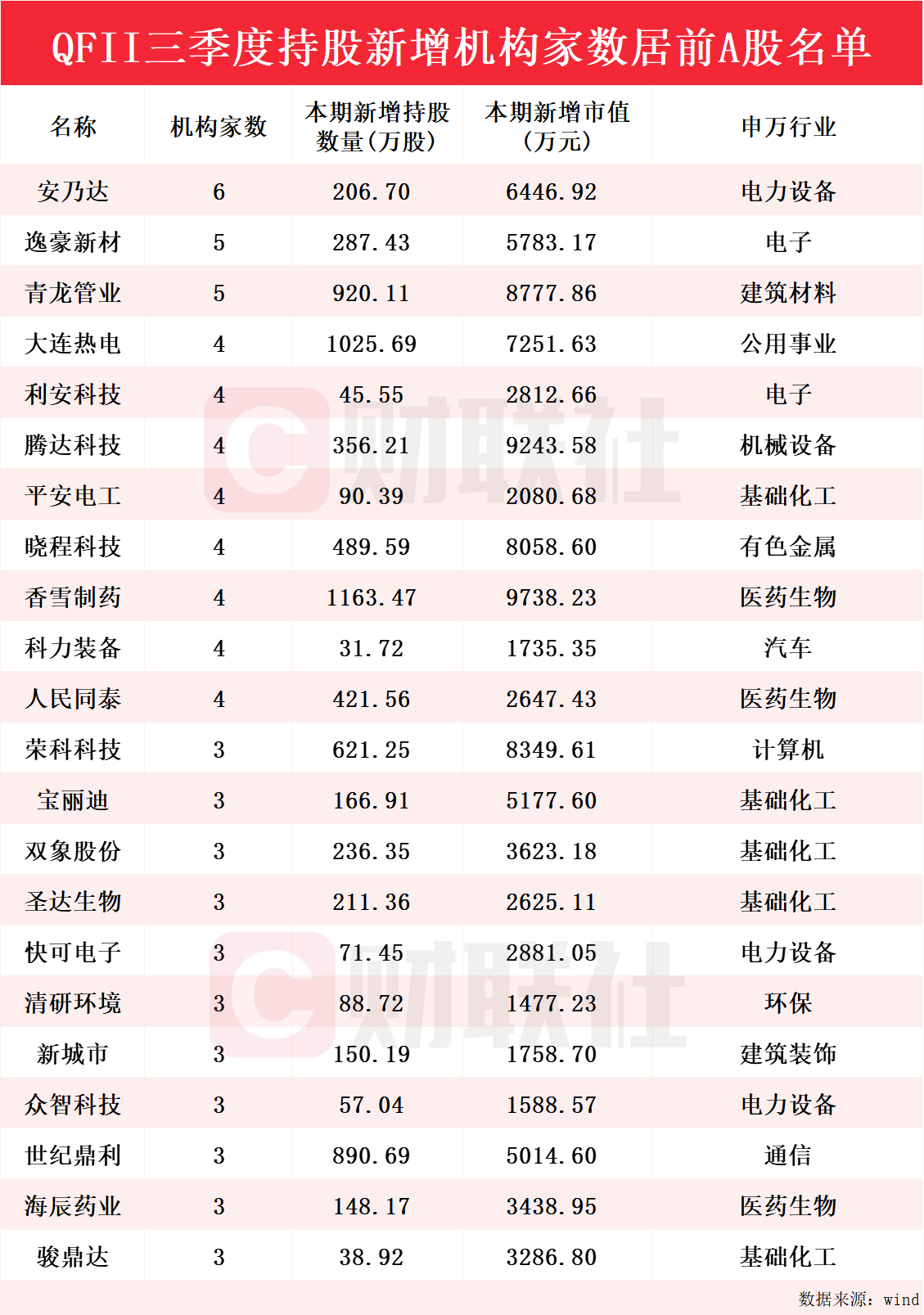

①A股上市公司进入三季报披露高峰,QFII三季度密集现身260只个股的前十大流通股东榜;②其中,新进入206家个股的前十大流通股东名单,安乃达获QFII持股新增机构最多,多达6家;③附上QFII三季度持股新增机构家数居前的A股名单一览(附表)。

财联社10月26日讯(编辑 笠晨)上市公司三季报正在密集披露,QFII三季度末重仓股及持股变动情况浮出水面。Choice数据显示,截至发稿,共有1603家上市公司披露了2024年三季报。从这些上市公司披露的前十大流通股东名单来看,有260家公司出现了QFII的身影。

从最新持仓动向来看,Wind数据显示,QFII三季度新进入206家个股的前十大流通股东名单。其中,安乃达获QFII持股新增机构家数最多,达6家;逸豪新材和青龙管业紧随其后,QFII持股新增机构家数达到5家。此外,大连热电、利安科技、腾达科技、平安电工、晓程科技、香雪制药、科力装备和人民同泰三季度获得QFII持股新增机构家数均为4家;荣科科技、宝丽迪、双象股份、圣达生物、快可电子、清研环境、新城市、众智科技、世纪鼎利、海辰药业和骏鼎达三季度获得QFII持股新增机构家数均达3家。具体详见下图:

电动两轮车电驱动系统生产商安乃达三季度获QFII新增持仓市值达6446.92万元。从安乃达披露的三季报来看,高盛集团、摩根大通证券有限公司、摩根士丹利国际股份有限公司、瑞士联合银行集团、巴克莱银行有限公司、美林证券国际有限公司位列前十大流通股东前六席位。安乃达10月18日公告,公司前三季度实现营业收入11.91亿元,同比增长2.90%;归属于上市公司股东的净利润8496.6万元,同比下降20.23%。安乃达9月11日发布投资者关系活动记录表公告,九号是公司的主要客户之一,合作的产品包括电动自行车电机、割草机电机、滑板车电机等,ebike电机产品目前也有合作。安乃达认为北美市场的增长潜力非常大,公司也是对北美市场做了布局,一部分客户已经在各个销售渠道出样。

电动两轮车电驱动系统生产商安乃达三季度获QFII新增持仓市值达6446.92万元。从安乃达披露的三季报来看,高盛集团、摩根大通证券有限公司、摩根士丹利国际股份有限公司、瑞士联合银行集团、巴克莱银行有限公司、美林证券国际有限公司位列前十大流通股东前六席位。安乃达10月18日公告,公司前三季度实现营业收入11.91亿元,同比增长2.90%;归属于上市公司股东的净利润8496.6万元,同比下降20.23%。安乃达9月11日发布投资者关系活动记录表公告,九号是公司的主要客户之一,合作的产品包括电动自行车电机、割草机电机、滑板车电机等,ebike电机产品目前也有合作。安乃达认为北美市场的增长潜力非常大,公司也是对北美市场做了布局,一部分客户已经在各个销售渠道出样。

主要产品有电子电路铜箔、铝基覆铜板等的逸豪新材三季度获QFII新增持仓市值达5783.17万元。从逸豪新材披露的三季报来看,瑞士联合银行集团、高盛集团、摩根士丹利国际股份有限公司、巴克莱银行有限公司、摩根大通证券有限公司分别位列前十大流通股东第三、第四、第五、第六和第十席位。逸豪新材10月25日公告,前三季度营业收入10.3亿元,同比增长8.07%;归属于母公司所有者的净亏损1419.36万元,上年同期净亏损1509.31万元,亏损缩窄。逸豪新材9月3日在投资者互动平台表示,公司加大对固态电池用铜箔材料的研发力度。逸豪新材9月2日公告,截至8月31日,公司通过股份回购专用证券账户以集中竞价交易方式累计回购公司股份3,271,742股,占公司目前总股本的1.94%。

主要从事高品质输水管道及相关产品的研发、生产、销售的青龙管业三季度获QFII新增持仓市值达8777.86万元。从青龙管业披露的三季报来看,美林证券国际有限公司、瑞士联合银行集团、巴克莱银行有限公司、高盛集团、摩根大通证券有限公司分别位列前十大流通股东第三、第四、第五、第八和第十席位。青龙管业10月25日公告,公司前三季度营业收入为17.28亿元,同比增长41.1%;净利润为1.13亿元,同比增长933.53%。青龙管业10月14日公告,公司收到《中标通知书》,成为某混凝土保护层预应力钢筒混凝土管(PCCPD-C)及钢制配件管采购1标的中标单位,中标金额为9632.34万元。青龙管业9月27日公告,公司中标7.29亿元预应力钢筒混凝土管采购项目。