① A few days ago, Ping An Bank issued an announcement stating that in order to further promote business development, additional fees related to profit production services will be implemented on January 25 next year; ② This year, international gold prices have broken through the 2,700 US dollars/ounce mark, sweeping the historical record for gold prices more than 20 times in a row. In addition to Ping An Bank, major state-owned banks have recently restarted their gold investment business.

Financial Services Association, October 28 (Reporter Peng Kefeng) Gold continues to soar, and more and more banks are taking the opportunity to launch new businesses.

A few days ago, Ping An Bank issued an announcement stating that in order to further promote business development, additional fees related to profit production services will be implemented on January 25 next year. It is worth noting that previously, some major state-owned banks also restarted physical gold fixed investment business after a lapse of two years.

Ping An Bank will add a fee program for the gold business, or point to a new linked gold business

Ping An Bank will add a fee program for the gold business, or point to a new linked gold business

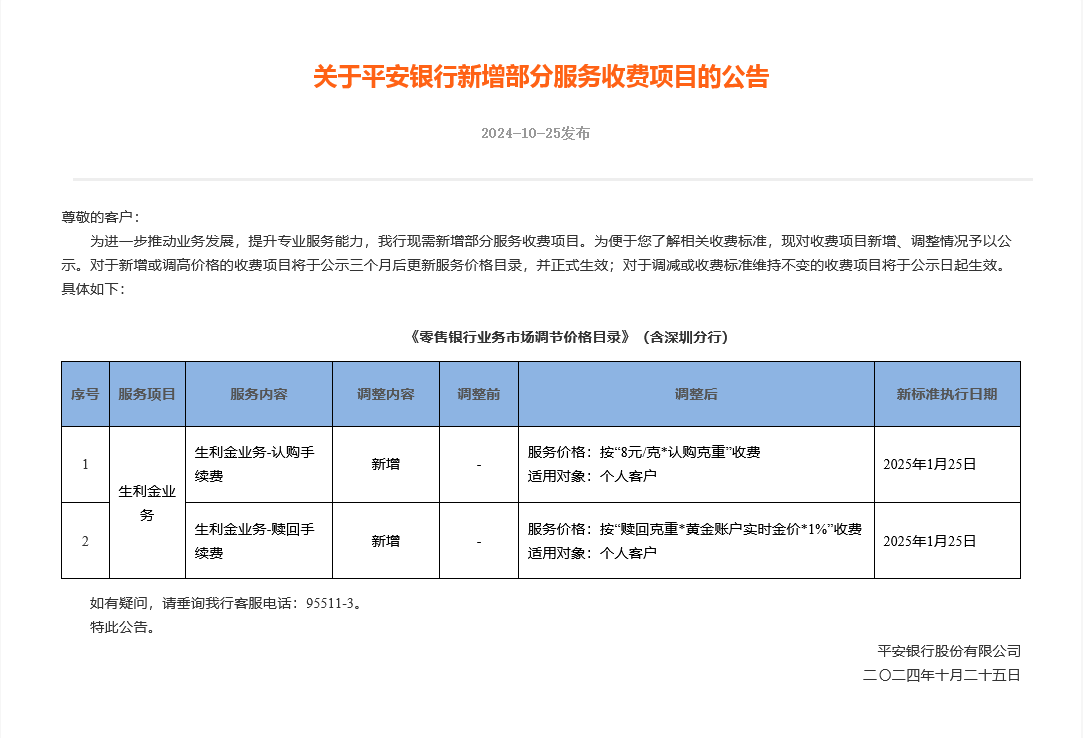

On the afternoon of October 25, Ping An Bank published an announcement on Ping An Bank's official website regarding some of Ping An Bank's new service fee items.

In the announcement, Ping An Bank stated that in order to further promote business development and enhance professional service capabilities, the Bank now needs to add some additional service fee items. In order to make it easier for you to understand the relevant fee standards, we are now announcing the addition and adjustment of fee items. The service price catalogue will be updated and officially put into effect three months after publication for additional or higher price items; fee items that have been reduced or remain the same will take effect from the date of publication. Specifically, the service price for the profit generation business adds a subscription fee: the fee is “8 yuan/gram*, subscription gram weight”, which is applicable to individual customers. Profit generation business - service price for redemption fees: Charged according to “redemption gram* gold account real-time gold price* 1%”, applicable to individual customers.

Ping An Bank also stated that the new charging service mentioned above will be implemented on January 25, 2025. If you have any questions, please call the bank's customer service number.

Today, the reporter called Ping An Bank customer service to inquire about the specific details of the profit production business mentioned above, but the other party said that the profit benefit business is different from the Ping An Savings Fund business, which previously raised the purchase point to 700 yuan. We will respond when we know the details. However, no further information was available at the time of press release.

According to Ping An Bank's official website, the Financial Services Association reporter also did not find specific information on the Lishengjin business, but judging from the price formula, this business is clearly related to gold trading.

However, the reporter noticed that according to documents such as the “Interim Measures on Service Price Management for Commercial Banks” and “Administrative Measures for the Protection of Consumer Rights and Interests of Banks and Insurance Institutions” issued earlier, banks are required to inform financial consumers about service items, prices, and preferential measures before providing services to financial consumers. New fee items or changes in fee standards should generally be announced three months in advance in accordance with relevant regulations on price management. Previously, when many state-owned banks added service charges, they also chose to issue announcements three months in advance.

A banking analyst at a brokerage firm also told the Financial Federation reporter that, taken from a comprehensive perspective, the profit margin should be Ping An Bank's intention to launch a new type of business linked to gold. Ping An Bank has always been active in developing the precious metals business among stock banks. Previously, it was the first to launch the “Gold Bank” brand, and “Gold-for-Profit” gold wealth management has also attracted widespread attention. However, it should be pointed out that since the Bank of China's “crude oil treasure” incident, many banks have basically stopped leveraged, high-risk personal precious metals trading operations. Currently, the mainstream gold business of major banks is still mainly based on savings accounts, physical gold, fixed income+gold financial management.

Gold prices skyrocketed during the year before major state-owned banks restarted physical gold business

The reporter noticed that the international gold price has broken through the 2,700 US dollars/ounce mark this year, sweeping the historical record for gold prices more than 20 times in a row. In addition to Ping An Bank, major state-owned banks have recently restarted their gold investment business.

On the morning of July 10, the Bank of Communications published an article on its official website stating that it will add a physical gold fixed investment product “Hoard Gold Treasure” in the near future and announce the fee standard. Specifically, “Hoard Jinbao” business fees include purchase renewal fees and repurchase fees. The former refers to handling fees for providing customers with gold purchase services, while the latter refers to fees for providing customers with Jinbao repurchase and monetization services. Among them, the purchase renewal fee is charged at no more than 20 yuan/gram, and the repurchase fee: no more than 6 yuan/gram. However, since then, the Bank of Communications has not released more information on the specific investment methods and comprehensive advantages of “Hoarding Jinbao.”

It is worth noting that in June 2022, the Bank of Communications published an article on its official website stating that with the launch of the bank's precious metals wallet business, the gold fixed investment business has obvious disadvantages. Currently, only a few customers still hold positions. In order to promote high-quality business development and strengthen risk management, the bank's gold fixed investment business system will cease external services on June 30, 2022, Beijing time. This also means that after a lapse of two years, the Bank of Communications has restarted the physical gold fixed investment business.

Furthermore, the Bank of Communications clearly stated that the “Hoarding Gold Treasure” fee standard will be implemented from October 10, 2024. This move is also similar to Ping An Bank's current practice, which formalized the new fee items three months in advance.