To the annoyance of some shareholders, Mobile-health Network Solutions (NASDAQ:MNDR) shares are down a considerable 40% in the last month, which continues a horrid run for the company. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

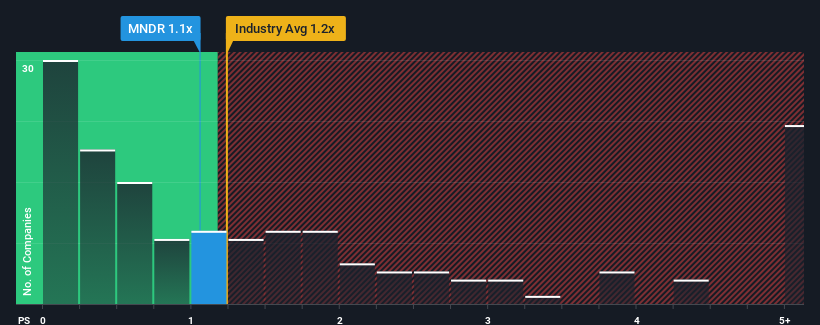

Although its price has dipped substantially, it's still not a stretch to say that Mobile-health Network Solutions' price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Healthcare industry in the United States, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Mobile-health Network Solutions Has Been Performing

Recent times have been advantageous for Mobile-health Network Solutions as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Mobile-health Network Solutions will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Mobile-health Network Solutions would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Mobile-health Network Solutions would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 77%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.7%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Mobile-health Network Solutions' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Mobile-health Network Solutions' P/S?

Mobile-health Network Solutions' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Mobile-health Network Solutions currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Mobile-health Network Solutions (1 is potentially serious) you should be aware of.

If you're unsure about the strength of Mobile-health Network Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.