The Xiamen Wanli Stone Stock Co.,Ltd (SZSE:002785) share price has done very well over the last month, posting an excellent gain of 41%. The last 30 days bring the annual gain to a very sharp 38%.

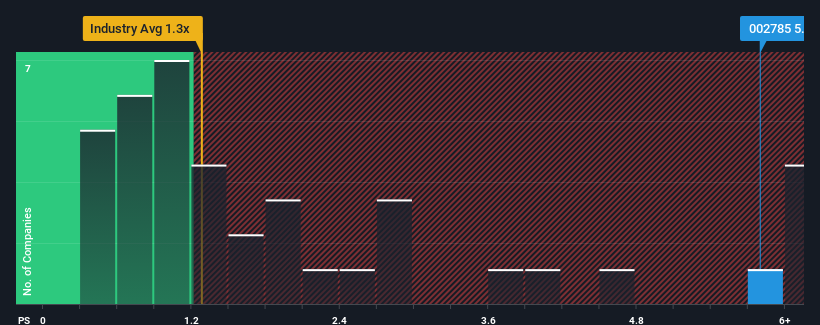

Following the firm bounce in price, given around half the companies in China's Basic Materials industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Xiamen Wanli Stone StockLtd as a stock to avoid entirely with its 5.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Xiamen Wanli Stone StockLtd Performed Recently?

Recent times have been pleasing for Xiamen Wanli Stone StockLtd as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xiamen Wanli Stone StockLtd.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xiamen Wanli Stone StockLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xiamen Wanli Stone StockLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The solid recent performance means it was also able to grow revenue by 18% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 16% over the next year. With the industry only predicted to deliver 7.8%, the company is positioned for a stronger revenue result.

With this information, we can see why Xiamen Wanli Stone StockLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Xiamen Wanli Stone StockLtd's P/S Mean For Investors?

Xiamen Wanli Stone StockLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Xiamen Wanli Stone StockLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Xiamen Wanli Stone StockLtd with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.