In terms of profit, although Q3 increased 13.8% year over year, profit fell 3.7% year over year in the first three quarters. The increase in profit was mainly due to cost control and increased other benefits.

Benefiting from increased outsourced coal and electricity sales, China Shenhua's Q3 revenue increased 3.4% year over year. Q3 net profit increased 13.8% year over year, mainly due to increased cost control and other benefits.

On the 25th, China's Shenhua announced financial results for the third quarter.

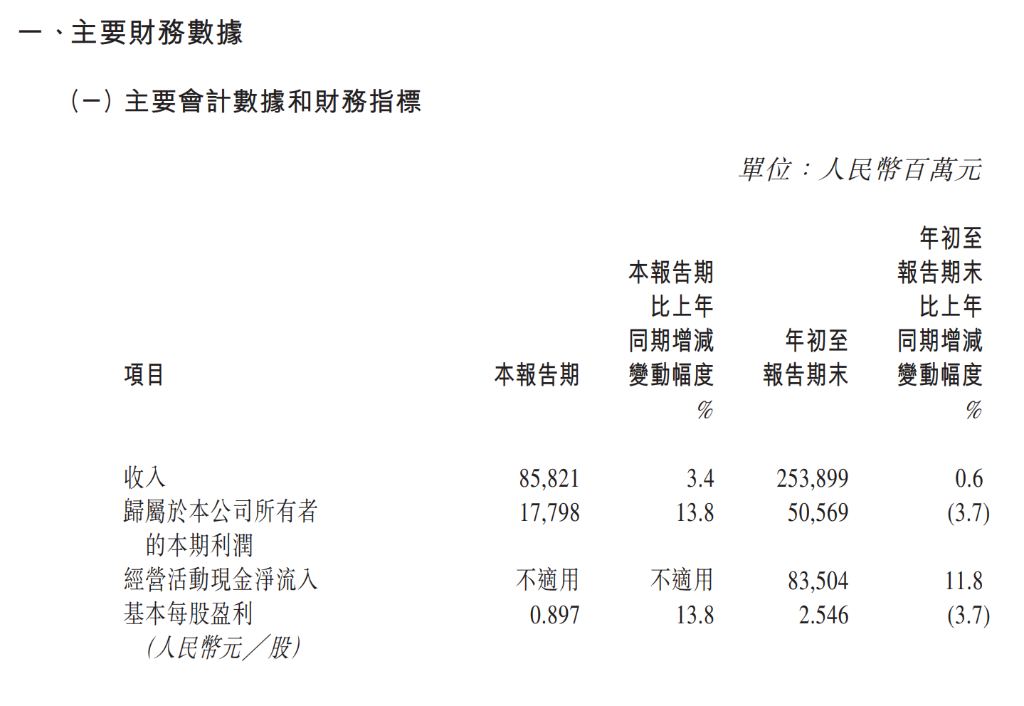

1) Key financial data

1) Key financial data

- Revenue: In the third quarter, revenue was 85.821 billion yuan, up 3.4% year on year; revenue for the first three quarters was 253.899 billion yuan, up 0.6% year on year.

- Net profit: In the third quarter, current profit attributable to company owners was approximately 17.798 billion yuan, up 13.8% year on year; profit was 50.569 billion yuan, down 3.7% year on year.

- Basic earnings per share: basic earnings per share for the third quarter were 0.897 yuan; basic earnings per share for the first three quarters were 2.546 yuan.

- Cash flow: As of September 30, 2024, net cash flow from operating activities was $83.504 billion, up 11.8% year over year.

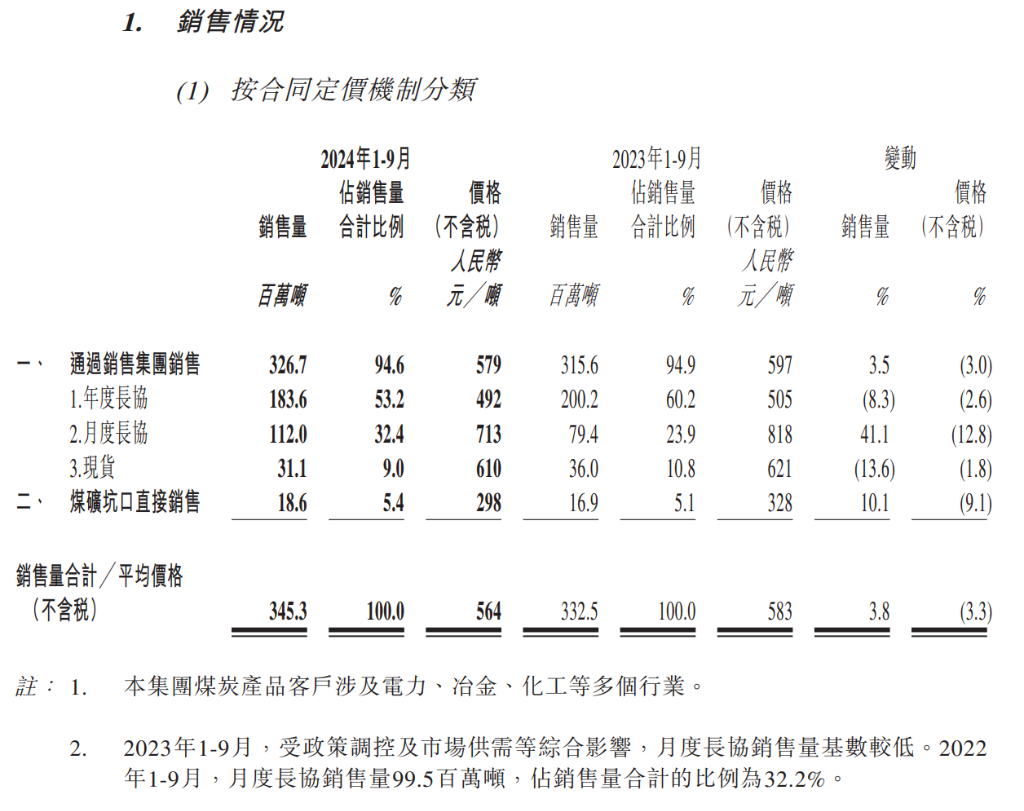

2) Sales

- Total sales volume: From January to September 2024, total coal sales volume was 345.3 million tons, up about 3.8% from 332.5 million tons in the same period last year.

- Average selling price: The overall average sales price dropped from 583 yuan/ton in 2023 to 564 yuan/ton in 2024, a decrease of 3.3%.

- Sales price: In terms of price, the annual price of Changxie dropped from 597 yuan/ton to 579 yuan/ton (down 3.0%), while the monthly price of Changxie dropped from 818 yuan/ton to 713 yuan/ton (down 12.8%).

During the reporting period, China's Shenhua's revenue mainly came from coal sales, which were driven by increases in outsourced coal sales and electricity sales. Total revenue increased 0.6% year over year to 253.899 billion yuan. However, the decline in sales prices has put some pressure on overall revenue.

The company plans to continue to expand its clean energy layout, such as the expansion of photovoltaic power generation projects. Furthermore, management said it will continue to optimize the cost structure and actively explore new market opportunities in the future.

1)

1)