On Oct 26, major Wall Street analysts update their ratings for $Tapestry (TPR.US)$, with price targets ranging from $63 to $66.

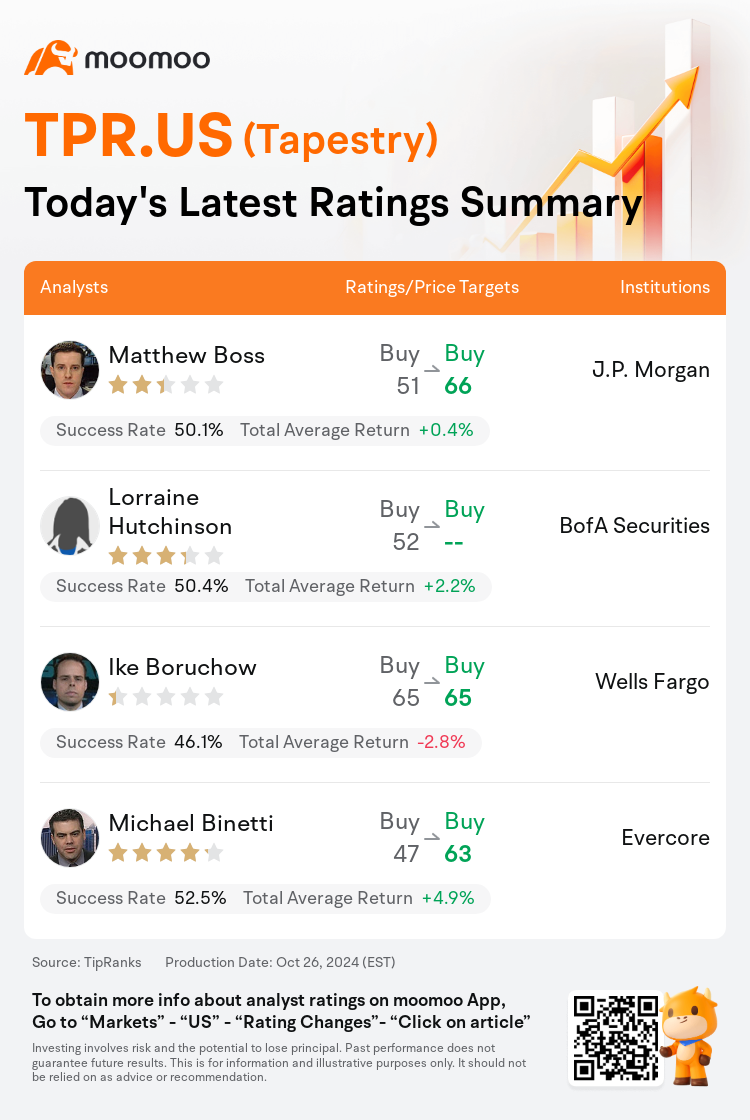

J.P. Morgan analyst Matthew Boss maintains with a buy rating, and adjusts the target price from $51 to $66.

BofA Securities analyst Lorraine Hutchinson maintains with a buy rating.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $47 to $63.

Furthermore, according to the comprehensive report, the opinions of $Tapestry (TPR.US)$'s main analysts recently are as follows:

The impediment of the Capri Holdings acquisition is seen as beneficial for Tapestry, allowing the company to concentrate on its reliable, high-margin, and strong cash flow generating operations instead of attempting to revitalize a floundering brand. The company is now positioned to reduce the debt incurred for the transaction and revert to a strategy focused on overall shareholder returns, characterized by a consistent and increasing dividend combined with substantial share repurchases.

The unsuccessful acquisition attempt of Capri Holdings has streamlined the narrative for Tapestry, offering a 'cleaner' outlook. Despite intentions to appeal the decision, it's possible that the management is quietly relieved. This development redirects attention to Tapestry's robust capacity to generate free cash flow, and it's anticipated that the company will recommence share repurchases in fiscal 2025.

Following a court ruling that supports the FTC in preliminarily blocking the acquisition of Capri Holdings by Tapestry, expectations have shifted, indicating that the stock may respond as if the deal will not proceed. Despite the ongoing appeal process, attention is turning back to company fundamentals. It is anticipated that both Coach and Kate Spade delivered strong performances in the first fiscal quarter, with results due on November 7. Notably, despite the challenges faced by luxury brands in China, Coach's performance in the region may provide a positive surprise for the quarter.

Here are the latest investment ratings and price targets for $Tapestry (TPR.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月26日,多家華爾街大行更新了$Tapestry (TPR.US)$的評級,目標價介於63美元至66美元。

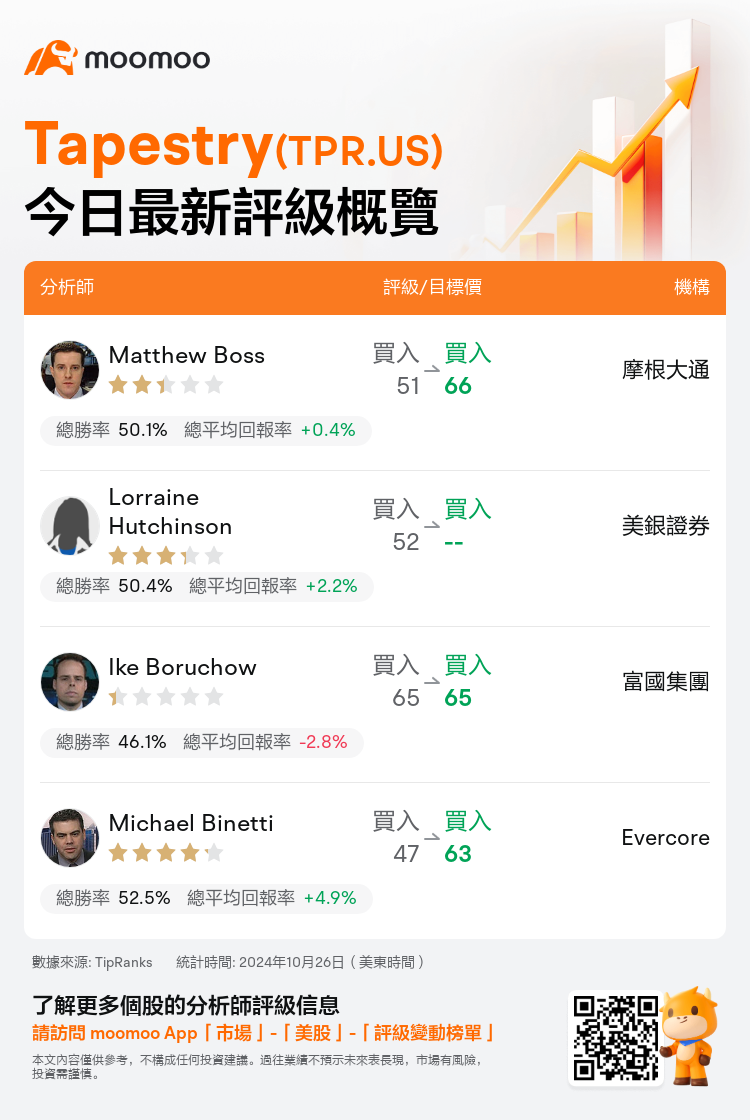

摩根大通分析師Matthew Boss維持買入評級,並將目標價從51美元上調至66美元。

美銀證券分析師Lorraine Hutchinson維持買入評級。

富國集團分析師Ike Boruchow維持買入評級,維持目標價65美元。

富國集團分析師Ike Boruchow維持買入評級,維持目標價65美元。

Evercore分析師Michael Binetti維持買入評級,並將目標價從47美元上調至63美元。

此外,綜合報道,$Tapestry (TPR.US)$近期主要分析師觀點如下:

對capri holdings收購的阻礙被視爲對tapestry有益,使公司能夠集中精力於可靠、高利潤和產生強勁現金流的業務,而不是試圖振興一個失敗的品牌。公司現在將債務減少到收購交易所需的水平,並回歸以整體股東回報爲重點的策略,以穩定且增長的股息結合大規模股份回購爲特徵。

對capri holdings未成功收購的嘗試使tapestry的敘事更清晰。儘管有意提出上訴,但管理層可能在悄悄鬆了一口氣。這一發展將注意力轉向tapestry強勁的自由現金流產能,並預計公司將在2025財年恢復股份回購。

在法院裁定支持FTC初步阻止tapestry收購capri holdings之後,預期發生了轉變,表明股票可能會表現得好像交易不會進行。儘管上訴程序仍在進行,注意力正轉向公司的基本面。預計coa和kate spade在第一個財季中表現強勁,結果將於11月7日公佈。值得注意的是,儘管奢侈品牌在中國面臨挑戰,但coa在該地區的表現可能爲本季度帶來積極的驚喜。

以下爲今日4位分析師對$Tapestry (TPR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Ike Boruchow維持買入評級,維持目標價65美元。

富國集團分析師Ike Boruchow維持買入評級,維持目標價65美元。

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.