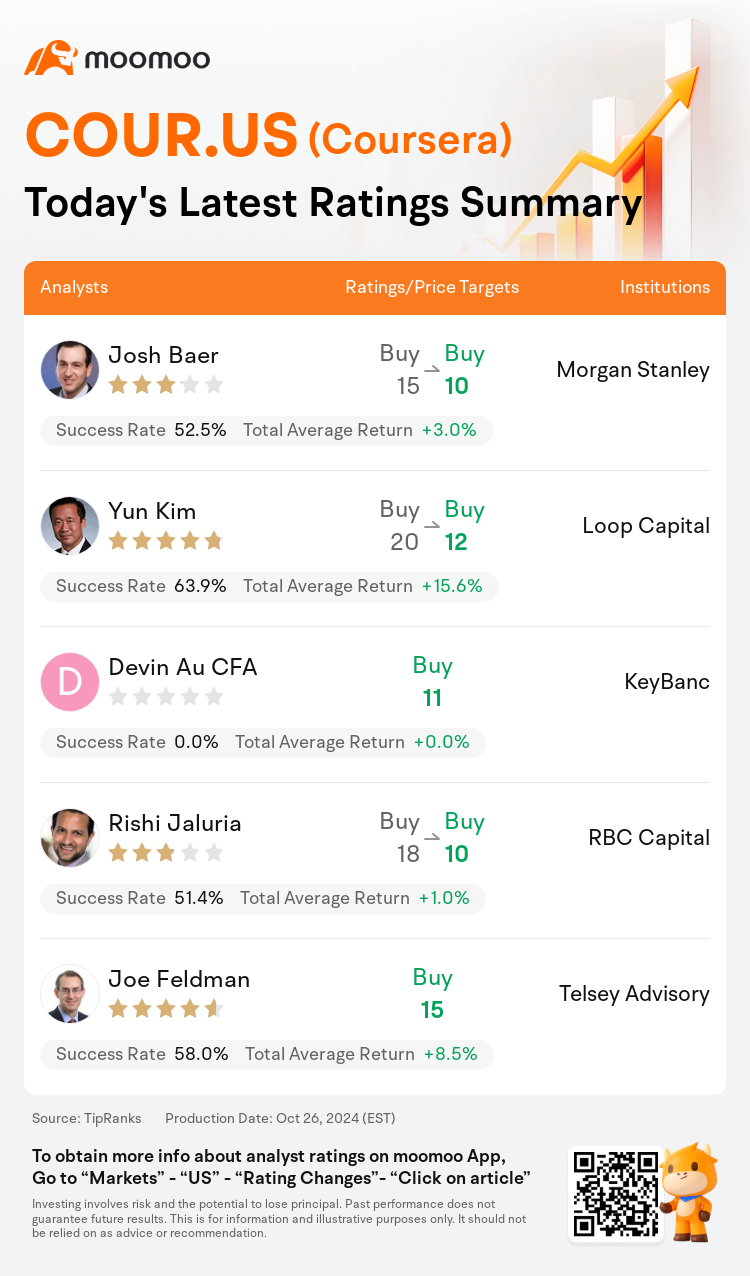

On Oct 26, major Wall Street analysts update their ratings for $Coursera (COUR.US)$, with price targets ranging from $10 to $15.

Morgan Stanley analyst Josh Baer maintains with a buy rating, and adjusts the target price from $15 to $10.

Loop Capital analyst Yun Kim maintains with a buy rating, and adjusts the target price from $20 to $12.

KeyBanc analyst Devin Au CFA initiates coverage with a buy rating, and sets the target price at $11.

KeyBanc analyst Devin Au CFA initiates coverage with a buy rating, and sets the target price at $11.

RBC Capital analyst Rishi Jaluria maintains with a buy rating, and adjusts the target price from $18 to $10.

Telsey Advisory analyst Joe Feldman initiates coverage with a buy rating, and sets the target price at $15.

Furthermore, according to the comprehensive report, the opinions of $Coursera (COUR.US)$'s main analysts recently are as follows:

A recent analysis observed that while Coursera's Q3 results surpassed consensus, there was a reduction in Q4 revenue guidance and a decrease in FY24 revenue growth projections from 10% to 9%. This was attributed to declining consumer retention and a 4 point decrease in Net Revenue Retention to 89% within the Enterprise segment. The expectation is that this could exert downward pressure on the stock. Nonetheless, the viewpoint is that shares currently represent a value that is too significant to overlook, given the company's profitable growth trajectory.

It is evident that Coursera is confronted with rapidly evolving market circumstances in its target markets, accompanied by additional challenges due to unfavorable macroeconomic factors in its North American region, a demographic trend towards more affordable emerging regions, and a more gradual uptake of Gen-AI technology among educational institutions. Nevertheless, Coursera is perceived to be aptly positioned to transform the higher education landscape in emerging markets, where there is a comparatively lower resistance to change.

The company delivered marginally improved Q3 revenue and EBITDA figures, yet projected a reduced revenue forecast for Q4, predominantly due to a decline in consumer strength, which is seen in the lesser retention of professional certificates. Although the reduced forecast is seen as disheartening, there remains an optimistic stance on the company's enduring potential within enterprise and degree offerings.

The recent quarter for Coursera was challenging, prompting a reassessment of the near-term growth expectations, which saw the company's shares decline by 19% after hours. The Consumer segment of Coursera is facing renewed difficulties as retention trends have shown signs of weakening, while the performance of its Enterprise business has been inconsistent. Despite these challenges, there remains long-term confidence in the company's prospects.

Coursera's third-quarter outcomes surpassed expectations, largely due to judicious expenditure management. Nevertheless, consumer engagement showed signs of weakening, with anticipated retention challenges likely extending into the fourth quarter. Additionally, a drop in Enterprise net retention revenue was observed, attributed to the phasing out of certain Government contracts. Despite these issues, there's an indication of 'stabilization' within the realm of corporate learning.

Here are the latest investment ratings and price targets for $Coursera (COUR.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月26日,多家华尔街大行更新了$Coursera (COUR.US)$的评级,目标价介于10美元至15美元。

摩根士丹利分析师Josh Baer维持买入评级,并将目标价从15美元下调至10美元。

Loop Capital分析师Yun Kim维持买入评级,并将目标价从20美元下调至12美元。

KeyBanc分析师Devin Au CFA首予买入评级,目标价11美元。

KeyBanc分析师Devin Au CFA首予买入评级,目标价11美元。

加皇资本市场分析师Rishi Jaluria维持买入评级,并将目标价从18美元下调至10美元。

泰尔西咨询分析师Joe Feldman首予买入评级,目标价15美元。

此外,综合报道,$Coursera (COUR.US)$近期主要分析师观点如下:

最近的一项分析发现,虽然Coursera第三季度的业绩超出了市场共识,但第四季度的营业收入指引有所下调,2024财年的营业收入增长预期也从10%下调至9%。这一情况被归因于消费者留存率下降以及企业业务板块净营收留存率下降4个百分点至89%。预期这可能给股票带来下行压力。尽管如此,观点是目前股票代表的价值过于重要,公司的盈利增长轨迹不容忽视。

显而易见,Coursera正面临其目标市场迅速演变的市场环境,加上由于北美地域不利的宏观经济因素、更向价格更实惠的新兴地区的人口趋势以及教育机构对Gen-AI技术的更为渐进的接受而带来的额外挑战。然而,Coursera被认为处于一个合适的位置,可以改变新兴市场的高等教育格局,在那里对变革的抵抗程度相对较低。

公司第三季度的营业收入和息税折旧摊销前利润(EBITDA)数据略有改善,但Q4的营业收入预测下调,主要是因为消费者实力下降,这体现在专业证书的留存率降低。尽管降低的预测被视为令人沮丧,对企业和学位业务的持久潜力仍持乐观态度。

Coursera最近一个季度面临挑战,促使重新评估近期的增长预期,导致公司股价盘后下跌19%。Coursera的消费者业务板块面临再度困难,留存率趋势显示出疲弱迹象,而企业业务的表现不稳定。尽管面临这些挑战,对公司前景仍然充满信心。

Coursera第三季度的业绩超出预期,主要归功于谨慎的支出管理。然而,消费者参与度显示出疲软迹象,预期的留存挑战可能延续到第四季度。此外,观察到企业净留存营收下降,归因于某些政府合同的逐步淡出。尽管存在这些问题,在企业学习领域内出现了“稳定”的迹象。

以下为今日5位分析师对$Coursera (COUR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

KeyBanc分析师Devin Au CFA首予买入评级,目标价11美元。

KeyBanc分析师Devin Au CFA首予买入评级,目标价11美元。

KeyBanc analyst Devin Au CFA initiates coverage with a buy rating, and sets the target price at $11.

KeyBanc analyst Devin Au CFA initiates coverage with a buy rating, and sets the target price at $11.