Trek 2000 International Ltd (SGX:5AB) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 6.3% isn't as impressive.

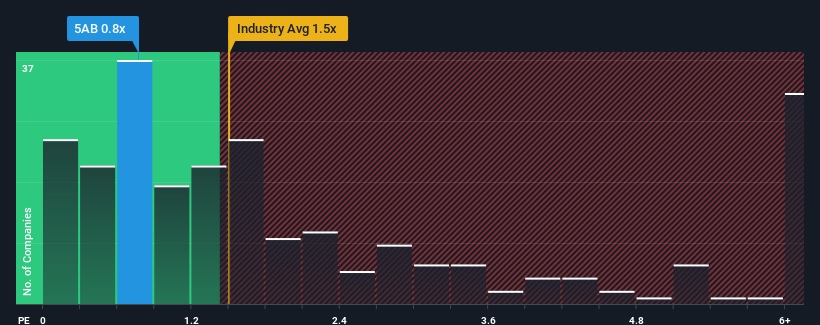

In spite of the firm bounce in price, Trek 2000 International's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Tech industry in Singapore, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Trek 2000 International's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Trek 2000 International has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Trek 2000 International will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Trek 2000 International?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Trek 2000 International's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Trek 2000 International's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 18% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Trek 2000 International's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The latest share price surge wasn't enough to lift Trek 2000 International's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Trek 2000 International revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Trek 2000 International (2 are a bit unpleasant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.