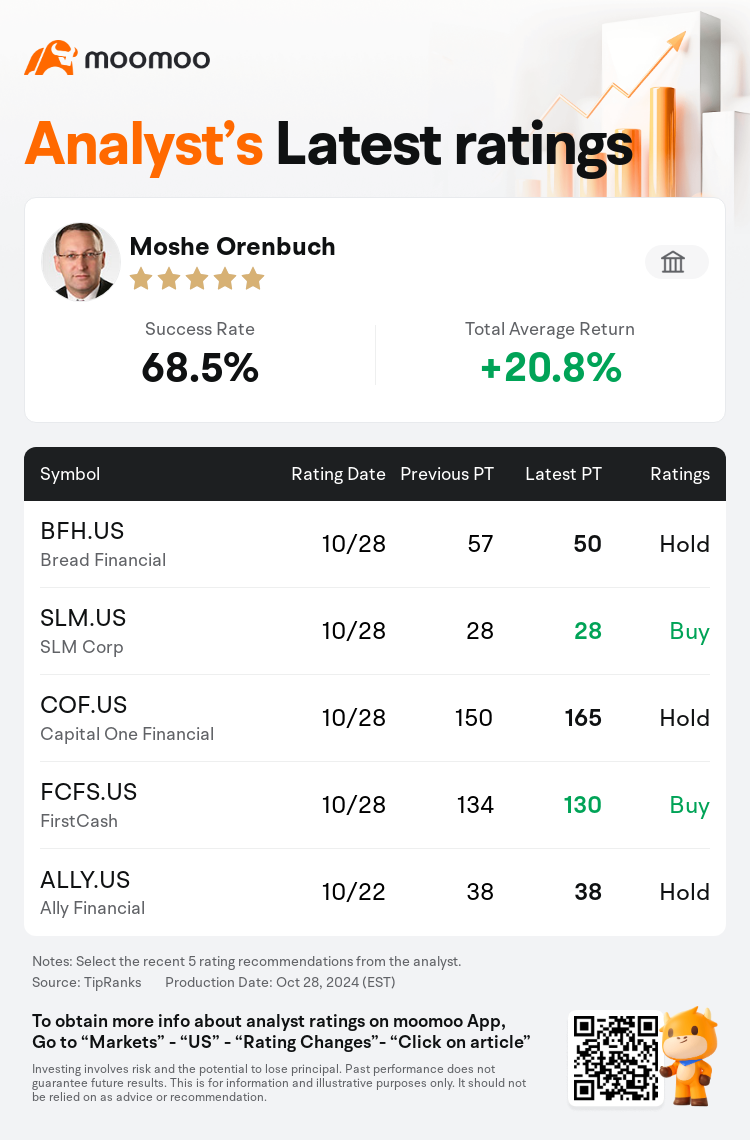

TD Cowen analyst Moshe Orenbuch maintains $Bread Financial (BFH.US)$ with a hold rating, and adjusts the target price from $57 to $50.

According to TipRanks data, the analyst has a success rate of 68.5% and a total average return of 20.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Bread Financial (BFH.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Bread Financial (BFH.US)$'s main analysts recently are as follows:

The Q3 results of Bread Financial held few surprises, with the company maintaining its full-year guidance. The moderate underperformance of the shares is believed to be due to the ongoing uncertainty regarding the timing of credit loss rate improvements. It is anticipated that a gentle economic downturn, coupled with the industry's recent tightening of credit and a deceleration in loan growth, will positively impact loss rates, particularly in the latter half of 2025. Furthermore, Bread Financial's reserve rate projections suggest that the loss rates in 2025 could align with or surpass the levels seen in 2024.

Bread Financial's Q3 earnings surpassed expectations predominantly due to reduced expenditures, and the credit outlook for fiscal 2024 seems to align with existing projections. However, preliminary insights into 2025 suggest only modest enhancements in credit performance.

Bread Financial reported a third-quarter miss in Net Interest Income, although operational expenses were more favorable; guidance remained steady with management observing stability.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

TD CowenのアナリストMoshe Orenbuchは$アライアンス・データ・システムズ (BFH.US)$のレーティングを中立に据え置き、目標株価を57ドルから50ドルに引き下げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は68.5%、平均リターンは20.8%である。

また、$アライアンス・データ・システムズ (BFH.US)$の最近の主なアナリストの観点は以下の通りである:

また、$アライアンス・データ・システムズ (BFH.US)$の最近の主なアナリストの観点は以下の通りである:

Bread Financialの第3四半期の業績は、同社が通年の予想を維持していたため、驚くことはほとんどありませんでした。株式のパフォーマンスが中程度低迷しているのは、信用損失率の改善のタイミングに関する不確実性が続いているためだと考えられています。緩やかな景気後退と、業界の最近の信用引き締めとローンの伸びの鈍化が相まって、特に2025年後半の損失率にプラスの影響を与えると予想されます。さらに、ブレッド・ファイナンシャルの準備金利予測では、2025年の損失率は2024年の水準と同等か、それを上回る可能性があることが示唆されています。

Bread Financialの第3四半期の収益は、主に支出の削減により予想を上回りました。2024年度の信用見通しは既存の予測と一致しているようです。しかし、2025年に関する暫定的な洞察では、信用実績のわずかな向上しか示唆されていません。

Bread Financialは、第3四半期に純利息収入が減少したと報告しましたが、営業経費はより好調でした。経営陣が安定性を観察している中、ガイダンスは安定していました。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$アライアンス・データ・システムズ (BFH.US)$の最近の主なアナリストの観点は以下の通りである:

また、$アライアンス・データ・システムズ (BFH.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of