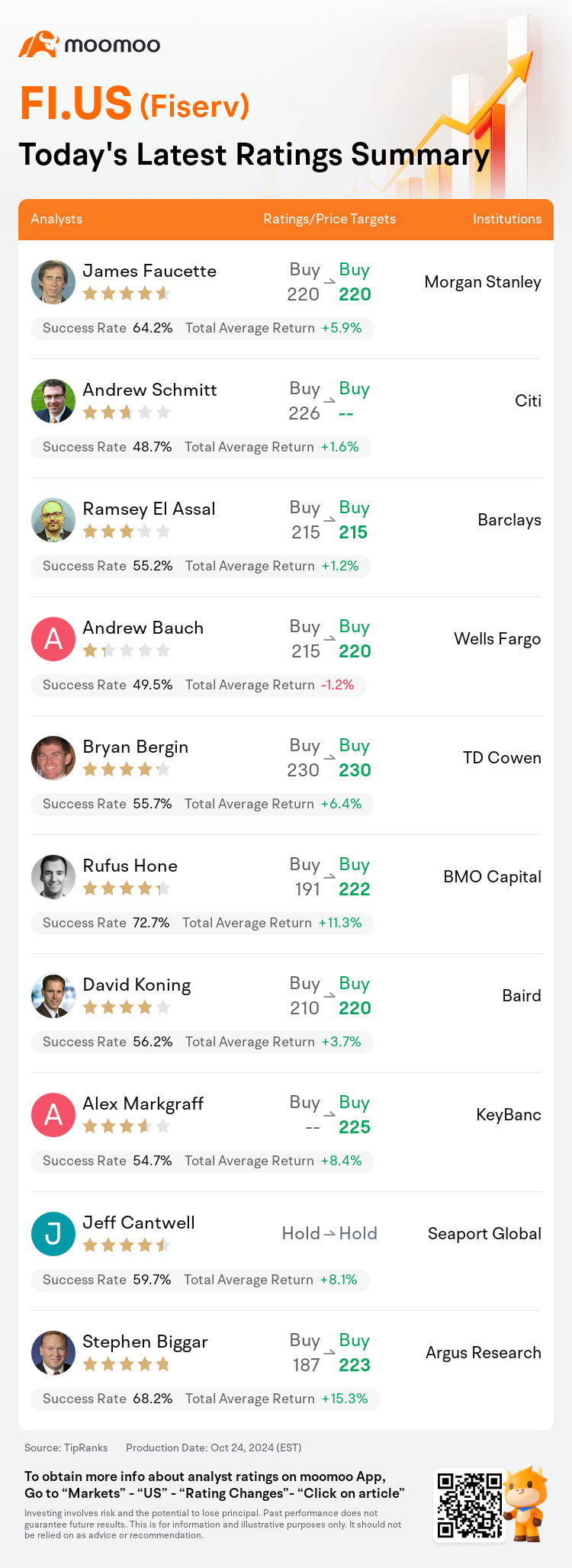

On Oct 24, major Wall Street analysts update their ratings for $Fiserv (FI.US)$, with price targets ranging from $215 to $230.

Morgan Stanley analyst James Faucette maintains with a buy rating, and maintains the target price at $220.

Citi analyst Andrew Schmitt maintains with a buy rating.

Barclays analyst Ramsey El Assal maintains with a buy rating, and maintains the target price at $215.

Barclays analyst Ramsey El Assal maintains with a buy rating, and maintains the target price at $215.

Wells Fargo analyst Andrew Bauch maintains with a buy rating, and adjusts the target price from $215 to $220.

TD Cowen analyst Bryan Bergin maintains with a buy rating, and maintains the target price at $230.

Furthermore, according to the comprehensive report, the opinions of $Fiserv (FI.US)$'s main analysts recently are as follows:

Despite a more cautious perspective from management regarding the consumer's financial health, a detailed analysis of sub-segments indicates that Fiserv's Merchant Solutions might see an organic growth acceleration in Q4.

Fiserv has shown a sustained growth trajectory even amidst a decelerating consumer spending backdrop. This consistent growth can be credited to its strategic focus on deepening Value-Added Services penetration, broadening its specialized software offerings, and leveraging its distinct distribution advantage. Particularly noteworthy is the company's initiative to expand the reach of Clover beyond domestic markets.

The company continues to perform effectively with a vast array of product innovations and cross-selling initiatives throughout its platform.

Fiserv's third-quarter outcomes presented a mixed picture, with reported revenues not meeting Street expectations, yet the adjusted earnings per share and updated guidance for FY24 surpassed Street projections.

The latest quarter for Fiserv demonstrated continued stability, featuring revenues that met expectations and earnings per share as well as margin surpassing forecasts. The recent uptick in the company's share price is seen as a sign that the positive momentum was warranted, with expectations of additional growth ahead.

Here are the latest investment ratings and price targets for $Fiserv (FI.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

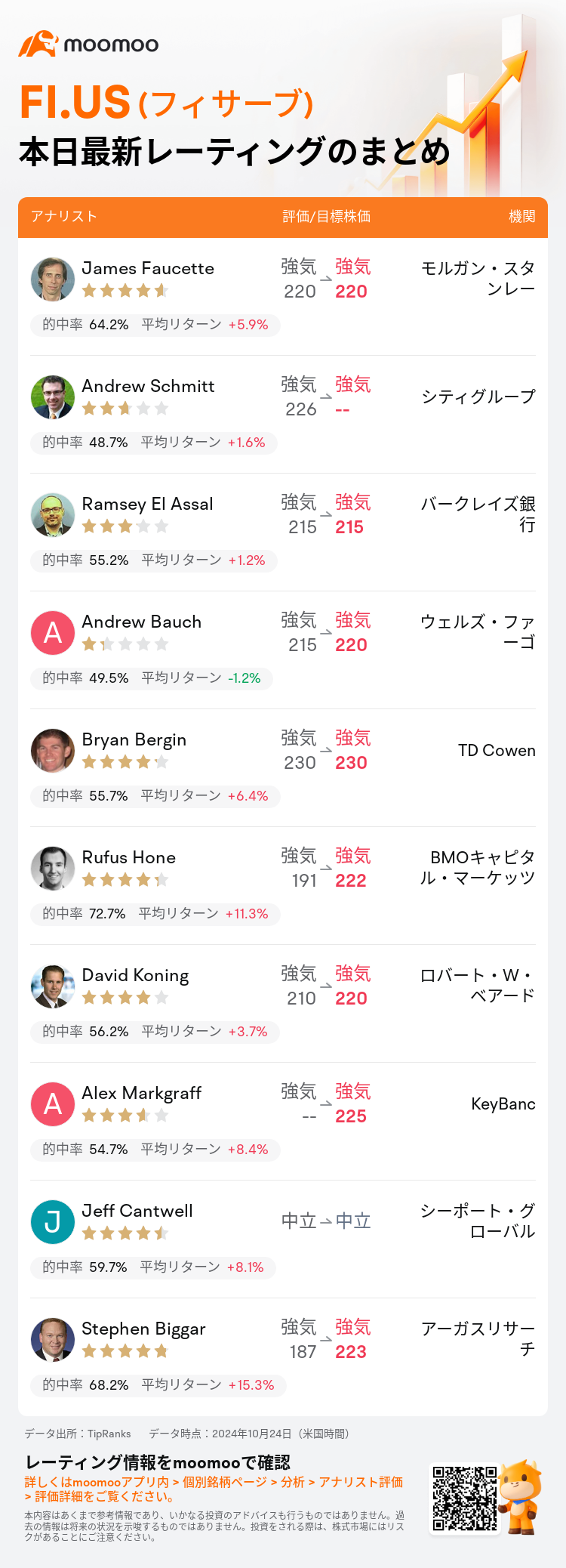

10月24日(米国時間)、ウォール街主要機関のアナリストが$フィサーブ (FI.US)$のレーティングを更新し、目標株価は215ドルから230ドル。

モルガン・スタンレーのアナリストJames Faucetteはレーティングを強気に据え置き、目標株価を220ドルに据え置いた。

シティグループのアナリストAndrew Schmittはレーティングを強気に据え置き。

バークレイズ銀行のアナリストRamsey El Assalはレーティングを強気に据え置き、目標株価を215ドルに据え置いた。

バークレイズ銀行のアナリストRamsey El Assalはレーティングを強気に据え置き、目標株価を215ドルに据え置いた。

ウェルズ・ファーゴのアナリストAndrew Bauchはレーティングを強気に据え置き、目標株価を215ドルから220ドルに引き上げた。

TD CowenのアナリストBryan Berginはレーティングを強気に据え置き、目標株価を230ドルに据え置いた。

また、$フィサーブ (FI.US)$の最近の主なアナリストの観点は以下の通りである:

消費関連に関する経営陣のより慎重な見方にもかかわらず、サブセグメントの詳細な分析によると、FiservのMerchant Solutionsは第4四半期にオーガニック成長が加速する可能性がある。

Fiservは、景気の鈍化する消費支出環境の中でも持続的な成長トラジェクトリを示しています。この一貫した成長は、付加価値サービスの浸透を深める戦略的焦点、特化したソフトウェアの提供の幅広げ、および独自の流通優位性を活用することによるものとされています。特に注目すべきは、国内市場を超えてCloverの届ける範囲を拡大する同社の取り組みです。

同社は、プラットフォーム全体での幅広い製品革新とクロスセリングの取り組みを通じて、効果的に業績を上げ続けています。

Fiservの第3四半期の結果は、報告された収益が市場の期待には及ばなかったが、調整後の1株当たり利益およびFY24の見通しは市場予想を上回りました。

Fiservの最新四半期は、収益が期待に添うもので、1株当たり利益やマージンが予測を上回る安定を示していました。企業の株価の最近の上昇は、肯定的な勢いが正当化された兆候と見なされ、今後のさらなる成長が期待されています。

以下の表は今日10名アナリストの$フィサーブ (FI.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

バークレイズ銀行のアナリストRamsey El Assalはレーティングを強気に据え置き、目標株価を215ドルに据え置いた。

バークレイズ銀行のアナリストRamsey El Assalはレーティングを強気に据え置き、目標株価を215ドルに据え置いた。

Barclays analyst Ramsey El Assal maintains with a buy rating, and maintains the target price at $215.

Barclays analyst Ramsey El Assal maintains with a buy rating, and maintains the target price at $215.