, 2024, accounting for 1.00% of the total share capital of the company.

The reporter from Caijing noticed that China Life Insurance has reduced its holdings in Wanfeng Auto Wheel four times this year, with two announcements of related reductions this month alone. After this round of reductions, China Life Insurance's stake has decreased from 8.87% at the beginning of the year to 5.87%.

However, Wanfeng Auto Wheel did not disclose in tonight's announcement whether China Life Insurance will continue to reduce its holdings. Wanfeng Auto Wheel stated that the source of China Life Insurance's share reduction came from block trading in the secondary market, without involving prior disclosure of the reduction.

However, Wanfeng Auto Wheel did not disclose in tonight's announcement whether China Life Insurance will continue to reduce its holdings. Wanfeng Auto Wheel stated that the source of China Life Insurance's share reduction came from block trading in the secondary market, without involving prior disclosure of the reduction.

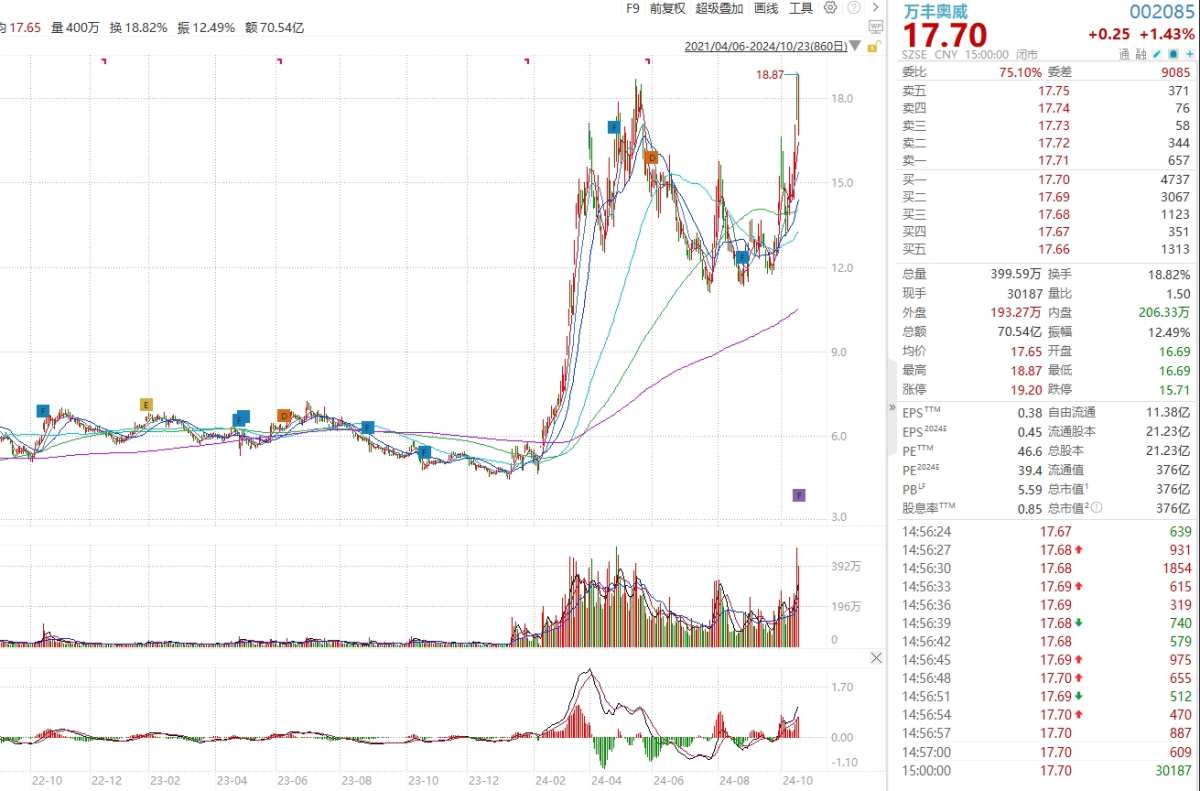

It is worth mentioning that Wanfeng Auto Wheel's stock price has increased by 261.92% this year, reaching a historical high.

China Life Insurance accelerated the reduction of its holdings in Wanfeng Auto Wheel in the third quarter.

Related data shows that China Life Insurance has been accelerating the reduction of its holdings in Wanfeng Auto Wheel since the third quarter.

According to Zhejiang Wanfeng Auto Wheel's disclosure, China life insurance reduced its holdings in four instances within the year, with a total reduction of 1% of the shareholding proportion in the first half of the year, and the recent two reductions reached 1% of the shareholding proportion each.

On May 6, Wanfeng Auto Wheel announced that China life insurance reduced the company's shares by 9 million shares through centralized bidding from April 24, 2024, to April 29, 2024, accounting for 0.42% of the total share capital of the company; On July 2, Wanfeng Auto Wheel announced that China life insurance reduced the company's shares by 12,232,900 shares from May 27, 2024, to June 27, 2024, accounting for 0.58% of the total share capital of the company.

Starting from the third quarter, on October 8, Wanfeng Auto Wheel announced that China life insurance reduced the company's shares by 21,232,900 shares through centralized bidding from August 2, 2024, to September 27, 2024, accounting for 1.00% of the total share capital of the company.

In addition, Wanfeng Auto Wheel announced tonight that China life insurance continues to reduce its shareholding by 1% within this month, and the total reduction in Wanfeng Auto Wheel's shareholding by China life insurance within the year has reached 3% of the shareholding proportion. Among the four reductions within the year, apart from the first reduction obtained through bulk trading, the sources of the remaining three share reductions were acquired through centralized bidding in the secondary market.

Wanfeng Auto Wheel announced tonight that as of the close of trading on October 22, 2024, China life insurance held a total of 124,612,610 shares of the company, accounting for 5.87% of the current total share capital of 2,123,297,520 shares of the company. All the above shares are unrestricted shares.

Wanfeng Auto Wheel's stock price has reached a historical high this year.

Wind data shows that Wanfeng Auto Wheel's stock price is currently at a historical high for the year. Starting from February this year, Wanfeng Auto Wheel's stock price has been continuously rising from below 5 yuan to over 17 yuan.

As of the close on October 23, Wanfeng Auto Wheel closed at 17.7 yuan per share, with a year-to-date increase of 261.92%.

According to the data, Zhejiang Wanfeng Auto Wheel is a company with the manufacturing industry in the automotive and aviation sectors as its core, forming a development pattern driven by the "dual engines" of lightweight automotive metal components and innovative manufacturing in the general aviation sector. Financial data shows that in the first half of this year, Zhejiang Wanfeng Auto Wheel's revenue was 7.372 billion yuan, a decrease of 1.80% year-on-year, with a net income attributable to the parent company of 0.398 billion yuan, an increase of 24.93% year-on-year.

From the perspective of insurance funds, it is quite common in the industry to adjust holdings during market conditions. Caifin.com reporters have noticed that in addition to PICC Life Insurance, China Life Insurance, Taikang Life, Sunshine Life, and the "Ping An Group" equity private equity funds have all recently reduced their holdings in A-share companies. According to incomplete statistics, at least 6 A-share companies have been reduced holdings by insurance funds in this round of market conditions.

不过,万丰奥威在今晚公告中并未披露百年人寿后续是否将继续减持。万丰奥威称,百年人寿减持股份来源为从二级市场集中竞价交易方式取得,不涉及减持预披露。

不过,万丰奥威在今晚公告中并未披露百年人寿后续是否将继续减持。万丰奥威称,百年人寿减持股份来源为从二级市场集中竞价交易方式取得,不涉及减持预披露。