Sunny Side Up Culture Holdings Limited (HKG:8082) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 152% in the last year.

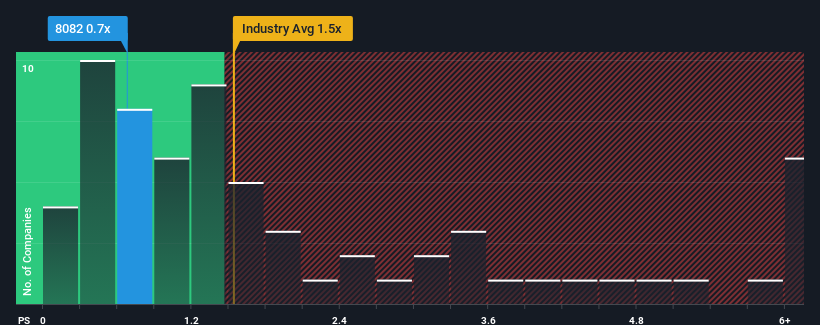

Although its price has surged higher, Sunny Side Up Culture Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Entertainment industry in Hong Kong have P/S ratios greater than 1.5x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Sunny Side Up Culture Holdings' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Sunny Side Up Culture Holdings has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunny Side Up Culture Holdings' earnings, revenue and cash flow.How Is Sunny Side Up Culture Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sunny Side Up Culture Holdings' to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sunny Side Up Culture Holdings' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Sunny Side Up Culture Holdings' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Sunny Side Up Culture Holdings' P/S?

The latest share price surge wasn't enough to lift Sunny Side Up Culture Holdings' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sunny Side Up Culture Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It is also worth noting that we have found 5 warning signs for Sunny Side Up Culture Holdings (1 makes us a bit uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of Sunny Side Up Culture Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.