Stock prices hitting record highs cannot conceal the performance roller coaster.

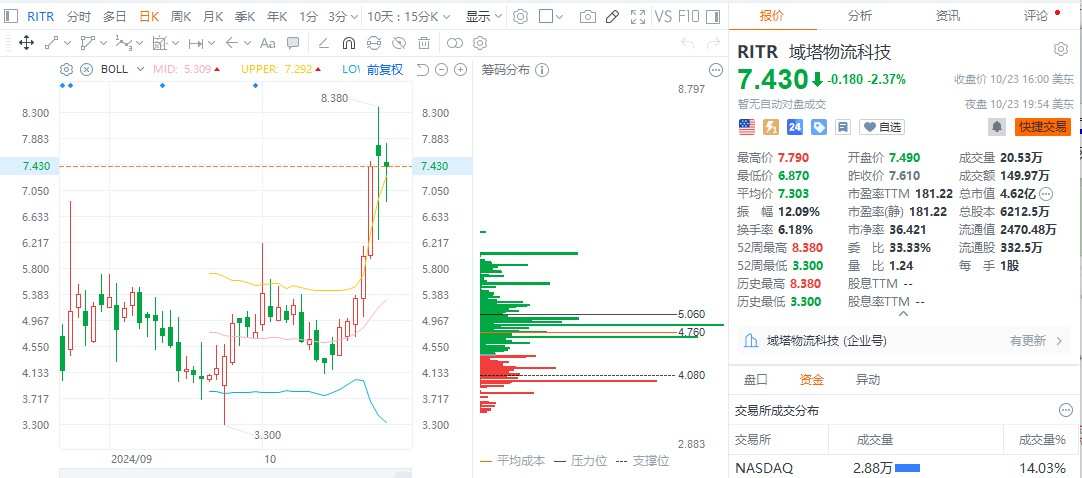

Reitar Logtech Holdings (RITR.US) stock price has recently reached record highs. Since late October, the stock has shown strong momentum, achieving its largest increase since going public. Over the course of six trading days (15th to 22nd), the cumulative increase reached 73%, with a peak of 8.38 Hong Kong dollars, skyrocketing by 109.5% from the IPO price of $4.

As of the close on October 23, the company closed at $7.43, with a total market value of approximately 0.462 billion USD, still showing an 85.8% increase compared to the IPO price.

As Reitar Logtech Holdings' stock price continues to hit new highs, investors also have two major concerns: one, whether the company's fundamentals are solid, and two, the risk of high-level profit-taking as funds flow in.

As Reitar Logtech Holdings' stock price continues to hit new highs, investors also have two major concerns: one, whether the company's fundamentals are solid, and two, the risk of high-level profit-taking as funds flow in.

Performance roller coaster

According to the prospectus, Reitar Logtech Holdings connects capital partners, logistics operators, and integrates and applies innovations in logistics technology through an end-to-end logistics solution business model, providing comprehensive logistic solutions. The company's business consists mainly of two parts: asset management and professional consulting services, as well as construction management and engineering design services.

As one of the earliest companies to enter the real estate + logistics technology or PLT solution industry in Hong Kong, Reitar Logtech Holdings has been operating in the logistics solution market since 2015, providing PLT solutions through the Reitar Group, and construction management and engineering design services through the Kamui Group. In the second half of 2022, the company acquired Kamui Group and Reitar Group. With many years of experience in the logistics industry, we have accumulated in-depth professional knowledge and established strong relationships with stakeholders in the industry, including investment funds, landowners, local and international third-party logistics companies, suppliers, and equipment manufacturers. The key competitive advantage of the company is the technical know-how related to customer operations gained through years of service.

Despite many years of deep cultivation, the company's performance overall shows a 'roller coaster' trend. From the fiscal year 2022 to the fiscal year 2024 (hereinafter referred to as the reporting period), Reitar Logtech Holdings' revenues were 0.144 billion yuan (in HKD, the same below), 84.4853 million yuan, and 0.252 billion yuan, with corresponding net profits during this period of 19.1647 million yuan, 63.6107 million yuan, and 19.628 million yuan, respectively. It is worth noting that in the fiscal year 2023, the company experienced almost a halving of revenue, but a significant year-on-year increase of 232% in net profit; while in the fiscal year 2024, the company's revenue increased by 200% year-on-year, but net profit dropped significantly, almost on par with the profit in the 2021 fiscal year.

Revenue declined in the fiscal year 2023, the company stated. Mainly due to the decrease in income from construction management and engineering design services for small and medium-sized projects. In 2022, the company provided services to 24 clients of 152 projects; in the fiscal year 2023, the company provided construction management and engineering design services to 19 clients of 174 projects.

The significant fluctuations in performance also drag down other financial indicators. For example, during the reporting period, the net cash generated from operating activities by the company was 2.9302 million yuan, 49.7143 million yuan, and -18.7364 million yuan. Its operating cash flow fluctuation follows the trend of net profit fluctuation. From the fiscal year 2023 to the fiscal year 2024, the company's cash and cash equivalents were 46.6132 million yuan and 6.3909 million yuan, showing a significant shrinkage.

Looking at the business segments, the company's revenues from construction management and engineering design services during the period were 0.142 billion yuan, 77.5 million yuan, and 0.231 billion yuan, accounting for 98.1%, 91.7%, and 91.7% of the total revenue, respectively; while asset management and professional consulting services still represent a single-digit percentage of total revenue. It is evident that Reitar Logtech Holdings still relies on construction management and engineering design services as the revenue pillar, with a relatively single business structure. In addition, the gross margin of this business showed a declining trend during the period, at 25.6%, 26.8%, and 23.5%, indicating a decline in the profitability of the main business, which is truly concerning for the company's growth.

In addition, Reitar Logtech Holdings has several key indicators in Hong Kong for its business scale and performance in providing construction management and engineering design services, including customer numbers, project numbers, and contract amounts. During the reporting period, the company had project numbers of 152, 174, and 48; customer numbers of 24, 19, and 19; and contract amounts of 0.152 billion yuan, 0.726 billion yuan, and 0.906 billion yuan. In short, there was a significant streamlining of project numbers, a reduction in customer numbers, and a focus on large cooperative projects.

The increasing demand for logistics solutions has led to the continued dependency of major clients, which remains a hidden concern.

With the increase in income, the development of e-commerce, and the shift in dietary patterns, the demand for meat, seafood, fruits, vegetables, dairy products, etc. continues to rise. These products are temperature-sensitive and require storage and transportation under controlled temperatures. In addition, people's concerns about food safety are increasing. Consumers' habits of purchasing fresh and frozen foods from organized retail channels such as supermarkets are continuously shifting compared to the traditional wet market. These trends are driving the demand for cold storage facilities in Hong Kong, supporting further investment in ongoing infrastructure improvements.

GLP forecasts that from 2021 to 2023, Hong Kong plans to provide up to approximately 5 million square feet (0.4645 million square meters) of new warehouse supply total floor area to promote the development of the local cold chain industry. In addition, in the 2021-22 Hong Kong Budget, the Hong Kong government specifically mentioned that the Airport Authority will actively explore measures to leverage its capability in handling temperature-controlled air cargo to enhance transshipment in the city. MARC Group expects that by 2026, the refrigeration sector in the Asia-Pacific region will grow from USD 111 billion in 2020 to USD 255 billion.

Against the backdrop of the highly developed refrigeration market, especially where logistics infrastructure, technology, and services have lagged behind market demand, the demand for logistics solutions significantly surpasses the supply, and the gap continues to widen. There are reasons to believe that given the company's leading market position in providing PLT solutions, comprehensive service business model, first-mover advantage, deep technical know-how, and strong customer base, Reitar Logtech Holdings is well positioned to capture the tremendous growth potential in the logistics solutions industry.

However, the company still relies on a small number of clients. During the reporting period, the total of the top five clients accounted for approximately 89.9%, 88.3%, and 94.6% of its total revenue. Especially as the company's resources shift towards large projects, the dependence on individual clients is estimated to deepen, potentially impacting its operational stability negatively.

Reitar Logtech Holdings also stated in its risk alerts that since most of the contracts awarded by the company are project-based, it is possible that after completing existing projects, it may not be able to secure new contracts from its main clients. If unable to sign new contracts with major clients and cannot obtain suitable projects of equivalent scale and quantity from other clients as replacements, the company's financial condition and operational performance will be significantly adversely affected.

In conclusion, although in the long run, with the development of the cold chain market in Hong Kong and the Asia-Pacific region, the demand for logistics solutions is increasing, providing growth space for reitar logtech holdings, but for now, the company's development "deficiencies" are obvious. For example: unstable performance, focus on large projects leading to more serious customer dependence, and once more upfront capital investment is needed for projects, the company's liquidity may immediately "show weakness".

随着域塔物流科技股价不断创新高,投资者亦有两大关注,其一该公司基本面是否扎实,其二则是随着资金涌入,或存在高位资金获利离场风险。

随着域塔物流科技股价不断创新高,投资者亦有两大关注,其一该公司基本面是否扎实,其二则是随着资金涌入,或存在高位资金获利离场风险。