先週、市場に画期的な利好材料が不足していたため、hang seng indexはサイドウェイ相場を維持するしかなかった。

【編集観市】

市場に突破的な好材料が不足しているため、先週のハンセン指数は横ばい状態を維持するしかなかった。

CCTVによると、イスラエルはイランに対して第二ラウンドの攻撃を開始し、軍事目標と発電所を主な標的としており、イランの油田や核施設への攻撃は避けて、問題を大きくしたくないようだ。これからイランの態度を見ることになるだろう。

CCTVによると、イスラエルはイランに対して第二ラウンドの攻撃を開始し、軍事目標と発電所を主な標的としており、イランの油田や核施設への攻撃は避けて、問題を大きくしたくないようだ。これからイランの態度を見ることになるだろう。

投資家の米連邦準備制度理事会の利下げ期待が低下し、米国の債券市場は売り浴びせの波を巻き起こした。今週、2年、5年、10年、30年の米国債の利回りが全面高騰し、中でも10年債の利回りは7月以来の最高値まで上昇し、これはグローバル市場にもかなりの影響をもたらしている。

中国の中央汇金は第3四半期に300etfを4つ超える2700億超を増持し、中証A500の非上場ファンドは初日に200億超の大型売りを記録している。市場の安定を維持している重要な力と言える。ただし、最近は外資も流出が見られる。

統計局によると、1~9月の全国規模の工業企業の利益は3.5%減少した。経済面ではまだ景気が回復していないことが示されている。中国の財務省次官廖岷氏によると、中国は年初の経済成長目標である約5%の実現に自信を持っている。

本週は再び月末の感知時期になり、しばしば転機のポイントとなります。中国の公式PMIとCaixin PMIに注目し、そして今週末のアメリカの雇用統計データが比較的重要で、11月の利下げに大きな影響を及ぼすでしょう。

現在、市場で取引できるカテゴリは比較的少なく、再編成系と低位で基本的な改善が見られる太陽光発電やリチウム電池、医薬品などがあります。刺激的なニュースは車や空売りがあります。

【今週の金株】

aluminum corporation of china(02600)

最近、中国アルミニウム上海株とアルミニウム国際工程と山東の提携増資契約を結んでおり、それに基づき、アルミニウム国際とアルミニウム山東は山東工程に50億元の現金で増資することに合意しています。そのうち、アルミニウム国際は30億元、アルミニウム山東は20億元を出資します。中国アルミニウムの上半期純利益は105%増の702億元となっています。

増資を通じて、企業は産業内で精製アルミニウム製品のリーディングポジションを維持し、製品の競争力を高めました。今年の業績を見ると、会社は歴史的な最高水準を達成し、酸化アルミニウム、原アルミニウム、マーケティング、発電などのすべてのビジネスセクションが成長しています。中国アルミニウムの上半期純利益は予想を大きく上回り、酸化アルミニウムの利益改善が主な要因となっています。

企業の主要製品の生産量が大幅に増加し、冶金級酸化アルミニウムが820万トン、精製酸化アルミニウムが207万トン、原アルミが363万トンなどになっています。設備の稼働率とコスト管理が著しく向上し、コスト管理は予算レベル内です。来年の3年間のキャピタル支出は100億元から200億元の見通しであり、戦略的投資プロジェクトの財務リソースを優先的に確保します。

【業界見通し】

中軟国際は10月22日、HuaweiはHarmony OS 5.0(Harmony OS NEXT)を正式に発表しました。10月8日にベータテストされた3機種に加え、今回さらに3機種がベータテストをサポートし、2025年には追加の機種が増えます。Harmony OS 5.0は、4.2よりも30%のフルードさが向上し、56分のバッテリー駆動時間が向上します。新しい分散型ソフトウェアバスを介して、3倍の接続速度、4倍の接続デバイス数、20%の消費電力最適化を実現しました。

Harmony OS 5.0エコシステムが急速に加速します。Harmony OS開発キットは開発効率を向上し、ネイティブインテリジェンスとアプリストアとの深い協力を通じて開発者の効率を向上させます。2024年10月22日現在、1.5万以上のアプリとメタサービスがネイティブHarmonyアプリストアに登録されています。

Huawei Harmony OS 5.0は、誕生以来最大のアップグレードを実現しました。2019年以来、Harmony OSは4世代を経て、革命的なHarmony OS 5.0が実現され、ネイティブに精緻、ネイティブにインターネット接続、ネイティブにインテリジェンス、ネイティブにセキュリティ、ネイティブに流動的です。

Harmony OSの普及率向上とソフトウェアエコシステムの持続的な加速は、Harmonyエコシステムパートナーに成長機会をもたらし、香港株では中国ソフトウェアインターナショナル(00354)などに注目が集まっています。

【データウォッチ】

香港証券取引所のデータによると、Hang Seng Index先物(10月)の未決済契約総数は87,591枚で、未決済純枚数は29,737枚です。Hang Seng Indexの決済日は2024年10月30日で、この周期指数の決算です。

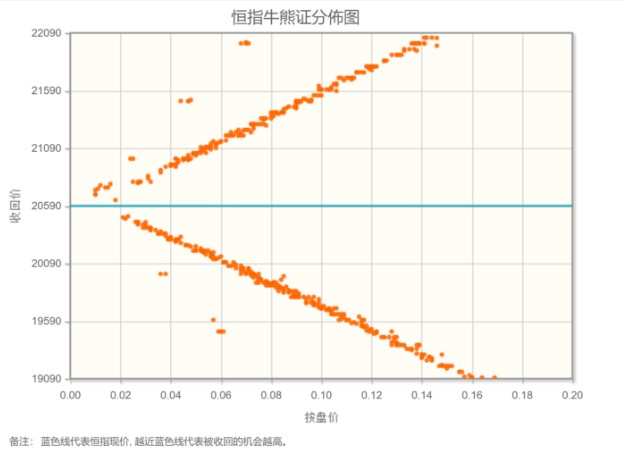

恒生指数のブルベアストリートトレンド状況を見ると、20,590ポイントの位置では、ブルベア証明書が中心に密集しており、Hang Seng Indexは2万ポイントで準備中です。トランプの取引が活発化し、米国の10年国債利回りは10月初めの3.74%から4.20%に急騰しており、連邦準備制度委員会の連続利下げの必要性が問われています。今週の恒生指数は下落する見込みです。

【編集者からのメッセージ】

香港株に投資するqdiiファンドの第3四半期の業績は一般的に良好です。今年年初からの収益率が30%を超えるqdiiファンドは、主に米団、アリババグループホールディング、テンセント、拼多多、携程、pop martなどのインターネット++インターネットプラス関連と新消費分野の株に重点を置いています。今年低迷しているqdiiファンドは、医薬品や新エネルギー車などのセクターに過度に集中しているためです。ポートフォリオを再編し、株式を切り替える面では、管理されている易方達の藍籌優選ファンドは、第3四半期にアリババ(09988)をトップ10の保有銘柄に追加し、2番目に重点を置いています。市場が反転すると、香港株の展望に楽観的な態度を持つファンドマネージャーの割合が著しく増加し、一方でハンセン・テクノロジーのインターネット分野への関心が高まり、配当利回りの高い株や配当株への関心がやや低下しています。

据央视报道:以色列对伊朗发动了第二轮袭击,主要针对军事目标和发电厂,并未打击伊朗的油田和核设施,看来不想把事情搞大。后续看伊朗的态度。

据央视报道:以色列对伊朗发动了第二轮袭击,主要针对军事目标和发电厂,并未打击伊朗的油田和核设施,看来不想把事情搞大。后续看伊朗的态度。