Hua Hong Semiconductor Limited (HKG:1347) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

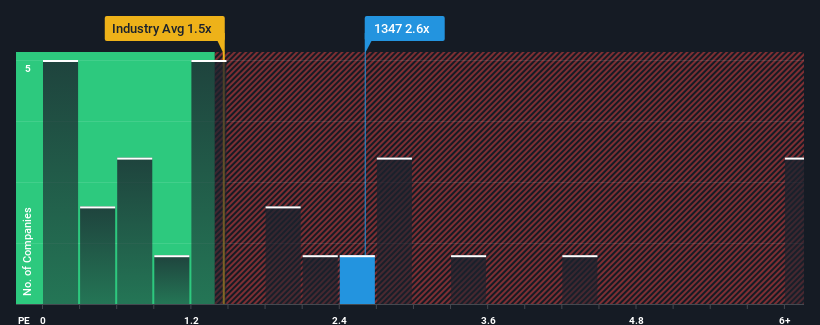

Following the firm bounce in price, when almost half of the companies in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Hua Hong Semiconductor as a stock probably not worth researching with its 2.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Has Hua Hong Semiconductor Performed Recently?

While the industry has experienced revenue growth lately, Hua Hong Semiconductor's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hua Hong Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Hua Hong Semiconductor's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Hua Hong Semiconductor's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. Even so, admirably revenue has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 19% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 17% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Hua Hong Semiconductor's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Hua Hong Semiconductor's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Hua Hong Semiconductor currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Hua Hong Semiconductor that we have uncovered.

If you're unsure about the strength of Hua Hong Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.