SBT Ultrasonic Technology Co.,Ltd. (SHSE:688392) shareholders would be excited to see that the share price has had a great month, posting a 46% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

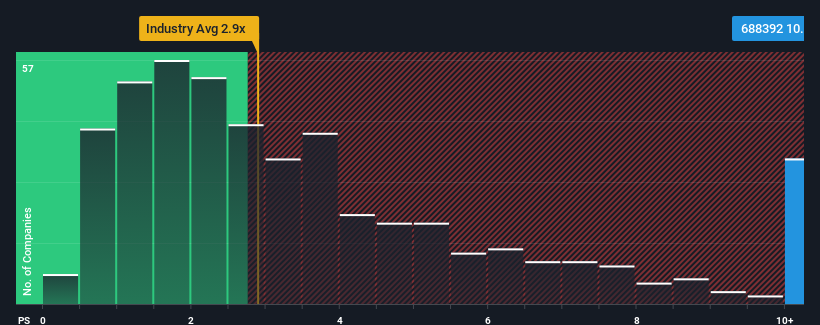

Since its price has surged higher, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider SBT Ultrasonic TechnologyLtd as a stock not worth researching with its 10.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does SBT Ultrasonic TechnologyLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, SBT Ultrasonic TechnologyLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on SBT Ultrasonic TechnologyLtd will help you uncover what's on the horizon.How Is SBT Ultrasonic TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, SBT Ultrasonic TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, SBT Ultrasonic TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 48% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 24%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that SBT Ultrasonic TechnologyLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From SBT Ultrasonic TechnologyLtd's P/S?

The strong share price surge has lead to SBT Ultrasonic TechnologyLtd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into SBT Ultrasonic TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 3 warning signs for SBT Ultrasonic TechnologyLtd (1 is a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of SBT Ultrasonic TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.