In the third quarter, enn natural gas retail sales volume increased by 5.5% year-on-year, station unloading volume increased by over 70% year-on-year, revenue and net income grew steadily. In 2024, the company is strategically positioning itself in the fields of henry hub natural gas, hydrogen energy, and comprehensive energy utilization, and has achieved phased results.

In the third quarter, enn natural gas's retail sales volume increased by 5.5% year-on-year, while the unloading volume of the receiving station increased by over 70% year-on-year, with stable growth in revenue and net income.

On Friday, October 25, enn natural gas released its third-quarter financial report:

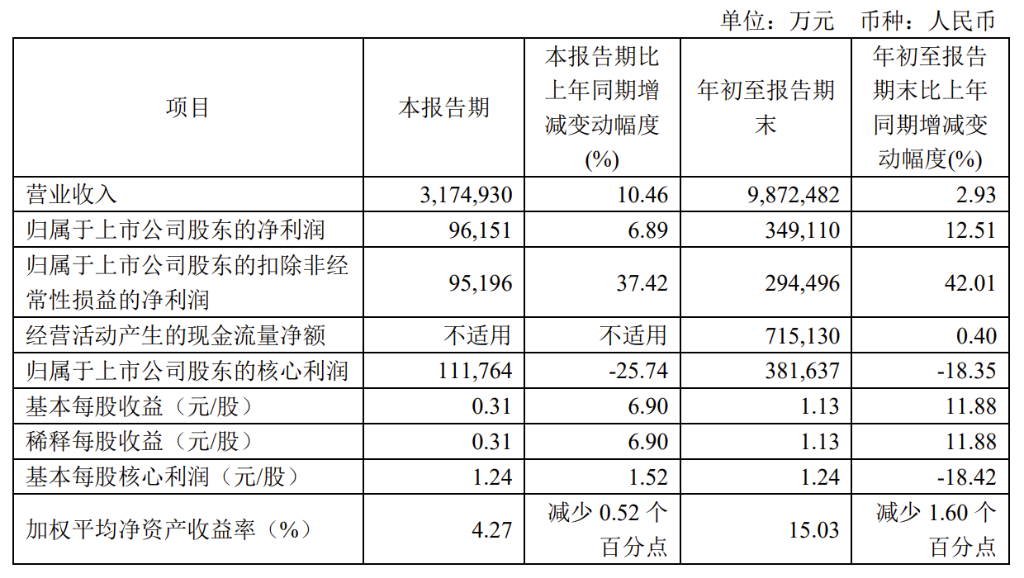

1) Key Financial Figures:

1) Key Financial Figures:

- Total revenue in the third quarter: 3.1749 million RMB, an increase of 10.46% year-on-year; total revenue in the first three quarters was 98.725 billion RMB, an increase of 2.93% year-on-year.

- Net income in the third quarter: 0.0962 million RMB, a 6.89% year-on-year increase; revenue in the first three quarters was 0.3491 million RMB, a 12.51% year-on-year increase.

- Earnings per share in the third quarter: 0.31 RMB, a 6.90% year-on-year increase; earnings in the first three quarters were 1.13 RMB, an 11.88% year-on-year increase.

- Net profit excluding non-recurring gains and losses: 0.0952 million RMB, an increase of 37.42% year-on-year.

- Total assets as of the end of the third quarter: RMB 13.514 million, RMB 134.574 billion at the end of 2023.

2) Main Products

- Platform gas trading sales volume in the third quarter: 1357 million cubic meters, a decrease of 5.4% year-on-year; platform gas trading sales volume in the first three quarters 4062 million cubic meters, an increase of 10.7% year-on-year.

- Natural gas retail sales volume in the third quarter: 6109 million cubic meters, an increase of 5.5% year-on-year; natural gas retail sales volume in the first three quarters 18819 million cubic meters, an increase of 4.8% year-on-year.

- Pan-energy sales volume in the third quarter: 9928 million kilowatt hours, an increase of 13.3% year-on-year; pan-energy sales volume in the first three quarters 29668 million kilowatt hours, an increase of 21.4% year-on-year.

- Receiving station unloading volume in the third quarter: 0.71 million tons, an increase of 73.2% year-on-year; receiving station unloading volume in the first three quarters 1.73 million tons, an increase of 33.1% year-on-year.

Enn Natural Gas Co., Ltd. is an A-share energy industry listed company, with business covering platform gas trading, natural gas distribution, industrial asia vets platform construction and operation, infrastructure operations, comprehensive energy, engineering construction and installation operations in the entire natural gas scenario.

In the first three quarters, enn natural gas's net income, excluding non-recurring gains and losses, increased by 42.01% year-on-year. The financial report stated that this was mainly due to the large amount of derivative settlements in the same period of the previous year that were not accounted for using hedge accounting, as well as the decrease in exchange losses due to the decrease in exchange rates from the beginning of the year to the end of the reporting period compared to the same period of the previous year, and the increase in profit contributions from energy production operations and infrastructure operations compared to the same period of the previous year.

As of September 30, 2024, enn natural gas disclosed that the number of shareholders in the company was 0.0206 million, an increase of 3587.0 shareholders from June 30, with a growth rate of 21.03%; the average number of shares held per shareholder decreased from 0.1817 million shares in the previous period to 0.15 million shares, with an average market value of 3.0878 million yuan per shareholder.

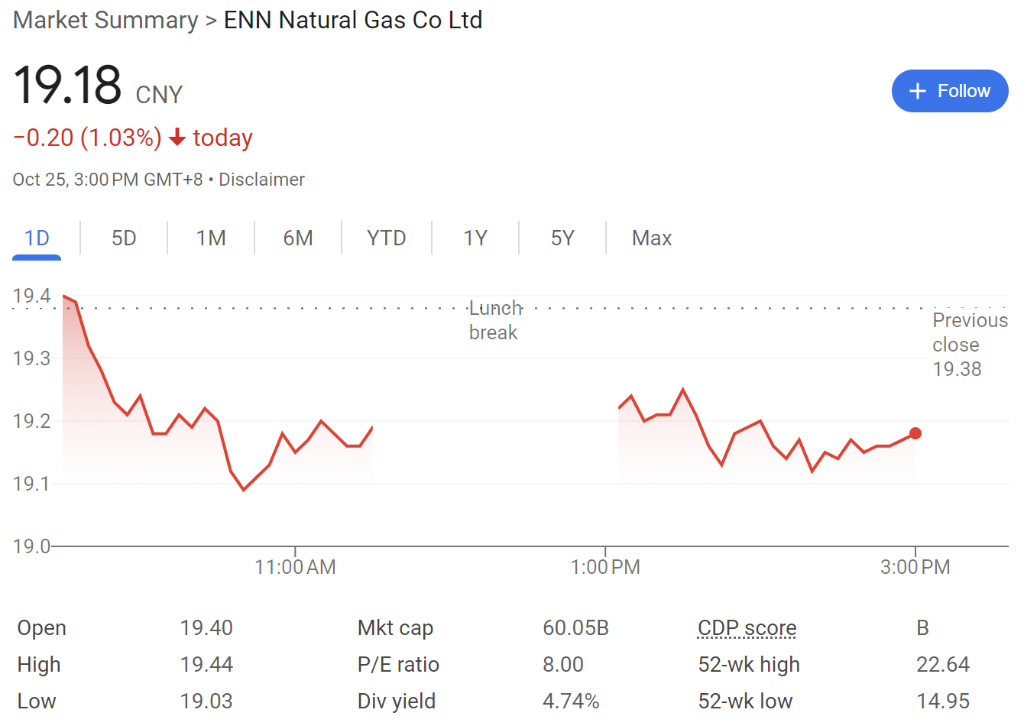

Today, enn natural gas closed down 1.03% at 19.18 RMB per share, with a market cap of 60.05 billion RMB.

Continuously deploying new energy technologies, delving into the transformation and application of clean energy

In 2024, enn natural gas stated that the company is making technological advancements in areas such as natural gas, hydrogen energy, and comprehensive energy utilization, achieving phased results.

The company has expanded new business in the field of hydrogen energy, including independently developing a Solid Oxide Electrolyzer Cell (SOEC) hydrogen production integrated system. Currently, the 50kW system design has been completed; in the field of hydrogen blending in natural gas pipelines, a hydrogen blending demonstration station for natural gas in Jiangsu invested and constructed by a subsidiary has been completed, designed with a hydrogen blending ratio of 10%, which can partially substitute natural gas to help customers achieve carbon reduction. Through its proprietary natural gas hydrogen production technology, the company has entered the mining industry for the first time, undertaking a 0.018 million Nm3/h natural gas reforming and synthesis gas project for a steel plant...

At the same time, the company actively responds to the national low-carbon energy transformation, upholds a sustainable development business philosophy, continuously improves governance structures and execution systems, and enhances ESG performance.