10月16日から25日まで、shanghai haohai biological technologyの香港株価格は大型株に連れて下落し、緩やかに回復していましたが、25日の市場後に公表された四半期報告書のせいで、次の下落局面に巻き込まれる可能性があります。

9月中旬から現在まで、shanghai haohai biological technology(06826)の香港株価は、ジョンソンエンドジョンソン大型株に続いて、急激な変動が続いていました。最初は9月17日から始まり、株価は29.57香港ドルから10月8日の最高値42.95香港ドルまで急上昇し、幅広い範囲で45.25%上昇しました。その後、10月8日にピークを迎えると再び大幅な下落が始まり、10月8日から10月15日までのわずか5取引日で、株価は最大25.38%下落しました。

10月16日から25日まで、shanghai haohai biological technologyの香港株価は大型株に連れて下落し、緩やかに回復していましたが、25日の市場後に公表された四半期報告書のせいで、次の下落局面に巻き込まれる可能性があります。

Zhijing Finance appが見ると、10月25日の市場終了後、shanghai haohai biological technologyが2024Q3の財務諸表を公表しました。しかし、会社の三半期業績が予想を下回ったため、10月28日、会社の株価は始値から下げ続け、取引中に最低29.75香港ドルまで落ち、最大の下落率は12.24%に達しました。

Zhijing Finance appが見ると、10月25日の市場終了後、shanghai haohai biological technologyが2024Q3の財務諸表を公表しました。しかし、会社の三半期業績が予想を下回ったため、10月28日、会社の株価は始値から下げ続け、取引中に最低29.75香港ドルまで落ち、最大の下落率は12.24%に達しました。

誰が企業業績を“引きずる”のか?

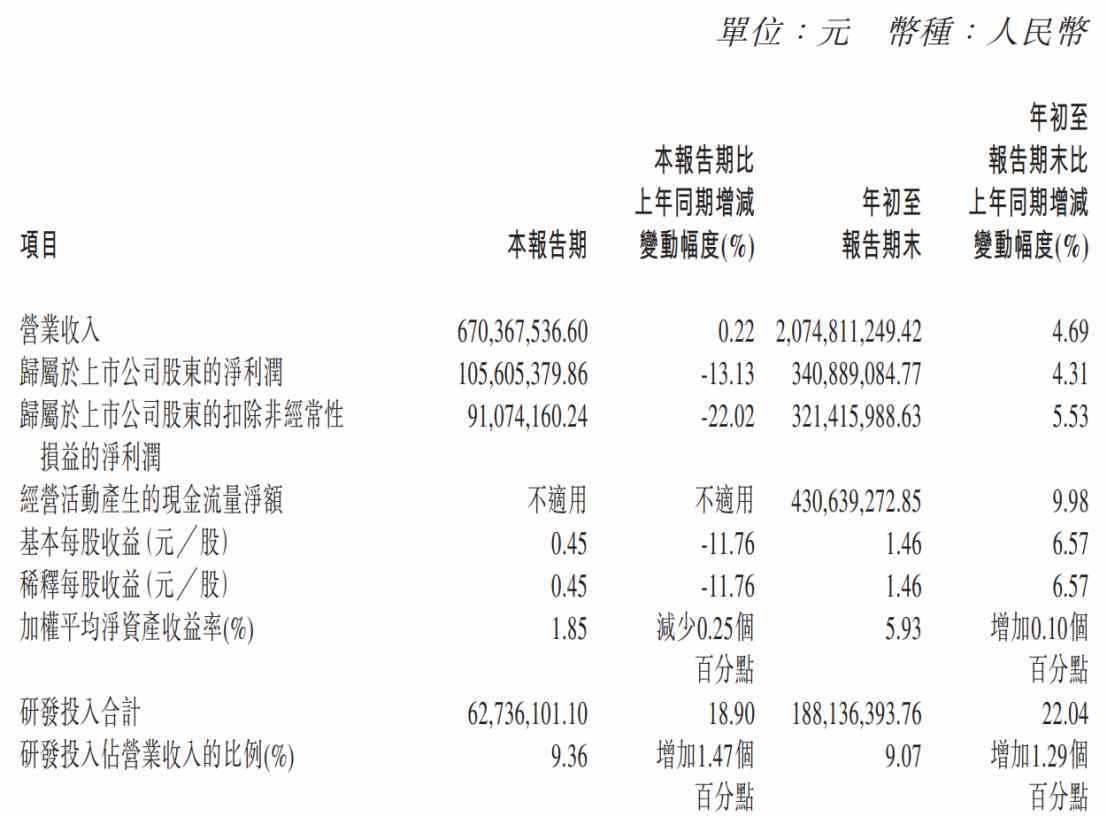

shanghai haohai biological technologyの最新の四半期報告によると、今年第3四半期の売上総額は6.70億元で、前年同期比で0.22%増加し、前四半期比で11.61%減少しました。純利益は1.06億元で、前年同期比で13.13%減少し、前四半期比で23.33%減少しました。調整後の純利益は9107.42万元で、前年同期比で22.02%減少し、前四半期比で32.60%減少しました。

一方、 今年前三四半期の売上高は207.5億元で、前年同期比で4.69%増加、親会社当期純利益は34.1億元で、前年同期比で4.31%増加しています。一方、 非調整親会社当期純利益は32.1億元で、前年同期比で5.53%増加しています。

sinolinkはリサーチレポートを発表し、会社の第三四半期の業績が予想を下回ったと述べています。

財務データから見ると、shanghai haohai biological technologyの「増収で増益しない」現象は明らかですが、これが株価下落の直接的な原因になるわけではなく、市場が気にするのはひょっとすると期待を下回る環比データかもしれません。

知証財経APPによると、2024年中間報告によると、売上高と当期純利益の両方が成長しました。売上高は6.97%増の140.4億元、当期純利益も14.64%増の23.5億元となりました。しかし、この安定したように見えるデータの背後には、増速が鈍化している信号が現れています。今年上半期、昊海生科の売上高と当期純利益の成長率は、前年同期の35.66%、188.94%から大幅に低下しています。

売上高の構成から見ると、shanghai haohai biological technologyの主力製品ラインには医療美容と創傷ケア製品、眼科製品、整形外科製品、防粘着及び止血製品、その他製品が含まれます。医療美容と創傷ケア製品と眼科製品が主力で、それぞれ売上高比率は45.22%と32.18%に達しています。

今年上半期、shanghai haohai biological technologyの医療美容と創傷ケア製品ラインの売上高は63.4億元に達し、前年比25.72%増加しました。そのうち、ヒアルロン酸事業の売上高はこの製品事業の65.76%を占めています。今年上半期、ヒアルロン酸事業は41.7億元の売上高を達成し、前年比51.30%増加しました。しかし、2023年上半期の114.35%の前年比増加に比べて、今年のshanghai haohai biological technologyのヒアルロン酸事業の売上高の増加ペースは著しく鈍化しています。

収益面から見ると、高粗利益の医療美容製品ラインの成長ペースの鈍化が会社の前三四半期の粗利率に圧力をかけ、粗利率は1.2ポイント減少して70.4%となり、環比で再び減少しています。半年報のデータを振り返ると、会社の当期総粗利率は70.51%で、前年同期の71.04%から低下しています。

shanghai haohai biological technologyは、眼科用人工水晶体、眼科用粘弾剤、整形外科用ヒアルロン酸注射液などの製品が新しい国家または省レベルの集中調達実施段階にあることを報告期間中にされており、製品販売価格が下落しており、ヒアルロン酸製品の売上増が全体の粗利益率の成長に寄与するのを基本的に相殺しています。今日の会社の粗利益率のさらなる環比減少は、集中調達の影響下で、眼科事業の量と価格の転換がまだ進行中であり、集中調達が会社の業績に与える影響がまだ前向きに転換していないことを示しているかもしれません。

核心セクターの成長ボトルネックはいつ解消されるのか?

昊海生科の収入は長らく眼科、医療美容、整形外科、外科の4つの大きな領域から主に得られています。中でも、眼科と医療美容が主要な収入源です。最新の財務諸表が公開された後、二次市場が振るわなかった理由は、おそらく、昊海生科が眼科と医療美容の2つの主要セクターで市場競争が激化しており、企業の成長空間がある程度圧迫されているためかもしれません。

第三四半期報告書には具体的な製品販売状況が開示されていませんが、今年の中間報告と照らし合わせると、眼科ビジネスの売上減少が全体の収益成長に大きく影響している可能性があります。眼科セクターから見ると、昊海生科の現在の売上主力は白内障用の人工水晶体製品と近視矯正用の角膜形状レンズ、つまりOKレンズです。

智通財経アプリによると、2023年11月、昊海生科子会社の新会社(Lenstec)、アーレン、河南宇宙、河南赛美詩、眼科粘弾剤製品がすべて落札されました。今回の国家調達では、これまでの地方レベル同盟調達に加えて価格がさらに下がり、今年から実施されることとなっていますが、これが2023年第四四半期の患者手術と販売代理店の受注意欲に影響を与え、それによって企業の収益に影響を及ぼす可能性があります。

調達価格の要因の消化がまだ進んでいないため、財務諸表上の反映は、会社の当期人工水晶体製品の売上が1.81億元であり、前年同期比で10.84%下落したことが示されています。眼科粘弾剤製品の売上は5042.04万元で、前年同期比で10.16%下落しました。近視防止と屈折矯正製品ライン全体の売上は20.1億元で、前年同期比で2.44%減少しました。

しかしながら、昊海生科は、後半の国家調達がさらに進展し、落札された人工水晶体と眼科粘弾剤製品の販売量がさらに増加する見込みであり、特に高級人工水晶体製品の販売量が伸びることが期待されており、製品の内部構造の最適化によって売上の成長が促進されると予想されています。

ただし、眼科分野の市場競争がますます激化している状況に直面した場合、昊海生科の製品ラインが落札したとしても、量と価格の転換がスムーズに進むかどうかは未知数です。

市場競争構図から見ると、現在、国内各種の人工水晶レンズのうち、非球面単焦点レンズが81.4%のシェアを占め、次いで双焦点レンズが11.2%のシェアを占めています。非球面レンズの市場占有率が最も高く、つまり人工水晶レンズは着実に進化し、市場シェアは絶対的な地位に上昇しています。

現在の国内の人工水晶市場の調達量から見ると、アイブライト医療のシェア率は最大で18.1%に達し、業種でトップです。次に、華潤の代理店であるジョンソンエンドジョンソンの視力康のシェア率は13.1%です。三番目に、昊海生科のシェア率は12.4%です。使用量から見ると、現在の市場シェアは比較的分散していますが、製品単価では、海外企業のシェアが明らかに大きく、現在、国内の人工水晶市場にはアルコン、ジョンソン・ビジョン、ボシュロム、そしてカールツァイスといった4つの外資系大手企業が60%以上の市場シェアを占めています。それに対して、国内ブランドの市場シェアは約30%です。

また、製品ラインを細分化して見ると、単焦点人工水晶の国内調達需要において、アイブライト医療が15.2%、ジョンソンエンドジョンソンが25.1%、カールツァイスが35.5%、アルコンが21%を占め、4大トップ企業が市場シェアの97%を占めています。一方、双焦点人工水晶市場の国内調達需要量構造では、カールツァイス、ジョンソンエンドジョンソン、高視、そしてアイブライト医療の4大巨頭の市場シェア率はそれぞれ31.4%、20.8%、14.8%、10.9%です。昊海生科は5位で10.3%です。そして、最高級の三焦点人工水晶市場では、現在、外資によってほぼ独占されており、その中でもカールツァイスが70.2%のシェアで市場トップを維持しています。

昊海生科にとって、医療美容領域ではヒアルロン酸が比較的低い敷居の医療美容製品として、競争の激しい市場競争に直面しており、競争リスクが増大しています。一方、眼科分野では、短期間で国産製品の代替と市場での地位確立が難しい状況です。核心セクターの成長制約が解消されない状況では、企業は二次市場での価値再評価を実現することが難しいかもしれません。

智通财经APP观察到,10月25日盘后,昊海生科披露了其2024Q3财报。然而,由于,公司三季度业绩低于预期,10月28日,公司股价早盘低开低走,盘中最低股价下探至29.75港元,最大跌幅达到12.24%。

智通财经APP观察到,10月25日盘后,昊海生科披露了其2024Q3财报。然而,由于,公司三季度业绩低于预期,10月28日,公司股价早盘低开低走,盘中最低股价下探至29.75港元,最大跌幅达到12.24%。