The company made a profit of 1.646 billion yuan in the third quarter of last year. The company announced that the main reason for the decline in performance was the significant overall decline in lithium product market prices, and additionally, the misalignment of pricing mechanisms further exacerbated the situation.

On Thursday, tianqi lithium corporation issued a Q3 performance forecast, with a significant decline in company performance, expecting a net loss of 5.85 billion yuan-5.45 billion yuan in the first three quarters of 2024, compared to a profit of 8.099 billion yuan in the same period last year.

The company's announcement stated that the main reason for the performance decline is the overall significant decline in lithium product market prices, and the misalignment of pricing mechanisms has further exacerbated the situation.

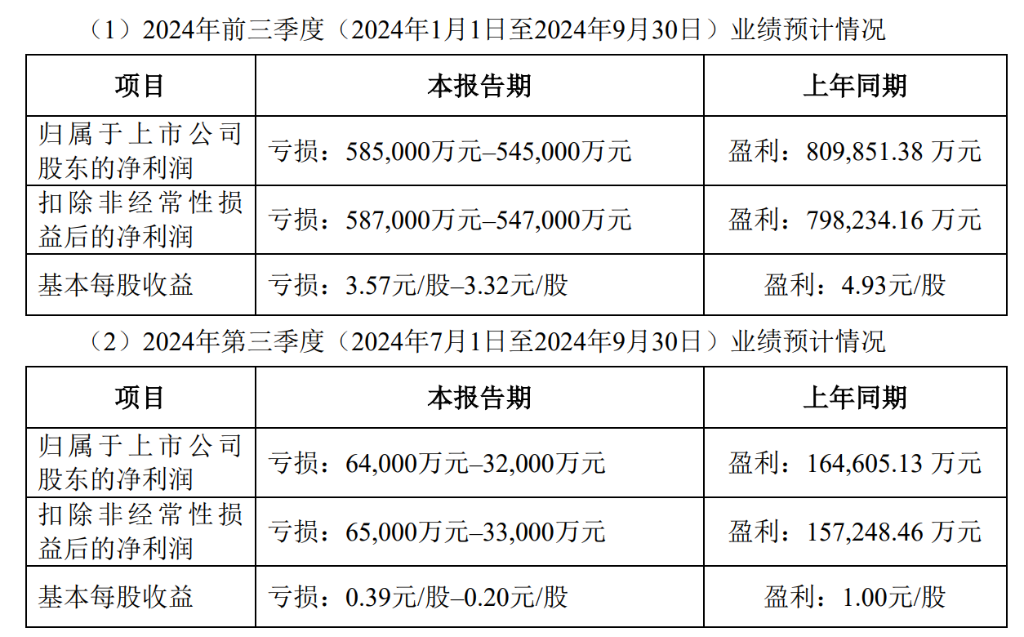

1) Situation of the current performance forecast

1) Situation of the current performance forecast

- In the first three quarters of 2024, the net income attributable to shareholders of the listed company is expected to be a loss of 5.85 billion yuan-5.45 billion yuan, compared to a profit of 8.099 billion yuan in the same period last year.

- In the third quarter of 2024, the net income attributable to shareholders of the listed company is expected to be a loss of 0.64 billion yuan-0.32 billion yuan, compared to a profit of 1.646 billion yuan in the same period last year.

- For the first three quarters, the basic earnings per share is expected to be a loss of 3.57 yuan/share-3.32 yuan/share, compared to a profit of 4.93 yuan/share in the same period last year; for the third quarter, the basic earnings per share is expected to be a loss of 0.39 yuan/share-0.20 yuan/share, compared to 1.00 yuan/share in the same period last year.

According to the company's announcement, affected by the fluctuations in the lithium product market, from the fourth quarter of 2023 to the third quarter of 2024, the overall market price of lithium products showed a significant downward trend, with the company's lithium product sales prices and gross profits decreasing significantly compared to the same period last year.

Due to the mismatch in the timing of the pricing mechanisms between the chemical-grade lithium concentrate pricing mechanism of the company's controlling subsidiary, Talison Lithium Pty Ltd (hereinafter referred to as "Talison"), and the company's lithium chemical product sales pricing mechanism, the company's operating performance in this reporting period incurred a temporary loss.

In the first three quarters of 2024, the market price of chemical-grade lithium concentrate decreased, and the price of lithium concentrate newly purchased by the company from Talison also decreased accordingly. With the gradual entry of newly purchased low-cost lithium concentrate into inventory and the gradual digestion of inventory lithium concentrate, the chemical-grade lithium concentrate cost consumed in the production costs of various company bases is gradually approaching the latest purchase price. The temporary mismatch in the lithium concentrate pricing mechanism is also gradually weakening, and the losses of the company in the second and third quarters of 2024 have both decreased compared to the previous quarter.

At the same time, benefiting from the steady increase in production capacity of the new factory, the sales volume of lithium compounds and derivatives in the first three quarters of 2024 and the third quarter of 2024 both achieved year-on-year and quarter-on-quarter growth.