Affected by market competition and supply chain costs, Chuanyin Holdings' third-quarter revenue was 16.693 billion yuan, down 7.22% year on year; basic earnings per share were 0.93 yuan, down 57.92% year on year.

Affected by market competition and supply chain costs, the revenue and gross margin of “The King of Mobile Phones in Africa” Telecom Holdings declined in the third quarter, and net profit fell by more than 40% year on year.

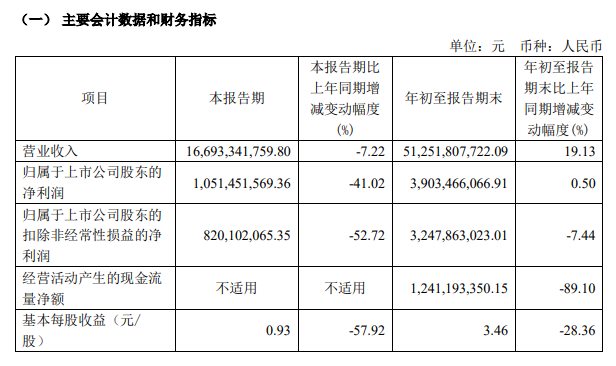

On the afternoon of October 28, Communication Holdings disclosed financial results for the third quarter. The following are the main financial data for the third quarter:

Revenue was 16.693 billion yuan, down 7.22% year over year;

Net profit attributable to shareholders of listed companies was 1.051 billion yuan, a year-on-year decrease of 41.02%;

Basic earnings per share were $0.93, down 57.92% year over year.

Looking at the first three quarters, despite an increase in revenue, the net profit growth rate was clearly almost flat. Communication Holdings' revenue was 51.252 billion yuan, up 19.13% year on year; net profit was 3.903 billion yuan, up 0.50% year on year. Basic earnings per share were $3.46, down 28.36% year over year.

In terms of R&D investment, it reached 1.824 billion yuan in the first three quarters, accounting for 3.56% of revenue, with a total increase of 7.87% over the same period last year. In terms of cash flow, net cash flow from operating activities was $1.241 billion, a sharp decrease of 89.10% over the previous year, mainly due to increased purchase payments.

Furthermore, during the reporting period, the company received a total of about 0.131 billion yuan in government subsidies, which included current losses, totaling 0.434 billion yuan from the beginning of the year to the end of the reporting period. These subsidies had a positive impact on the company's performance.

Communication Holdings' main business is focused on mobile phone manufacturing and sales. Faced with fierce market competition and supply chain pressure, R&D investment remains high, and its profitability is significantly challenged.

Judging from mobile phone market data, Communication Holdings is under sales pressure. Canalys data shows that global smartphone shipments increased 5% year-on-year in the third quarter of 2024, the fourth consecutive quarter of growth. However, the transmission declined markedly, falling directly out of the top five in the world this quarter, overtaken by OPPO and Vivo.

It is worth mentioning that since the end of September, the stock price of Communication Holdings has dropped from a high of 118 yuan/share to 89.53 yuan/share, a sharp drop of more than 15%.

营收为166.93亿元,同比下降7.22%;

营收为166.93亿元,同比下降7.22%;