YesAsia Holdings Limited (HKG:2209) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 984% in the last year.

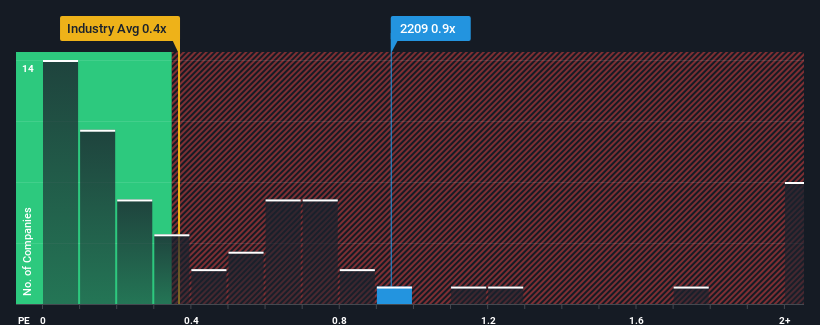

Even after such a large drop in price, when almost half of the companies in Hong Kong's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider YesAsia Holdings as a stock probably not worth researching with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does YesAsia Holdings' Recent Performance Look Like?

YesAsia Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on YesAsia Holdings.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as YesAsia Holdings' is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as YesAsia Holdings' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 75%. The strong recent performance means it was also able to grow revenue by 42% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 62% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this information, we can see why YesAsia Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

YesAsia Holdings' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that YesAsia Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 3 warning signs for YesAsia Holdings you should be aware of, and 1 of them is potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.