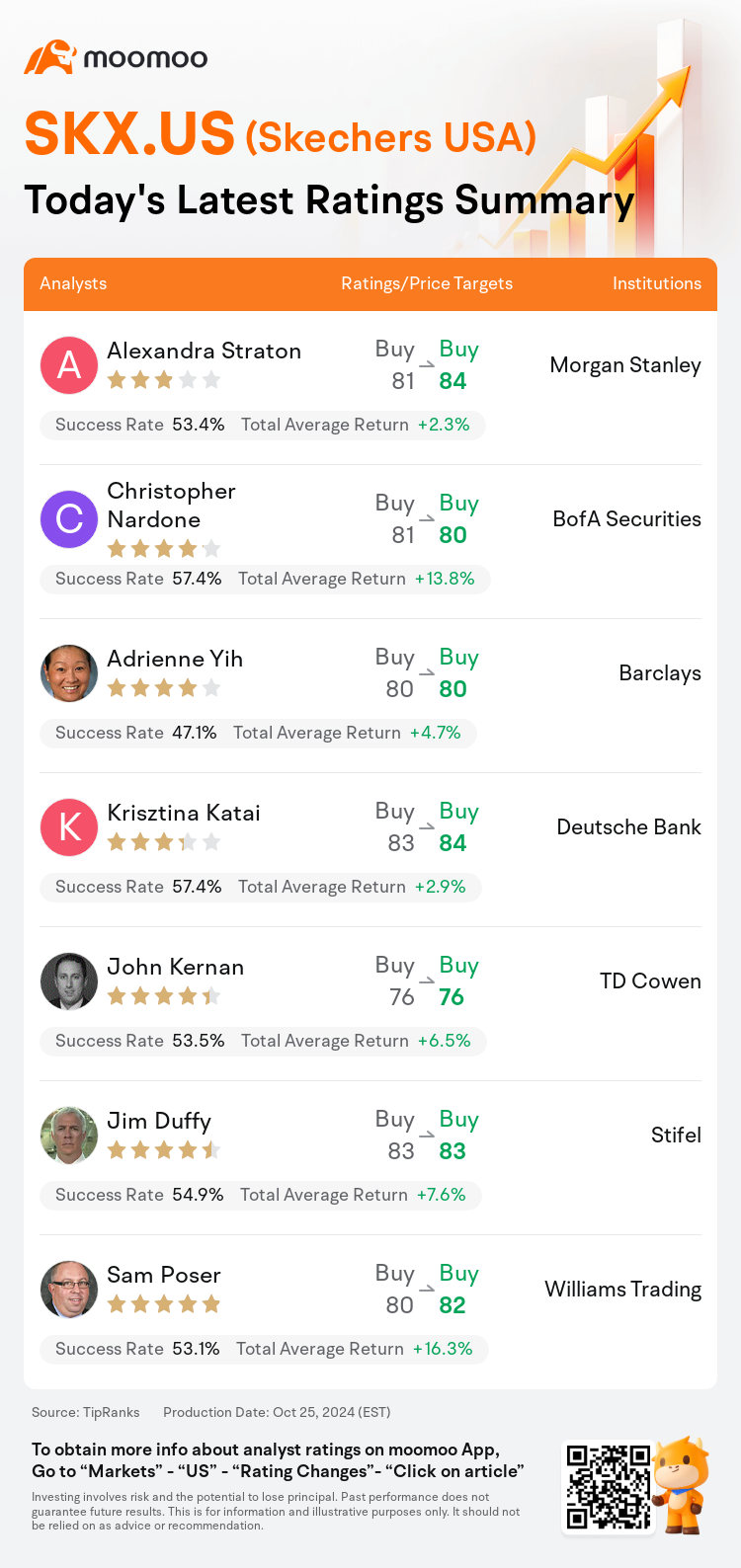

On Oct 25, major Wall Street analysts update their ratings for $Skechers USA (SKX.US)$, with price targets ranging from $76 to $84.

Morgan Stanley analyst Alexandra Straton maintains with a buy rating, and adjusts the target price from $81 to $84.

BofA Securities analyst Christopher Nardone maintains with a buy rating, and adjusts the target price from $81 to $80.

Barclays analyst Adrienne Yih maintains with a buy rating, and maintains the target price at $80.

Barclays analyst Adrienne Yih maintains with a buy rating, and maintains the target price at $80.

Deutsche Bank analyst Krisztina Katai maintains with a buy rating, and adjusts the target price from $83 to $84.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $76.

Furthermore, according to the comprehensive report, the opinions of $Skechers USA (SKX.US)$'s main analysts recently are as follows:

The lowered forecast for Skechers' price reflects an adjustment due to management's update on the fiscal year sales outlook, which has been revised to express sustained brand vigor across various channels. Consequently, the earnings per share estimate for FY24 has been increased, taking into account the stronger-than-anticipated earnings reported in Q3, while the projection for FY25 earnings per share has been modestly reduced.

Skechers posted a 'beat and raise' third quarter, indicative of robust wholesale performance and positive developments in Europe, the Middle East, and Africa, partially balanced by a gross margin discrepancy due to challenges in China and promotional activities. These issues are viewed as temporary.

Skechers demonstrated commendable performance with a 16% increase in sales and the preservation of near-record gross margins in Q3. This is particularly notable given the shift back to wholesale channels, combined with less favorable conditions in China and other challenges.

Skechers' third-quarter report showcased accelerated growth in domestic wholesale and robust sales increase of 30% in Europe, the Middle East, and Africa. Nevertheless, the company faces near-term risks, including weakened performance in China, a gross margin shortfall, and elevated inventory levels that need to be managed carefully.

Here are the latest investment ratings and price targets for $Skechers USA (SKX.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

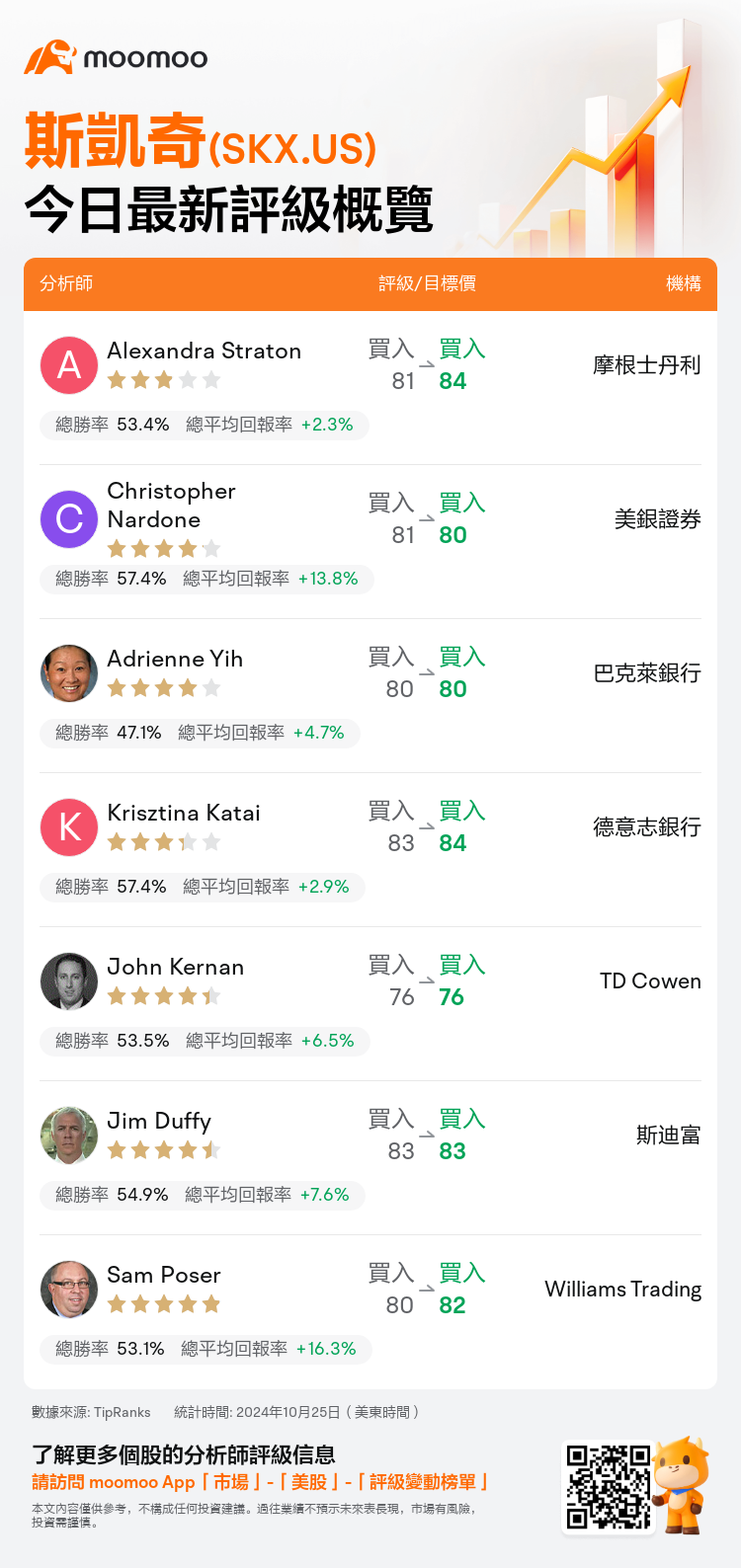

美東時間10月25日,多家華爾街大行更新了$斯凱奇 (SKX.US)$的評級,目標價介於76美元至84美元。

摩根士丹利分析師Alexandra Straton維持買入評級,並將目標價從81美元上調至84美元。

美銀證券分析師Christopher Nardone維持買入評級,並將目標價從81美元下調至80美元。

巴克萊銀行分析師Adrienne Yih維持買入評級,維持目標價80美元。

巴克萊銀行分析師Adrienne Yih維持買入評級,維持目標價80美元。

德意志銀行分析師Krisztina Katai維持買入評級,並將目標價從83美元上調至84美元。

TD Cowen分析師John Kernan維持買入評級,維持目標價76美元。

此外,綜合報道,$斯凱奇 (SKX.US)$近期主要分析師觀點如下:

Skechers的股價下調預測反映出一項調整,因爲管理層更新了財年銷售前景,其已修正以表達不同渠道中持續品牌活力。因此,考慮到Q3報告的盈利強於預期,FY24每股收益估計已增加,而FY25每股收益預測略有降低。

Skechers發佈了一個「超預期並提高」的第三季度業績報告,顯示了強勁的批發業績和歐洲、中東和非洲市場的積極發展,部分抵消了由於中國挑戰和促銷活動導致的毛利率差異。這些問題被視爲暫時性的。

Skechers在第三季度展示了令人稱讚的表現,銷售額增長了16%,並在Q3保持了接近紀錄的毛利率。這尤爲引人注目,考慮到回歸批發渠道,加上中國和其他地區的條件較差帶來的挑戰。

Skechers的第三季度報告展示了國內批發領域的增長加速,以及歐洲、中東和非洲市場銷售的增長達30%。然而,公司面臨短期風險,包括中國表現疲軟、毛利率下滑以及需要謹慎管理的庫存水平。

以下爲今日7位分析師對$斯凱奇 (SKX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Adrienne Yih維持買入評級,維持目標價80美元。

巴克萊銀行分析師Adrienne Yih維持買入評級,維持目標價80美元。

Barclays analyst Adrienne Yih maintains with a buy rating, and maintains the target price at $80.

Barclays analyst Adrienne Yih maintains with a buy rating, and maintains the target price at $80.