Liaoning Oxiranchem,Inc. (SZSE:300082) shares have continued their recent momentum with a 32% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.4% over the last year.

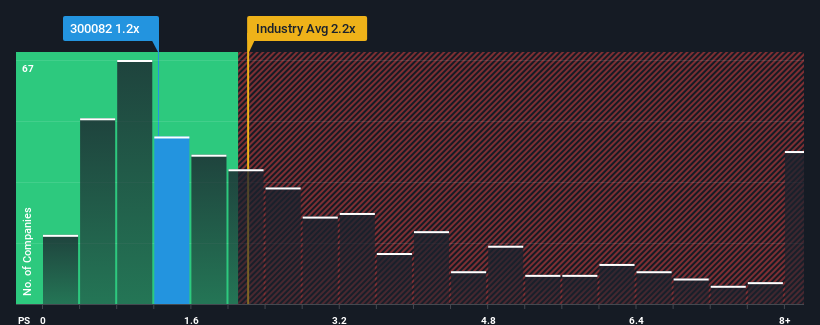

In spite of the firm bounce in price, Liaoning OxiranchemInc's price-to-sales (or "P/S") ratio of 1.2x might still make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Liaoning OxiranchemInc Has Been Performing

Liaoning OxiranchemInc hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Liaoning OxiranchemInc will help you uncover what's on the horizon.How Is Liaoning OxiranchemInc's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Liaoning OxiranchemInc's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Liaoning OxiranchemInc's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. The last three years don't look nice either as the company has shrunk revenue by 44% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 23% over the next year. That's shaping up to be similar to the 21% growth forecast for the broader industry.

With this information, we find it odd that Liaoning OxiranchemInc is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Liaoning OxiranchemInc's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Liaoning OxiranchemInc's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Liaoning OxiranchemInc (1 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.