Since late September this year, with the rise of the A-share large cap, the new stock market has become more and more hot. Four new stocks listed in October soared on the first day by 7-17 times. Today (October 24), two new stocks listed on the gem board, Suzhou Tianmai (301626) and 6912 (301592), surged one after another.

Due to the small market capitalization of new stocks and lack of trapped shares, they are easily manipulated by funds. In addition, with the limited number of new listings this year, the issuing price-earnings ratio is generally lower than the industry PE ratio, providing greater room for the performance of new stocks after listing, further fueling the market's enthusiasm for new listings.

However, when investing in new stocks, attention should also be paid to their fundamentals and a reasonable evaluation of investment value. Because many new stocks will continue to decline after the violent rise on the first day of listing.

Image Source: Wind

Image Source: Wind

Today, let's analyze the gem board new stock 6912.

The IPO price of 6912 this time is 29.49 yuan per share, with an issue PE ratio of 22.66, lower than the industry's PE ratio of 42.12. As of the close on the 24th, the company's stock price surged over 554%, the TTM PE ratio skyrocketed to 133.95 times, with a total market value of approximately 13.5 billion yuan.

The company's predecessor, 6912 Limited, was established in Deyang, Sichuan in 2017, and in 2021 transformed into a joint-stock company, dedicated to the research and development of military training equipment and special military equipment that meet practical combat needs.

6912 has successively developed and introduced military communication and command simulation training equipment, combat simulation training equipment and other military equipment to the market. Among them, the military communication and command simulation training equipment has been purchased by many military units. The combat simulation training equipment mainly provides a combat training environment for the troops, enhances the training efficiency of the troops, and assists in the efficient implementation of 'training coupled with real combat'.

In the field of special military equipment, the company has solved key technical problems such as the integration of field optical cable into multi-mode cabling, anti-interference communication of data communication terminal, independently developed field optical communication equipment, and has been mass equipped to military clients.

Image source: Prospectus

The company's main products are military training equipment, special military equipment and other military equipment. Specifically, from 2021 to the first half of 2024, more than 79% of 6912's revenue comes from military training equipment products, with the revenue share of military communication and command simulation training equipment being over 45%.

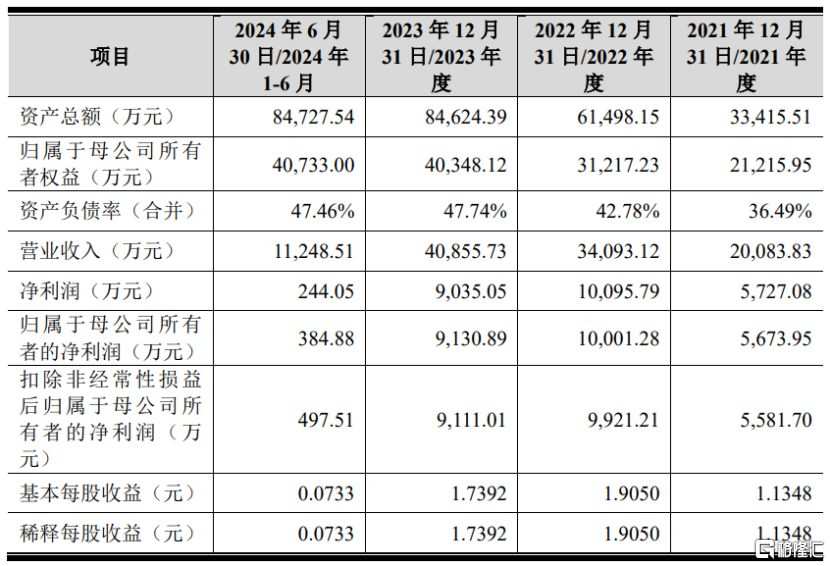

In terms of performance, in the reporting periods of 2021, 2022, 2023, and the first half of 2024, 6912's revenue was approximately 0.201 billion yuan, 0.341 billion yuan, 4.09 billion yuan, and 0.112 billion yuan respectively, with net income of approximately 57.2708 million yuan, 0.101 billion yuan, 9035.05 million yuan, and 2.4405 million yuan respectively.

For the year 2024, the company expects its revenue to be approximately 0.532 billion yuan, a year-on-year increase of 30.32%, and expects its net income to be approximately 0.11 billion yuan, a year-on-year increase of 21.86%.

Main financial data and financial indicators, image source: prospectus

During the reporting period, benefiting from the national military reform policy and the implementation of the Thirteenth Five-Year Plan, the company's performance has grown somewhat, but whether it can continue to grow steadily in the future is still influenced by external factors such as national macro strategies and defense policies.

At the same time, compared with state-owned military industry units in the same industry, 6912 has relatively small capital strength and business scale. The military industry market mainly relies on methods such as bidding, competitive negotiations to acquire new business, leading to the risk of unfavorable market expansion affecting the speed of company development and profitability.

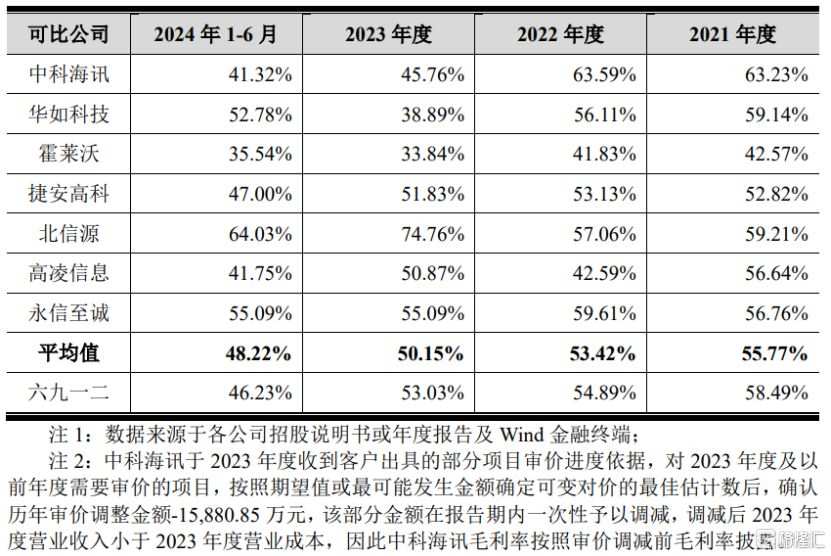

In 2021, 2022, and 2023, 6912's main business gross margin was 58.49%, 54.89%, and 53.03% respectively, showing a downward trend year by year. Combining with the cost of order execution and based on cautious considerations, it is estimated that the gross margin in 2024 will be 46.18%.

Overall, the company's main business gross margin is at a medium level among comparable companies in the industry, with no significant differences from comparable companies in the same industry.

The gross margin situation of the company's comparable companies in the same industry, image source: prospectus

Products from 6912 are mainly used in the military industry sector, with customers including the military, military groups, and research institutes. During the reporting period, the sales to the top five customers accounted for 82.55%, 67.77%, 62.21%, and 76.52% of the annual revenue respectively, which is quite significant. In the future, if the company's newly developed products fail to gain customer recognition, it may impact the company's operational performance.

The company operates in the technology-intensive military equipment sector, where key industry competition lies in new technology and product innovation. Due to the long development and industrial application cycles, substantial investment, and the risk of rapid market demand changes and product obsolescence after mass production of new products.

During the reporting period, the research and development expenses of 6912 were 15.4562 million yuan, 22.6897 million yuan, 28.5124 million yuan, and 17.7192 million yuan respectively, with R&D expenditure rates of 7.70%, 6.66%, 6.98%, and 15.75% respectively. Despite the overall increase in R&D expenses, the R&D expenditure rate is still significantly lower than the average level of comparable companies in the same industry.

Comparison of the company's R&D expenditure rate with comparable companies in the industry, image source: prospectus

图片来源:Wind

图片来源:Wind