RBC Capital analyst Shelby Tucker maintains $NextEra Energy Partners LP (NEP.US)$ with a hold rating, and maintains the target price at $29.

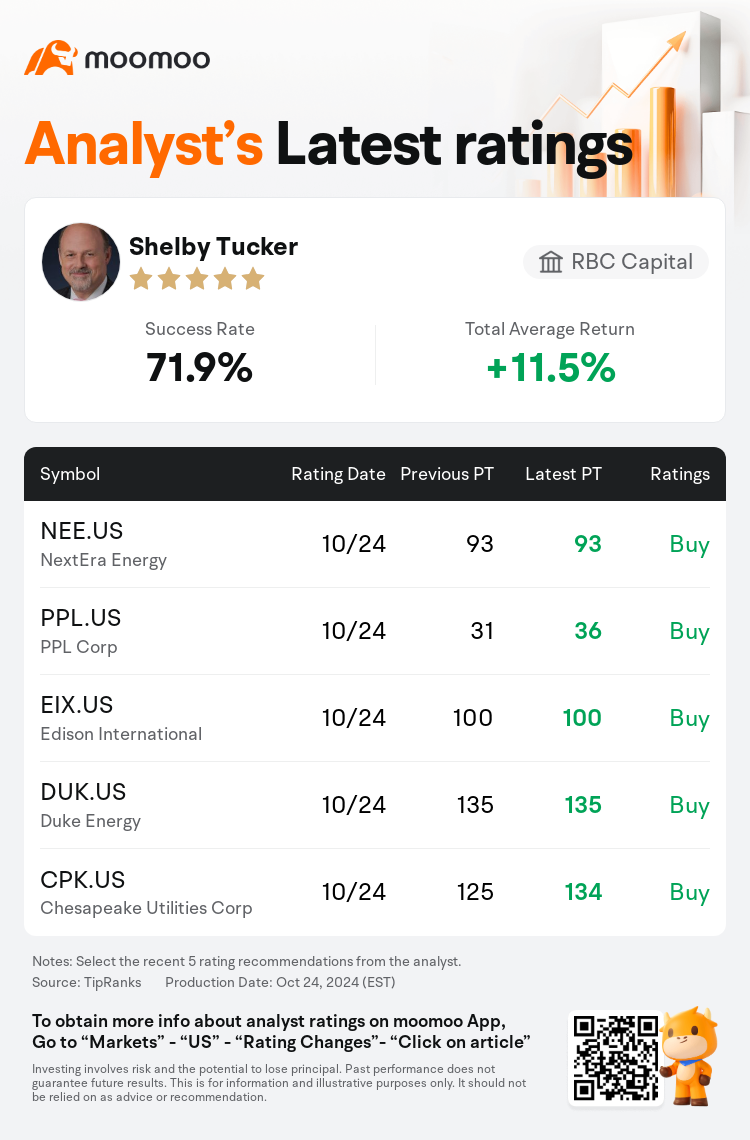

According to TipRanks data, the analyst has a success rate of 71.9% and a total average return of 11.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $NextEra Energy Partners LP (NEP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $NextEra Energy Partners LP (NEP.US)$'s main analysts recently are as follows:

NextEra Energy Partners' third-quarter performance did not meet expectations, mainly due to reduced wind resources. More crucially, the company has signaled its intention to update investors by or before the fourth-quarter earnings call about the strategic evaluation of its long-term convertible equity portfolio financing obligations and its cost structure. The anticipation of an announcement concerning asset transfers, combined with a potential distribution adjustment, is viewed as a potential stimulant for the stock that may enhance growth prospects into fiscal 2026 and further.

Following Q3 earnings, management indicated that a strategic update regarding cash deployment is expected by Q4, which may include a near-term dividend reduction. The subsequent decline in the stock's value was not solely a reaction to this news but also stemmed from speculation about the extent of the potential cut. The perspective offered is one of a lack of concern, suggesting that a dividend adjustment may be prudent to manage significant CEPF acquisitions and could align the dividend yield with that of industry counterparts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

RBCキャピタル・マーケッツのアナリストShelby Tuckerは$ネクストエラ・エナジー・パートナーズ (NEP.US)$のレーティングを中立に据え置き、目標株価を29ドルに据え置いた。

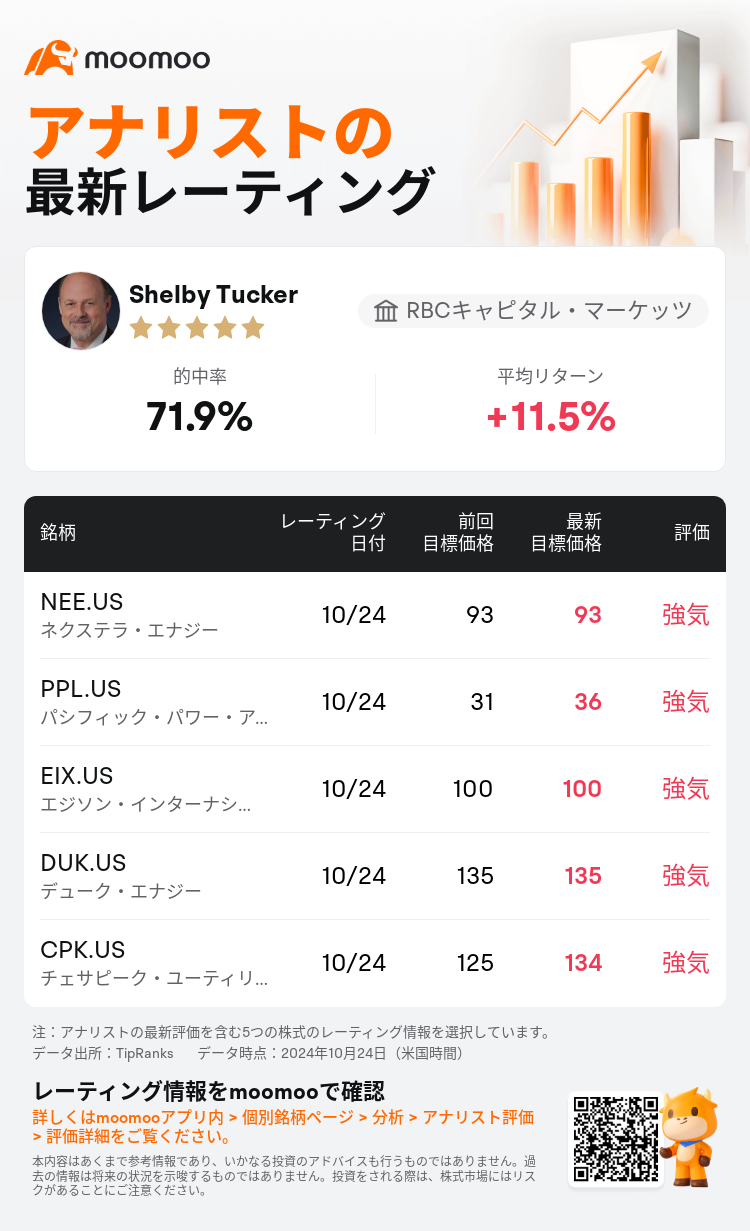

TipRanksのデータによると、このアナリストの最近1年間の的中率は71.9%、平均リターンは11.5%である。

また、$ネクストエラ・エナジー・パートナーズ (NEP.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ネクストエラ・エナジー・パートナーズ (NEP.US)$の最近の主なアナリストの観点は以下の通りである:

ネクステラ・エナジー・パートナーズの第3四半期の業績は、主に風力資源の減少により、期待に応えられませんでした。さらに重要なのは、同社が第4四半期の決算発表までに、またはそれ以前に、長期コンバーチブル・エクイティ・ポートフォリオの融資債務の戦略的評価とコスト構造について、投資家に最新情報を提供するという意向を示したことです。資産譲渡に関する発表への期待は、潜在的な分配調整と相まって、2026年度以降の成長見通しを高める可能性のある株式の潜在的な刺激要因と見なされています。

第3四半期の収益を受けて、経営陣は、現金配分に関する戦略的更新が第4四半期までに予定されていることを示しました。これには、短期的な配当削減が含まれる可能性があります。その後の株価の下落は、このニュースに対する反応だけでなく、潜在的な値下げの程度についての憶測からも生じました。提示された見方は、懸念がないというものです。これは、CEPFの大規模な買収を管理するには配当調整が賢明であり、配当利回りを業界の同業者の配当利回りと一致させる可能性があることを示唆しています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ネクストエラ・エナジー・パートナーズ (NEP.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ネクストエラ・エナジー・パートナーズ (NEP.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of