Amazon Attacks Temu and Shein's Turf With New Low-Cost Storefront: Report

Amazon Attacks Temu and Shein's Turf With New Low-Cost Storefront: Report

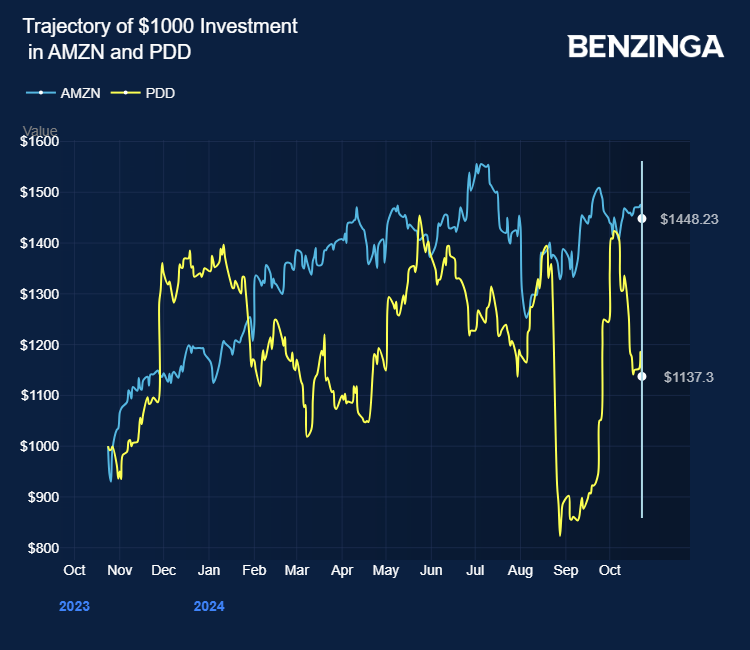

Amazon.Com Inc's (NASDAQ:AMZN) rivalry with discount platforms like PDD Holdings Inc's (NASDAQ:PDD) Temu and Shein prompted the former to set strict price caps for merchants on its new low-cost storefront.

亚马逊公司(NASDAQ:AMZN)与pdd holdings Inc(NASDAQ:PDD)的Temu和Shein等折扣平台的竞争促使前者为其新的低成本商店制定了严格的价格上限,以限制商家的价格。

The Information reports that the price limits, based on messages sent to merchants, include $8 for jewelry, $13 for guitars, and $20 for sofas.

据《The Information》报道,根据向商家发送的消息,价格限制包括珠宝8美元,吉他13美元,沙发20美元。

Amazon plans to ship orders from a facility in Guangdong, China, while offering sellers reduced fulfillment fees for items sold through this new platform.

亚马逊计划从中国广东的设施发货,同时为通过这一新平台销售的商品提供降低的履行费用。

Also Read: Alibaba Rival Temu's Aggressive Model Shift Sparks Supplier Protests: Report

另请参阅:阿里巴巴竞争对手Temu的激进模式转变引发供应商抗议:报告

Amazon's move coincides with slower retail sales growth, which saw just a 5% rise in the second quarter, down from 7% in the previous quarter.

亚马逊的举措与零售销售增长放缓同时发生,第二季度仅增长了5%,低于上一季度的7%。

Prior reports indicated Amazon's plans to launch a new section on its site offering affordable items to overseas consumers, shipped directly from warehouses in China to compete with the bargain platforms like Temu and Shein, featuring unbranded fashion, home goods, and daily necessities with 9 to 11-day delivery times.

先前报道显示,亚马逊计划在其网站上推出一个新的版块,为海外消费者提供实惠商品,直接从中国仓库发货,以与Temu和Shein等折扣平台竞争,包括非品牌时尚、家居用品和每日必需品,送货时间为9至11天。

Reportedly, Amazon is ramping up efforts to recruit more Chinese sellers to expand its affordable product offerings in the U.S. and other markets.

据报道,亚马逊正在加大招募更多中国卖家的努力,以扩大其在美国和其他市场的实惠产品供应。

In 2024, Amazon opened new offices in Wuhan and Zhengzhou to support its global market strategy.

2024年,亚马逊在武汉和郑州开设新办公室,以支持其全球市场战略。

Temu owner PDD reported fiscal second-quarter 2024 revenue growth of 86% to $13.36 billion, missing the consensus estimate of $14.02 billion.

PDD母公司Temu报告2024财季营收增长86%,达到133.6亿美元,低于预期的140.2亿美元。

Goldman Sachs' Eric Sheridan expects Amazon to show strong revenue growth and improved operating margins in its third-quarter report.

高盛的分析师Eric Sheridan预计亚马逊将在第三季度报告中展示强劲的营业收入增长和改善的运营利润率。

The analyst flagged stable e-commerce demand, with units sold outpacing revenue as consumers shift to lower-priced items, supporting Amazon's long-term strategy.

分析师指出,随着消费者转向价格较低的物品,稳定的电子商务需求以销售单位超过营业收入的方式增长,支持亚马逊的长期策略。

Temu Parent PDD's Stock Prediction For 2024

2024年Temu母公司PDD的股票预测

PDD Holdings's revenue growth in FY23 was 80.34%, reflecting the influence of various factors including the macroeconomic environment, demand for its products and services, and its position relative to competitors. This growth is a critical indicator for investors assessing the company's future prospects.

PDD Holdings在FY23年的营收增长率为80.34%,反映了宏观经济环境、对其产品和服务的需求以及与竞争对手的相对位置等各种因素的影响。这种增长是投资者评估公司未来前景的关键指标。

Some macro factors that could impact the company's performance in the next year include higher interest rates, progress on reeling in inflation and labor market strength. The Fed's benchmark rate is currently at 4.83%, while PPI recently came in unchanged, growing 1.8% from last year. The unemployment rate was most recently reported as 4.1%.

可能影响公司明年表现的一些宏观因素包括较高的利率、控制通货膨胀的进展和劳动力市场的强势。联邦基准利率目前为4.83%,而最近的PPI数据保持不变,同比增长1.8%。最近报告的失业率为4.1%。

An investor should pay attention to economic conditions to decide whether they think the macro environment is positive or negative for PDD Holdings stock. For real time economic data and breaking market updates, check out Benzinga Pro. Try it for free.

投资者应关注经济状况,以决定他们认为宏观环境对PDD Holdings股票是积极还是消极的。如需实时经济数据和最新市场更新,请查看Benzinga Pro。免费试用。

How does this stack up against PDD Holdings peers?

这与PDD Holdings的同行公司相比如何?

Investors may also want to analyze a stock in comparison to companies with similar products or in similar industries. PDD Holdings operates in the Consumer Discretionary sector. The stock has experienced average annual growth of 6.97% compared to the -20.93% average of its peer companies. This is above the broader sector movement of PDD Holdings.

投资者可能还想分析一家股票与拥有类似产品或在类似行业中的公司进行比较。 pdd holdings 在消费者自由选择领域运营。 与同行公司的平均年增长率相比,该股票的平均年增长率为6.97%,高于 pdd holdings 更广泛行业的运动。

Price Actions: PDD stock is down 4.33% to $122.95 at the last check Wednesday. AMZN stock is down 2.51% at $184.93.

价格走势:pdd 股价下跌4.33%,至122.95美元,最新检查日期为周三。 亚马逊股价下跌2.51%,报价184.93美元。