Piedmont Lithium Hits Record Production, Shipping Over 31K Tons of Spodumene in Q3 for EV Supply Chain, Plans for 116K-Ton Spodumene Shipment Target in 2024

Piedmont Lithium Hits Record Production, Shipping Over 31K Tons of Spodumene in Q3 for EV Supply Chain, Plans for 116K-Ton Spodumene Shipment Target in 2024

Piedmont Lithium ("Piedmont" or the "Company") (NASDAQ:PLL, ASX: PLL))), a leading North American supplier of lithium products critical to the U.S. electric vehicle supply chain, announced that it shipped approximately 31,500 dry metric tons ("dmt") of spodumene concentrate in Q3'24 as its jointly owned North American Lithium ("NAL") achieved new quarterly production and operational performance records.1 NAL, North America's largest producing spodumene mine, is jointly owned by Piedmont (25%) and Sayona Mining Limited (75%) (ASX: SYA).

美國領先的鋰礦產品供應商Piedmont Lithium(「Piedmont」或「公司」)(納斯達克:PLL,ASX:PLL)宣佈,由於其共同擁有的北美鋰礦(「NAL」)實現了新的季度生產和運營業績記錄,該公司將近期出貨約31,500幹噸(「dmt」)鋰輝石精礦。1 NAL是北美最大的鋰輝石礦,由Piedmont(25%)和Sayona Mining Limited(75%)(ASX:SYA)共同擁有。

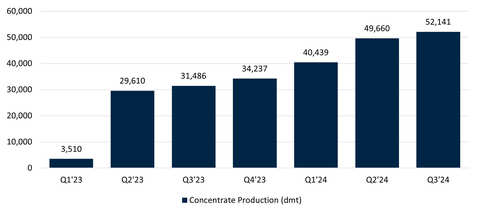

Figure 1: NAL Concentrate Production (Graphic: Business Wire)

圖1:NAL精礦生產(圖表:商業線)

In response to a customer request, the Company will shift a planned cargo from Q4'24 to early Q1'25. As a result, Piedmont is targeting shipments of approximately 55,000 dmt of spodumene concentrate in Q4 for total 2024 shipments of approximately 116,000 dmt. While this single cargo push into early 2025 will cause a nominal adjustment from our prior guidance of 126,000 dmt for 2024, we expect this shift to be accretive to our 2025 shipments totals and does not impact Piedmont's total offtake quantities at NAL.2

應客戶要求,公司將將計劃在2024年第四季度運送的貨物推遲至2025年初。因此,Piedmont計劃在第四季度運送約55,000 dmt的鋰輝石精礦,以實現2024年總出貨量約116,000 dmt。雖然這次單獨的貨物推遲至2025年初將導致對我們先前指引的2024年126,000 dmt的輕微調整,但我們預計這一變動將有助於2025年的總出貨量,不會影響NAL的總提貨量。2

Q3'24 Operational Results Summary

2024年第三季度運營成果摘要

| Piedmont Lithium | Units | Q3'24 | Q2'24 | QoQ Variance | 2024 YTD | 2023 YTD | YoY Variance |

| Concentrate Shipped | kt dmt | 31.5 | 15.5 | 125% | 60.9 | 29.0 | 110% |

| Average Grade | % Li2O | ~5.4% | ~5.5% | (0.1%) | ~5.5% | ~5.4% | 0.1% |

| NAL1 | Units | Q3'24 | Q2'24 | QoQ Variance | 2024 YTD | 2023 YTD | YoY Variance |

| Ore Mined | kt wmt | 240.3 | 233.7 | 3% | 825.1 | 562.8 | 47% |

| Concentrate Produced | kt dmt | 52.1 | 49.7 | 5% | 142.2 | 64.6 | 120% |

| Plant (Mill) Utilization | % | 91% | 83% | 8% | 82% | 65% | 13% |

| Lithium Recovery | % | 67% | 68% | (1%) | 67% | 57% | 10% |

| Concentrate Shipped | kt dmt | 49.0 | 27.7 | 77% | 134.8 | 48.2 | 180% |

| Piedmont Lithium | 單位 | 2024年第三季度 | Carrols 收購 | QoQ Variance | 2024年累計銷售額 | 2023年累計銷售額 | YoY Variance |

| 濃縮鐵礦出貨 | 千噸幹基噸 | 31.5 | 15.5 | 125% | 60.9 | 29.0 | 110% |

| 協議詳情:爲了收購該物業的100%權益,該公司需要向Golden Share支付累計200萬美元的現金和證券款項,具體如下: | %氧化鋰 | ~5.4% | ~5.5% | (0.1%) | ~5.5% | ~5.4% | 0.1% |

| NAL1 | 單位 | 2024年第三季度 | 第二季度24年 | 環比差異 | 2024年至今 | 2023年至今 | 同比差異 |

| 開採的礦石量 | kt wmt | 240.3 | 233.7 | 3% | 825.1 | 562.8 | 47% |

| 濃縮物產量 | kt dmt | 52.1 | 49.7 | 5% | 142.2 | 64.6 | 120% |

| 工廠(磨坊)利用率 | % | 91% | 83% | 8% | 82% | 65% | 13% |

| 鋰礦回收 | % | 67% | 68% | (1%) | 67% | 57% | 10% |

| 濃縮物已發貨 | 千噸幹基噸 | 49.0 | 27.7 | 77% | 134.8 | 48.2 | 180% |

In Q3'24, NAL produced 52,141 dmt and shipped 48,992 dmt, of which approximately 31,500 dmt of spodumene concentrate were sold to Piedmont and shipped to Company customers.

在2024年第三季度,北美鋰礦生產了52,141噸鋰精礦,裝運了48,992噸,其中約31,500噸鋰輝石精礦銷售給piedmont lithium並運往公司客戶。

NAL increased quarterly production by 5% in Q3'24 compared to the prior quarter. Mill utilization achieved a record high of 91% for the quarter benefitting from the availability of the recently completed crushed ore dome. The increased utilization rate also drove an improvement in unit operating costs, which declined by 15% quarter-over-quarter when excluding the impact of inventory movements. Recoveries dipped marginally in the quarter due to a slight reduction in feed grade and increased use of the WHIMS magnetic separators. Importantly, in September 2024, NAL reported its first incident-free safety month since the restart of operations in 2023 with no lost time injuries, no modified duty injuries, and no medical aid injuries.

2024年第三季度,NAL與上一季度相比,季度產量增加了5%。銑礦利用率達到了該季度的紀錄高點91%,受益於最近完工的碎礦圓頂的可用性。提高的利用率也推動了單位運營成本的改善,當排除庫存變動影響時,季度運營成本下降了15%。回收率由於進料品位略微降低和使用WHIMS磁選分離器增加,季度稍有下滑。重要的是,在2024年9月,NAL報告了自2023年重啓運營以來首個無事故安全月,沒有失工時間事故,沒有調整工作職責的傷害,也沒有醫療援助方面的傷害。